Gold n’ S&P Highs for All to See!

For a month which through the last dozen years hardly has been happy for Gold — and certainly century-to-date dreadful for the S&P 500 — let’s hear it here in this September of 2025 for All-Time Highs all ’round! Whee-Heee!

Through the 14 trading days of this September-to-date, Gold has posted record highs in eight, toward settling yesterday (Friday) at an All-Time Weekly Closing High of 3719, the year-to-date gain now +40.9%. Too for the S&P, albeit not always on the same day, there’ve also been eight days of record highs, the mighty Index settling the week at 6664, both a record daily and weekly close, the year-to-date performance now +13.3%.

Reprise from The Great Depression “The Dance of the Dollars” as crooned by the inimitable Ginger Rogers:  “We’re in the money, We’re in the money…”

“We’re in the money, We’re in the money…” –[Warner Bros., “Gold Diggers of 1933”].

–[Warner Bros., “Gold Diggers of 1933”].

Or as we’ve in more recent years occasionally quipped: “Marked to market, everybody’s a millionaire; marked to reality, nobody’s worth squat.”

“So mmb, obviously the S&P hasn’t crashed yet, right?”

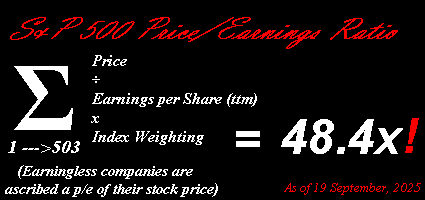

Rather, it has what we call “up-crashed”. Squire is referring of course to last Saturday’s edition of The Gold Update per its title “Gold Gets the Cash (Ahead of S&P Crash?)“ For in spirit with the Federal Open Market Committee having voted nearly unanimously this past Wednesday to lower The Bank’s Funds Rate by our anticipated -0.25% — (an event “priced-in” a few billion times) — the S&P 500 posted a +1.2% weekly rise, as did Gold gain +1.1%. But specific to the S&P, how’s that price/earnings ratio of 48.4x workin’ out for ya?

But let’s instead turn the tables on Squire and ask him a question:

You have today $100,000 to invest for one year, and (excluding Gold), which of the following two options’ results would you select?

- Option 1: in a year’s time your $100,000 investment shall additionally have garnered $3,610 in yield such that you’ll then have $103,610;

- Option 2: in a year’s time your $100,000 investment shall additionally have garnered $1,171 in yield such that you’ll then have something in the range of $83,000 to $119,000. Squire?

“Option 1, mmb, which is the one-year T-bill, ’cause Option 2 is the too much crazily-overvalued S&P.”

Smart boy is our Squire. (For those of you scoring at home, Option 2’s $83k – $119k range includes the wee yield and is one standard deviation both above and below the S&P’s annual average percentage change through this century’s 24 completed years).

‘Course, given the perilously overvalued S&P today — similar to that just preceding the DotComBomb — a like fall of more than -50% in the S&P would instead place the low end of Option 2’s range just under $50k.

Further into a deep numerical dive, you may have seen last evening’s release by the Commodity Futures Trading Commission of the Commitments Of Traders for the S&P 500 futures: ’tis net Short -225,100 positions, the most since that which preceded last year’s S&P demise from March into April. Either way, have a nice day.

But to get on with good old Gold, century-to-date ’tis now +1,259%. ‘Course the nattering nabobs of Gold negativism are always quick to point out that Gold has no yield. We simply let them instead be happy with their S&P 500’s approximately +550% gain including yield across the same stint.

Now with respect to our opening Gold Scoreboard, price (3719) has been racing up toward the Dollar debasement value of 3866. However, per the aforementioned FedFunds interest rate cut, that ought raise the debasement bar higher still as dough more affordably flows out through the Fed window. Indeed this past week, the StateSide “M2” money supply reached its own all-time high of $22.207T. That of course “supports” (not) the current S&P 500 market capitalization of $58.800T. (Have we made mention in the past of the “Look Ma! No Money!” crash?)

Still, as glorious as has been Gold’s recent run, might it be (only temporarily) done? Per the following website graphic of Gold’s value vis-à-vis its movement relative to those of the primary BEGOS Markets (Bond / Euro / Gold / Oil / S&P 500), price today at 3719 is +241 points “high” above its smooth valuation line at 3479, (levels rounded to nearest whole number). Across the graphic (excluding this most recent excursion), when price’s deviation has been at least this “high” by the lower panel’s oscillator, Gold within 21 trading days (one month) has declined by an average -6.1% (which from here would be -227 points into revisiting the upper 3400s). All that courtesy of the “Markets Don’t Move in a Straight Line Dept.”:

Notwithstanding some wariness to potential near-term pullback, in turning to Gold’s weekly bars from a year ago-to-date, price has now recorded a fourth consecutive “higher high”. ‘Course, hardly is that a record. Twice this century Gold has recorded 11 weekly “higher highs” from late August into November of 2007 and again from early August into mid-October of 2010. But we shan’t say “no” to now four-in-a-row:

Meanwhile, struggling to make any gains-in-a-row is the Econ Baro. Specific to this past week’s streak of 14 incoming metrics: four improved period-over-period (notably September’s Philly Fed Index and August’s “ex-auto” Retail Sales), five maintained their prior pace or level, and five were worse (notably September’s NY State Empire Index, plus August’s Housing/Permits data, along with everyone’s favourite lagging indicator of The Conference Board’s Leading Indicators).

Thus was the Fed’s rate cut bang on time? Or shall next Friday’s release by the Bureau of Economic Analysis of August’s Personal Consumption Expenditures suggest the FOMC “pause” next time? Regardless, scarcely does the Economic Barometer appear to be in its prime despite an S&P oh so sublime:

To be sure, Gold’s past five week’s have been nothing less than marvelous. But as we next turn to our two panel graphic of the daily bars from three months ago-to-date on the left and 10-day Market Profile on the right, the rolling over of the “Baby Blues” are the early hint of this latest uptrend nearing its end, with the labeled 3683 as volume-dominant support:

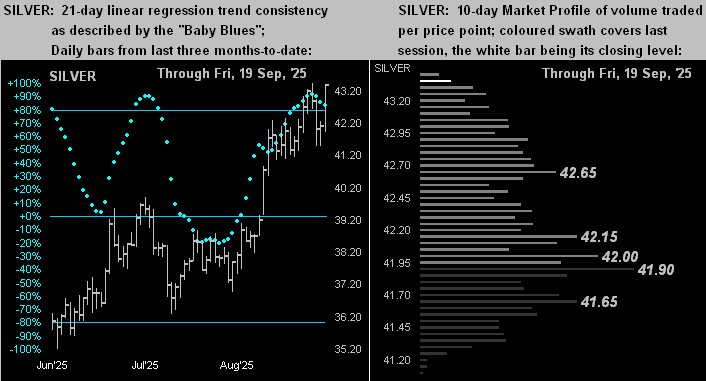

As for Silver, the settle yesterday at 43.37 was her highest daily close since 22 August 2011 as well as her highest weekly close since that ending 25 April 2011; (Silver’s all-time intraday high is 49.82 from 25 April 2011). Here as well are her “Baby Blues” (at left) and Profile (at right). More broadly, the Gold/Silver ratio presently 85.8x maintains more upside in due course for Sister Silver:

Monday at 18:19 GMT brings 2025’s autumnal equinox, (which for you WestPalmBeachers down there you call “the first day of fall”). Query: Shall “fall” arrive as a double entendre at Broad and Wall? For the S&P has gone far beyond any dutiful call…

But you can stay secure with Gold through it all!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

********