Gold: The More Things Change, The More They Remain The Same

Despite the arrival of numerous vaccines, Covid-19 is still having a huge impact, with bankrupt businesses, lockdowns and full hospitals in the worst economic collapse since the Great Depression. In fact, the unprecedented economic intervention has helped boost markets despite the economic losses, as investors look beyond the damage with rose coloured glasses and push stocks to their highest levels ever. Some see echoes of the past with the “Roaring Twenties”, a great analogy because after the Spanish Flu infected a third of the world’s population, what followed was a huge economic boom and a soaring stock market as people celebrated a dazzling decade of Gatsby-esque decadence.

Brighter times were also buoyed by World War I rebuilding and the introduction of automobiles and electricity. American culture was born, helped by electricity which allowed radio broadcasting to unite the nation with news and music across America. There was even the Bloomsbury group of intellectuals, which included Virginia Woolf and economist John Maynard Keynes and his welfare state. However, the bubble eventually burst as overextended banks failed and everything came crashing down in 1929, forever etched in people’s memory.

Jump to 2021, the Covid-19 pandemic is fixed in our memories, prompting shifts in our behavior and lifestyles. Like the 1920s, investors are celebrating a return to economic normalcy based on hope that the vaccines herald the beginning of the end of the pandemic and allow us to revert to as before, or better. The internet, artificial intelligence, big data and streaming have become the cultural equivalent. And who would believe Bob Dylan would get $300 million for his entire songwriting catalog? But, today with stocks in an epic bubble, turning companies into overnight sensations, are we celebrating too soon? Afterall, the gilded Twenties was a prelude to the Great Depression of 1933 when unemployment soared to 25 percent. Amid the markets’ euphoric highs of today, pity we forget the lessons of the past.

The 1920’s Redux

To be sure, there are ominous parallels with the stock market mania of today and the stock market crash of 1929. Margin debt today has spiked to record highs as a decade-long bull market helped by the trillions of dollars of stimulus from the Fed, evolved into the biggest bull market in history, exceeding the dot-com bubble and famous South Sea Bubble. And with a good part of US debt in negative territory, investors are not so concerned about inflation, consistent with the 1920s scenario. A key difference, was that in the 1920s the Fed actually reduced money, which exacerbated the Great Collapse, a lesson that modern central bankers won’t forget. This time money supply has jumped by an unprecedented 25%, in contrast to the 33% drop in the Great Depression between August 1929 to March 1933.

To be sure, the vaccines hold the promise of a return to normal such that investors are throwing caution to the wind, rushing into the stock market in a “greater fool theory”, that states people can always make money by buying stocks, no matter the valuation because they could always sell them for a higher profit. The gamble is that there is always a greater fool willing to pay a higher price. Last year, despite the pandemic, US stock sales exploded to a record $435 billion led by $100 billion of initial public offerings (IPOs) that included Airbnb, DoorDash and Twitter. Surging markets are caught up a “Twenties-type” panic buying on the premise that despite overvalued multiples of 40 times plus, prices can only go higher, gambling not investing on expectations that a greater fool will pay higher prices tomorrow.

Occupy Wall Street

Recently shares in GameStop, a loss making Texas-based video game retail chain spiked 1,600 percent as retail investors piled in spurred by chat rooms on social media sites, like Reddit. Social media disrupts again. This time an army of retail investors took aim at Wall Street’s “short” players and acting in a herd-like manner drove heavily shorted stocks in a “short squeeze” like GameStop to the sky, causing billion-dollar losses as specialist short selling hedge funds scrambled to buy back and close their positions. The democratization of finance aided by commission free trades and $2000 stimulus checks have made stocks, commodities, and their derivatives, the vehicle de jour. Stocks have become chips at the casino and not companies, whose fortunes ebb and rise with profitability or lack there of. It may be fun, but the premise to buy now and sell later, to a “greater fool” is gambling, not investing.

In late 1929, a shoeshine boy gave Joe Kennedy, John F. Kennedy’s father, a stock tip. Joe Kennedy thought, if a shoeshine boy is giving me stock tips, it’s time to get out of the market. The Depression hit soon after. Today, that shoeshine boy is Reddit.

But gambling is nothing new, nor is the urge to get rich. In 1980, the billionaire Hunt brothers attempted to corner the silver market buying every ounce of silver. Silver skyrocketed to almost $50 an ounce. They were sunk, not by other sellers but by the regulators who changed the rules of the game. This is likely to happen again. But drilling deeper, the current bubble is symptomatic of the liquidity generated by government stimulus packages and four rounds of quantitative easing. In 2009, the Fed’s largesse went to the Wall Street banks. This time the largesse was dropped from helicopters and deposited directly into investors’ bank accounts. The Hunts? They were forced into bankruptcy.

We can recall the old broker tale that neatly captures the mania of today, of two salesmen who make a living by selling truckloads of sardines, back and forth to each other, but at ever higher prices so that their respective firms would reflect bigger profits. This was a very profitable exercise until one of the salesmen decided to taste the sardines and discovered they were rancid and inedible, so he destroyed the sardines. When the other salesman came by to buy the sardines again, he was told the sardines were destroyed because the sardines were rancid. The other salesman screamed, “the sardines are to be sold, not eaten”. Such is the lesson of today’s stock market, with the nuts and bolts of buyers and sellers, fleeing to a multitude of products on expectations that a greater fool will always buy or sell at ever higher prices and valuations. Because of the shortage of investment vehicles, private equity too has boomed with many setting up “side-car” companies becoming both buyers and sellers in an incestuous relationship, of selling to each other at ever higher prices.

There is another big difference between now and the Twenties, in that the 2020 presidential election was in many ways a triumph for democracy with President Biden winning the popular vote by a seven million vote plurality. The election however unveiled a deeper schism and a polarised nation. Blue states over red states. Republican against Republican. Wealth and power were also concentrated in the urban areas, reflecting a widening gap between income and racial inequality. The coronavirus itself was politicized, undermining confidence in America. In other words, President Biden faces a multitude of challenges including the US economy, which has become structurally unequal, fueling the identity politics supported by half of the nation. Of concern, democracy itself is being undermined when half of the population feels they are not represented, creating the polarisation and “identity politics” that tested Abe Lincoln’s “for the people, of the people and by the people” decree.

American Exceptionalism

America is exceptional. Exceptional for the mob chaos on Capital Hill, to losing the battle against Covid-19, to botching the distribution of the all-important vaccines, to its income disparity fueled by their government’s propensity to spend their way out of their problems. Rounds and rounds of quantitative easing and its low interest policy forced investors to seek higher returns from the risky stock market. A consequence is a widening chasm between Wall Street and Main Street, leading to the populism so widespread today. No longer, it seems is there middle ground or even a middle class. Donald Trump and Boris Johnson exploited this “snowflake” society with the pandemic only exacerbating the schism, where in the American context, we have a civil war, not state vs state, but in the Republican Party itself. America is in danger.

With an end to the pandemic in sight, President Biden, in control of both Houses, is likely to loosen yet again the purse strings of the nation despite its tower of debt. Although, quantitative easing has been tried before; we are in the fourth round in the fight to resuscitate the American economy. The last round of stimulus at yearend was only a “down payment” and the $1.9 trillion mega-relief plan only widens the gulf between the rich and poor. Society today is unequal. With the Democrats in control of both Houses, higher taxes and income distribution is likely, but that too has been tried before with the rich only richer, widening the inequality of today.

The Emperor Has No Clothes

Making things worse is the threat and growing influence of the unbridled social media platforms and their power. Financial markets have been rocked by the tale of GameStop retail investors taking on Wall Street and winning. Today 3.96 billion people or half the world is on social media. Europe is attempting to tax the Big Tech behemoths and ironically it was the denial of access to Mr. Trump that heightened the scrutiny. America however is in a reality crisis. Mr. Trump only exploited the social media platforms and taking a page from his former occupation as a reality TV host, successfully perpetuated a faux reality that worked for almost four years.

Mr. Trump is the Emperor with no clothes. As In the tale of the Emperor who demanded ever grander clothes and when two con-artists talked him into wearing a magical invisible costume, the townspeople swooned in admiration, too afraid to speak the truth, until a child observed, “he has no clothes!”. The town then realised the child was right, the Emperor had no clothes. Today, Mr. Trump’s faux reality has been found wanting, but without clothes, the damage has been done. While many are relieved to see the end of Donald Trump, they should be reminded that a sizeable constituency of some 74 million Americans voted for him and many of those voters believe that Mr. Biden is an illegitimate president– those people have not retired. Trumpism is very much alive, making Mr. Biden’s task more difficult, if not impossible.

International countries were bewildered by the sight of a sitting president and his acolytes refusing to acknowledge a democratic voting result and the assault on democracy destroyed trust in America’s democratic process. In seeking to overturn a certified election, Donald Trump caused a Republican civil war. This hypocritical behavior only diminishes America’s standing in the world, particularly when Mr. Trump has laid the groundwork for an opposition-in-waiting, further stoking the fires of alienation. What country will listen to the United States when it questions its own election? Will they welcome US observers? Is the leading republic of the free world any different from any other banana republic?

True, the West’s version of democracy has zigzagged and been tested numerous times in the past. President Bush sought to export America’s version of democracy when they invaded Iraq in 2003 to look (unsuccessfully) for weapons of mass destruction and soon after, the next president, Mr. Obama denounced the invasion and tried to pull American troops out, emboldening the other axis of evil, Iran. Or recently there was Prime Minister Johnson’s reneging on his EU agreement, which made a mockery of the Brexit negotiations that led to a “Brexit- lite”. Today, the club of democratic states seems to be getting smaller, whilst there is an upsurge in populist autocrats from a growing list including Brazil, Venezuela, Saudi Arabia, Pakistan, Cuba, Iran, and Russia. A major difference though. We can change our leaders and America did just that. Expectations here are ahead of reality.

To be sure, there is much to celebrate with scientists around the world creating various Covid-19 vaccines in such a short period of time. That, it seems is the easy part. But getting some to wear a mask or swaying the “first refusers” to get vaccinated will be even harder. Of concern is that the spreading infection worldwide and its mutations are curbing vaccine and economic optimism, particularly since for some, mass vaccination is 12 months away. And, notwithstanding that America spends the most in the world for healthcare at 18% of GDP, or more than twice that of Switzerland’s per capita, the country has the highest per capita death rate in the world, because they continue to disregard basic mitigation, strategies or protocols. There must be a vaccine against stupidity. Mr. Biden’s plan to vaccinate 100 million people in 100 days is a start to sanity.

Living in a Golden Age of Ignorance

While, money is cheap, so is risk despite US bankruptcies reaching 9-year highs. The economic impact of the coronavirus has revolutionized a generation of policymakers in which central banks’ inflation fighting has been relegated to second place. Worrisome though, is that long before GameStop, the government’s debt-fueled spending seemed to know no limits with investors betting that the continuation of the easy money “fiscal stimulus to infinity” is riskless. Markets have made a major bet on the Fed’s assurance of support that creates a space and comfort level that rewards aggressiveness and big bets. Overlooked is that America’s twin deficits and mountain of debt must be financed by importing foreign capital, which history shows is unsustainable. America lives on borrowed money, and time.

The Keynesian orthodoxy so much in fashion today calls for governments to use monetary policy to support their economies. Once again, when the economy crashed as in 2009 or the March pandemic meltdown, central banks borrowed and when that became too high, they loosened the monetary reins, making it cheaper to borrow and spend, averting another Great Depression. But it became habit forming. In the last decade, four rounds of quantitative easing have led to inflating a massive speculative bubble and a record $18 trillion of negative-yielding debt as investors scrambled for safehavens to protect their wealth. Today, under the new and improved money doctrine of Modern Monetary Theory (MMT), there is to be no limit to government borrowings, because the ensuing growth will pay down the debt. Wall Street cheered and new highs were posted. Markets celebrated further when the head disciple, Fed Chair Powell slashed rates again buying more bonds in record amounts, declaring that stimuli would now be open-ended, no matter the inflation rate or costs. Notwithstanding that negative yields and unlimited money printing were the building blocks of the Weimer hyperinflation and the French fiat inflation, the market’s view is that it is different this time.

The puzzle is particularly worrisome considering the benchmark S&P 500 ratio has never been higher at 38 times price to earnings or double its historic average of 15 times. The market is the most expensive, ever. An example of the current market enthusiasm is that despite selling less than half a million cars, Tesla, is up sevenfold and has a market cap that exceeds the market cap of the top seven car companies in the world. The market is up simply because it is the only casino in town where money is not only cheap, it is free. Free money has lifted all asset boats. Bubbles are everywhere. In funnelling into the stock market, a reckoning is coming for the world economy when the vaccine and market expectations meet reality, which we believe will ricochet through the financial system with negative consequences. There is no greater fool on the horizon. The sardines are rancid.

It Is All About the Debt

The consequence is that the Institute of International Finance estimated that in the first nine months of last year, the world increased borrowings from 310 percent of global income to 365 percent, a new record. Under a low interest rate environment, the bond market rocketed with companies and governments issuing a record $9.7 trillion of bonds and debt, led by the Fed and other central banks. Under Trump, the national debt exploded by almost $8 trillion or more than the combined GDP of Germany and Japan. Other administrations are to blame too. Since the 2009 meltdown, at least four tranches of quantitative easing have been tried, financed entirely by debt to boost the US economy and put a floor under its creaking credit market.

Only two decades ago, the benchmark 10-year Treasury yield was more than 6 percent while dividend yields were just 1 percent. However, recently US Treasuries have gone from 1.9 percent to 0.8 percent before jumping 25 basis points over 1 percent on inflation fears. With a good part of the yield curve negative, as the volume of new issuances strain the balance sheets of Wall Streets’ bigger banks, an increase in bond yields is likely in the wake of mandatory entitlements plus the big spending plans of the Biden administration. Debt has become king. Today as our aging society grows, the added pension obligations must to be added to the escalating debt load and like taxes, government stimulus programmes have become permanent, paid by the next generation to follow. America’s stimulus packages are some 14% of GDP, equal to the New Deal and Marshall Plan combined. In the past four years, US government debt increased by $7 trillion and now exceeds US GDP at 110 percent.

America starts off fiscal 2021 with the largest two-month budget deficit on record. The system is so debt clogged that 1% yields no longer attracts buyers. Americans are in denial about the changing outlook. Corporate debt-to-earnings ratios are at all-time peaks. Credit rating reductions are at all time highs. The Fed believes that driving financial markets to bubble levels is the solution and much like Mr. Trudeau in Canada, believes that they can spend and print their way out of their problems. This has been tried before and always ends badly. And worse, despite trillions of stimulus and tax cuts, the US economy only grew by an anemic 1.7% since the beginning of 2017. So much debt, so little growth. Legendary scientist Albert Einstein once defined insanity as repeating the same actions, over and over again, yet expecting a different result. Will we ever learn? Insane.

The Spectre of Inflation

A major risk to the largest stock market mania in history is the spectre of a new era of inflation. While a pickup in inflation has been elusive over the past decade, allowing central banks to print more debt, the absence of inflation is the very foundation on which central banks use as an excuse to print, and upon everything is priced. The current consensus is that inflation is in hibernation or even dead, but history shows that complacency is the market’s worst enemy, particularly when the Fed itself pivoted last summer, declaring that it would tolerate higher inflation, undoubtedly because higher inflation erodes the value of outstanding debt.

Like the “Roaring Twenties”, the “reflation trade” is based upon the unprecedented build-up in liquidity and massive scale of government spending that inflated a stock market bubble on hopes that households and businesses celebrate an end to lockdowns by going on a spending spree. Share prices in other countries are also at near highs and real estate everywhere is in a bubble. Few noticed though that the imbalance of growth has been exacerbated by the Trump’s tariffs, Brexit and the pandemic, which caused supply shortages and bottlenecks, sparking price increases in commodities from iron ore to copper to oil. Inflation is quietly on the rise. Global food prices, a lead indicator of inflation, have reached the highest levels since July 2014. Oil is climbing higher as the Saudis curtail output. All are lead indicators of inflation. The Bloomberg Commodity Index was up 2% in the first week of January. Moreover, with globalisation in retreat, efficiencies are lost and China is even experiencing domestic price pressures for goods and labour, the feedstock of higher inflation. We believe the market has not discounted higher inflation, or hyperinflation.

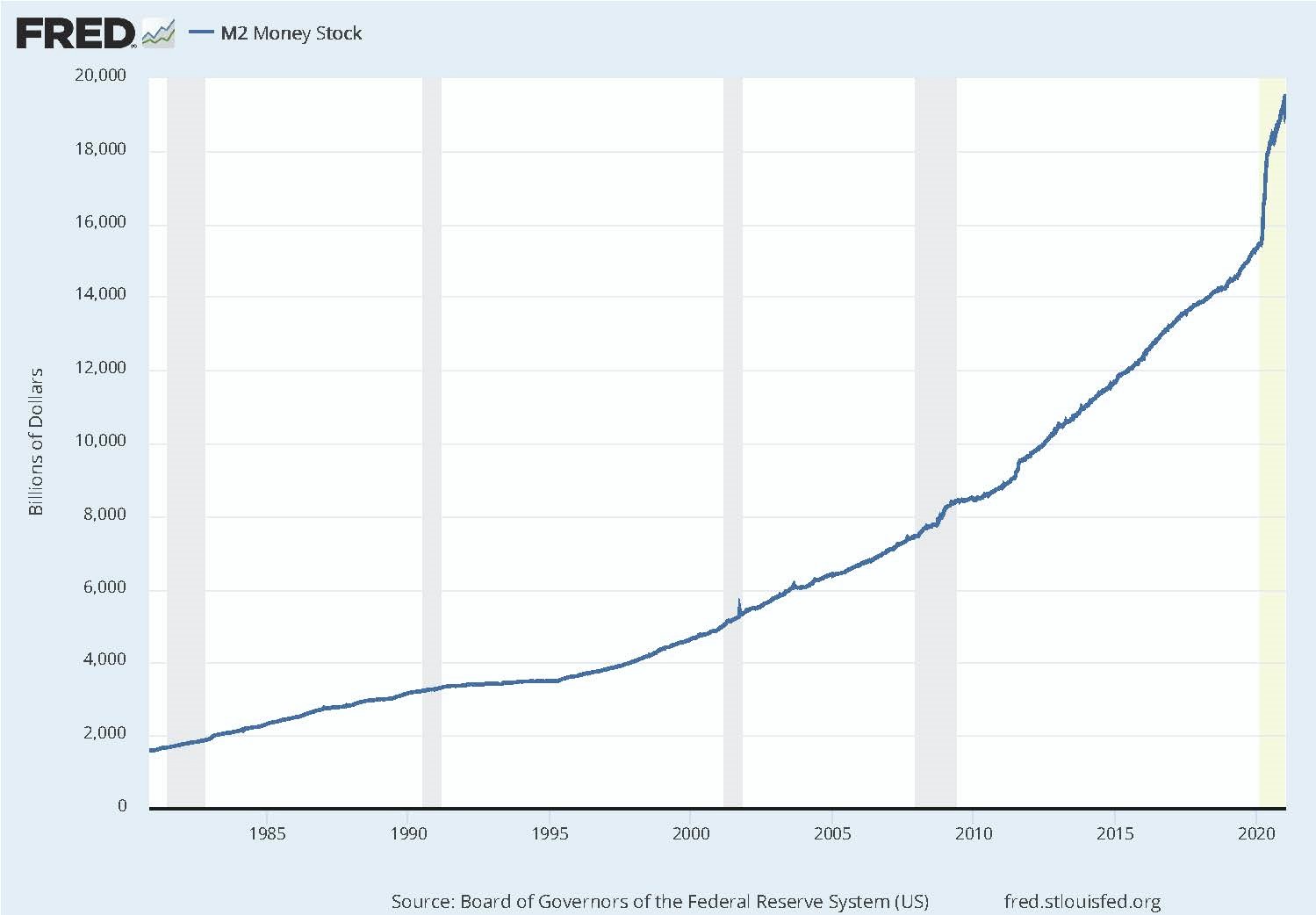

Of equal concern is that US broad-based money supply (M2) has exploded a sharp 25% from a year ago, the highest in more than a century and a half, surpassing the “Roaring Seventies” when double digit money supply growth and twin deficit spending resulted in double digit inflation and near hyperinflation. Then Fed Chairman Volcker was forced to rachet up interest rates to 20 percent which triggered a serious recession to stop hyperinflation. And three decades later with the global recovery sputtering, policymakers including the Biden administration are contemplating another round of spending, just to jumpstart demand. More stimulus will bring relief but not a cure for the economic pain. This is a recipe for disaster. It is not so different this time.

Inflation is often described as “too much money, chasing too few goods”, which causes prices to rise, eg. the stock market or gold. Inflation was already here as Mr. Trump’s isolationist foreign policy boosted inflation with fewer cheap imports, because manufacturers shifted their supply chains and raised domestic prices due to supply shortages of everything from computers to jet fuel. And today there are even shortages of microchips causing auto companies to curtail production. Investors are overlooking the obvious, there is inflation in property, sky-high stock prices and toilet paper. We believe that when inflation “returns”, easy money will cease, interest rates will go up, and risk premiums will soar as investors discover that dollar weakness only amplifies inflation.

Hyperinflation Now?

The common denominator shows that over two centuries when governments spend and spend, incurring huge deficits financed by borrowed funds and pays for them with unlimited money printing, the increase in money eventually ends up with inflation and sometimes hyperinflation as the money supply increases, prices rise. In America’s case, the unprecedented debt and spending is all too familiar and already there is a classic case of too much money chasing too few goods, or too few stocks or too few homes. Is there a limit? History shows that inflation is always with us and today we have asset inflation. Scratch a little deeper, the building blocks of hyperinflation are in place.

Hyperinflation has been around for ages, as far back as Ancient Rome when they added worthless metal to their coins, which debased their currency and what followed was hyperinflation under the emperor Diocletian. There have been about twenty or so hyperinflation episodes in recent memory, including the Chinese hyperinflation in 1947 when the government (Nationalists, Japanese and Communist) printed money to fight a war, paving the way for Mao Tse-Tung. One of the most severe was Hungary in 1946 when they issued a 10 quintillion pengő note (one followed by 19 zeros) when prices rose by 4.19 quintillion percent or 4,190,000,000,000.000,000%) in one month. Then there was Germany’s Weimar government who fought a major war with borrowed money and in January 1920, one dollar was worth 42 marks but three years later was worth only 4.2 trillion marks. Hyperinflation is even with us today, in Venezuela, Iran and Turkey. Pity that we forget the lessons of the past.

Beijing Bashing Will Hurt the US

America’s problems are China’s opportunity. Wary of China’s geopolitical heft, Mr. Trump’s trade war with China morphed into a Cold War, which isolated the US, whilst strengthening China. The United States is not the only economic superpower it seems. China’s return to superpower status has created an alternative to America’s financial hegemony and a rival on security, trade and economic fronts. And now today, after China’s entry into the WTO upended global manufacturing, Chinese and American businesses are inextricably linked and despite Trump’s Cold War and prospects of a Tech War, President Biden will ironically pivot to the East, not because of the EU becoming China’s largest trade partner, ahead of the United States or, a change in hard-line American sentiment but because China is the financier to the world, including America’s largest creditor.

With $3.1 trillion of foreign exchange reserves, as banker to the world, China has used its economic muscle, with a mix of Yankee market power and geopolitical importance, to broaden its influence in the 21st century. Instead of an exporter of goods, China has become an exporter of capital as its factories reopened in the spring while the world wrestled with the pandemic. China’s capital markets have become important too. China’s benchmark CSI 300 index is up 30%, doubling the performance of the S&P Index last year, reflecting China’s successful recovery from the coronavirus and influx of foreign investors. China attracted the most of any investment, as the country welcomes them in, opening its financial markets to the rest of the world. China has emulated America’s Marshall Plan, providing loans through its $1 trillion, Belt and Road Initiative (BRI), financing ports and railroad lines to further trade, extending China’s influence in Asia, Europe and the Middle East.

Multilateral agreements and alliances also helped China’s GDP to double four times between 1980 and 2010. Between 2010 and 2020 China’s GDP doubled yet again. Although the world’s economies will shrink from the pandemic, China will show positive growth of 2 percent in 2020 and 8 percent in 2021. Consumption has come roaring back from the depths of the pandemic and exports rose a record $2.6 trillion reflecting a strong recovery, in stark contrast with other major economies. We believe that as China opens its $50 trillion financial markets service industry to foreign investors, the country’s impact in the financial markets will rival its dominance in trade and manufacturing as international capital flow in, not out.

The Monetary Consequences for America

China’s real estate market did not exist 30 years ago, but is now one of the world’s largest and important centres of finance and economy activity. China was also one of the first nations with a homegrown vaccine with millions already vaccinated, raising the stakes in vaccine nationalism. To be sure while Trump’s tariffs remain, a positive first step for President Biden was to re-establish a new era of multilateral relationships with the World Trade Organization (WTO) and World Health Organization (WHO). We believe these multilateral forums are an important step to ease tensions between the world’s two great economic superpowers. The biggest change needed however is to treat China as a competitor, not an adversary to avoid the “Thucydides trap”, which holds when a rising power confronted a ruling power in 12 out of 16 cases, the result was bloodshed.

And today, with the US national debt topping $3.75 trillion to $28 trillion and a growing federal deficit because of the pandemic, foreigners hold a whopping $7 trillion or almost 26% of American debt. Significant is that at the end of September, China one of the largest holders of U.S. debt, has steadily reduced its purchases, to the lowest level in five years, holding $1.06 trillion of a total $21 trillion.

With so much dollar debt outstanding held by foreigners, it is hard to see how America can fund its obligations, without a lower dollar, America’s economy has become financially fragile. America is right to worry about China. Who is to finance America, if China keeps selling Treasuries? For America to turn its back on the things that made it great, is no answer.

There Is No Free Lunch

The US dollar has fallen more than 12% from its peak, underlining concerns that the pandemic will deepen the recession. In a prelude to a Currency War, the US Treasury recently added Switzerland and Vietnam to a long list of “currency manipulators” which includes trading allies South Korea, Germany, Italy, Taiwan and India. Currency is the medium of international trade and the anchor against which other nations value their currencies, as well as a reserve currency held by banks. Yet the dollar itself is weakening due to America’s piling up of record debt, which debases the dollar, undermining its reserve currency hegemony. Also, the struggling US economy with 10 million Americans on unemployment benefits has caused a glut of capital. Treasury Secretary, Janet Yellen fired the first salvo, warning trading partners of currency manipulation, which has yet to be discounted by the buoyant market.

The US dollar has been on a roller coaster ride ever since the Bretton Woods Agreement in the Forties made the dollar the world’s reserve currency replacing British Sterling. Then the US was the world’s largest creditor, while Britain was the largest debtor, which resulted in the loss of its status because of its accumulated war debts. Since then, the dollar has been volatile losing 90 percent of its purchasing power. In 2008, the US dollar collapsed after the financial crisis forced the Fed to flood the system with dollars after the debt aftershocks. Even before that, the US ran twin deficits (budget and current account) and the aftershocks resulted in a 20% correction in 2002. Earlier in 1985, the dollar similarly collapsed but the drop was deliberate this time as part of the Paris Agreement when five countries pushed the dollar down. And as recently as last March, the US Treasury almost seized resulting in a Fed bailout to overhaul the $21 trillion market as the repo market imploded. Today, a trust deficit has caused the dollar to slump to multiyear lows on fears that the Fed’s “easing to eternity” policy will create an avalanche of dollars, which added to the trillions of dollars of stimulus will push up inflation, eroding the value of dollar assets.

The Dollar Is Not Forever

Simply, money has become free, dropped this time from helicopters and deposited directly into Main Streets’ bank accounts. And given the unprecedented explosion in money supply, there is lots of it. Governments believe, particularly the newly installed Democratic administration, that the printing press is the solution to our ills, and despite generating the greatest financial bubble in history, are rejecting their own noted economist, Milton Friedman who famously argued, “Inflation is always and everywhere a monetary phenomenon”. Although US consumer prices have risen for the seventh straight month, the authorities are betting that a revival of the world economy will allow us to grow out of this new debt. It is a hope.

The US dollar’s supremacy is backed by its economic clout, incumbency and full faith in the American government. But with record debts and a health, political, and economic crisis, the dollar had its worst month in a decade as all of this has worrying implications for the outlook beyond the pandemic.

Meantime, financial markets are getting riskier. We believe serious investors are beginning to worry about the leveraging of America and the most recent pandemic spending spree comes at a time when its credit card is already maxed out. So much money, so few results. Of growing concern is that America’s response to Covid-19 to again print dollars in limitless quantities will undermine the dollar’s reserve currency status. Much of Covid-19 is still unknown, but its costs mount.

What is known is that in debasing the dollar, US debt has already surpassed 110 percent of economic output, a threshold that other nations (like Greece) often signal a coming crisis and a level at which countries find difficult to pay bills. In 2008, that debt ratio was 75 percent of GDP. We believe the dollar’s reign ends when the rest of the world loses confidence that the US can’t keep paying its bills. A failure scenario of the world’s biggest economy is not what investors want to contemplate or have discounted in the euphoric market. While faith in the Fed and vaccines have taken over, overlooked is that the United States has become the world’s largest debtor, and China, the world largest creditor. The dollar is not forever.

Recommendations

As such, gold is a good thing to have. Like America’s polarised political system, investors either love gold or hate gold despite gaining 25 percent in 2020. It comes down to trust. The case for owning stocks is based on low interest rates and zero inflation. We believe the inevitable pickup in inflation will fuel interest in gold, a classic inflation hedge. Gold for thousands of years has provided monetary stability as a tool of wealth preservation and for most of its years, a worldwide reserve for money, as a hedge against currency debasement. There is no way to tell how much debt is too much, but American’s debt is unsustainable, causing countries and investors to look for alternatives. We have seen this movie before. The “Roaring Twenties? No, the fiat inflation in France in the late 1700s or the Weimar hyperinflation, or Zimbabwe or Venezuela today. A day of reckoning is in the offing. Gold is an effective hedge for that day. Plus ça change, plus c'est la même chose.

Gold’s 25 percent gain last year, outpaced most other assets. Gold is also a barometer of fear and there is much uncertainty today from geopolitical, to inflation, to the pandemic, to the debasement of the US dollar. Since President Nixon devalued the dollar by severing its link to gold, the US dollar has been particularly volatile. However, both central banks and investors have lately sought dollar protection by buying gold for protection in the current negative yield environment. As such we continue to believe gold will top $2,200 an ounce within 12 months.

China has become the world’s biggest consumer of gold and biggest producer but still must import more. China’s gold miners’ reserves are limited and despite attempts to purchase offshore producers, they’ve been largely unsuccessful. We expect China to continue to be a buyer as they add to their official reserves and seek to internationalize the renminbi, including making it a central bank backed digital currency that would lessen dollar hegemony. Although gold miners’ shares have performed well, they remain underowned and undervalued. We expect gold equities to outperform the markets as gold’s recent rise shows that investors are nervous and buyers like China and the industry themselves need to replace depleting reserves. The lack of discoveries also reveals the industry’s difficulty in replacing depleting reserves.

Consequently, we believe M&A activity this year will be driven by the industry’s need to replace reserves. The industry is flush with cash and all are generating piles of free cash flow. Dividends have become de rigour. Year to year, earnings comparisons will be favourable, attracting even the growth cult of investors. We like the senior players like Barrick, B2Gold, and Agnico Eagle which recently purchased troubled TMAC to boost its northern operations and reserves. Mid-tier producers like Eldorado are also favoured. Developers like McEwen Gold, Osisko, and Sabina are likely M&A participants. We also like Lundin Gold, the newest player because they will expand the rich Fruta del Norte mine.

Companies

Agnico-Eagle Mines Ltd.

Agnico acquired TMAC Resources for $457 million, the trouble prone producer. The Hope Bay mine in Nunavut never lived up to expectations and was a sink hole for money. However, Agnico with their mining complex in Nunavut is expected to re-examine the mine plan and look for synergies. We like the deal because it boosts Agnico’s footprint and production. At the same time, Agnico is conducting an underground exploration programme at Malartic as that project goes deeper with at exploration ramp into Odyssey, East Malartic and East Gouldie. We like Agnico here, particularly for their rising production and reserve growth profile.

B2Gold Corp.

Low cost senior gold producer, B2Gold produced 970,000 ounces last year and will produce 1 million ounces at AISC of $900 an ounce from Fekola in Mali, Otijkoto in Namibia and Masbate in the Philippines. B2Gold’s next mine is the open pit Gramalote JV project, which will contribute in 2024. B2Gold is debt free. We like B2Gold’s for its organic growth and expect more news from the Fekola expansion.

Barrick Gold Corp.

Barrick produced about 4.8 million ounces last year in line with guidance which excluded production from joint venture Porgera in Papua New Guinea, which was placed on care and maintenance last year following a dispute with the government. This year production is expected to be flat but Barrick is expected to unveil plans for expansions at joint venture Pueblo Viejo, the Nevada Gold Mines complex and higher copper output from Lumwana and Zaldivar. Barrick’s finances are much improved, with free cash flow enabling them to boost dividends and pay down debt. We like Barrick here as they possess the largest array of Tier I assets, growing reserve potential and quality management.

Centamin PLC

The Egyptian miner produced 452,000 ounces last year in line with earlier reduced guidance. Centamin expects lower production this year at 420,000 ounces at AISC of $1,200 an ounce due to lower grades and a revamped mine plan after a pit failure. Nonetheless, the producer plans to boost exploration and a Phase I Sukari life of mine review is expected to offer good news. Centamin has no debt. Centamin is one of the few mines in Egypt and we believe this cash flow machine and 15 million ounce resource would be an attractive tidbit for a producer looking for a long-life asset.

Centerra Gold Inc

Centerra sold its Hardrock Mine project to Orion Mine Finance for $225 million surfacing hidden value. Centerra has a solid balance sheet with $800 million of cash and no debt. Centerra’s output will be flat this year with output from Mt. Milligan in British Columbia, Kumtor in the Kyrgyz Republic and Oksut in Turkey. Centerra reported better results last year due to improved output from Kumtor. With the Kyrgyz election out of the way, we expect Centerra to table its Kumtor technical report which should give guidance for the next few years.

Eldorado Gold Corp.

Eldorado boosted reserves last year to almost 18 million in situ ounces due to an increase in reserves at Lamaque in Quebec. Eldorado’s Olympias in Greece contributed and a breakthrough agreement with the government could give the go-ahead at Skouries. Meantime, production was disappointing at maturing Kisladag in Turkey, producing 57,000 ounces while Efemcukuru produced 26,000 ounces in line with expectations. Eldorado acquired QMX, a junior in the Val D’or camp, which has a land package in the Abitibi greenstone belt, which is within trucking distance of Eldorado’s Lamaque mine. At current levels we like Eldorado because of the hidden value of the Greek assets which are not reflected in Eldorado’s share price. Eldorado produced 530,000 ounces last year but will produce 450,000 ounces at AISC of $1,000 an ounce due to the harvesting of Kisladag.

Kirkland Lake Gold Ltd.

Kirkland Lake produced 1.4 million ounces in line with Detour producing a solid quarter. Kirkland again bought back shares for a total of almost 20 million shares. Macassa output fell in the quarter, but the mine should produce 230,000 ounces bringing Kirkland’s 2021 output to 1.4 million ounces at AISC of $800 an ounce. Kirkland is a cash machine so we would not be surprised to see them on the acquisition trail again following the acquisition of Detour for its 20 million ounces of in situ reserves, Kirkland will use its highly valued shares as currency.

Lundin Gold Inc.

The world’s richest gold mine produced 240,000 ounces last year from Fruta del Norte in Ecuador. This year, Fruta del Norte should produce 400,000 ounces due to a $19 million expansion to increase throughput to 4,200 tpd. At a whopping grade of 10 g/t, the low-cost producer has a 14 year mine life and Lundin recently boosted reserves 8% to 5.41 million ounces. Of note, Lundin has an aggressive exploration program seeking to find other epithermal targets in the area. We like the shares for its upside potential.

Newmont Corporation

The world’s largest gold producer, Newmont will produce 6.5 million ounces at AISC of $970 an ounce this year, but guided flat production until 2023. Newmont has 96 million ounces of reserves and is a cash machine throwing off $400 million free cash flow for every $100 increase in gold. However, megaprojects like Yanacocha Sulfides won’t be completed near term but will cost $2 billon, ramping up in 2024. Newmont is also reworking Goldcorp’s Pamour (formerly Century), Penasquito and Musselwhite. Near term Newmont is working on Tanami 2 expansion in Australia. Newmont pays $1.00 a share and has a unique dividend paying model. We prefer Barrick here.

Yamana Gold Inc.

Yamana acquired Monarch Gold for $152 million to put 100% owned Wasamac in the Abitibi region of Quebec into production with 1.8 million in situ ounces, a feasibility study contemplates an under ground mine producing 142,000 ounces at AISC of $630. Widths and grade are good and the project will cost about $500 million and could be in production in a couple of years. Feed could go to nearby Glencore or Iamgold’s Westwood. Yamana needs Wasamac because of a flat production profile over the next few years since El Penon and Jacobina are mature. Yamana still has a stretched balance sheet which will be tested as it builds-out Wasamac. Sell.

John R. Ing

********