Gold Pared Gains Last Week as the Dollar Advanced

Strengths

- The best performing precious metal for the week was gold, but still off 3.03%, with the strong surge in the U.S. dollar. Aya Gold & Silver released its first quarter production and financials this week. Production came in higher than expected at 459,000 ounces to consensus of 389,000 ounces, due to higher head grade from mine development work completed in the first quarter and additional equipment onsite. Financials also beat with adjusted earnings per share (EPS) of $0.02 versus consensus of ($0.01); operating cash flow was $0.04, above consensus of $0.01.

- K92 Mining reported second quarter 2022 earnings with AISC of $893 per ounce, 26% below consensus of $1,207 per ounce, once again, showcasing the increasing economies of scale, which may continue in the future. Importantly, the strengthening balance sheet ($82 million cash at quarter-end, with no debt), ideally positions K92 to invest in its planned growth.

- Centerra Gold announced the appointment of Paul Chawrun as its new COO, effective September 6. Mr. Chawrun was most recently COO of Teranga Gold, and Credit Suisse views his technical expertise as positive for advancing Centerra’s Goldfield project.

Weaknesses

- The worst performing precious metal for the week was silver, down 8.47%, moving with the drop in gold. Gold fell this week, following four straight weeks of gains, as investors assessed signs that China’s economy is struggling to recover ahead of minutes from the Federal Reserve later in the week. Bullion fell as much as 1.1% on Monday, after the longest run of weekly gains in almost a year, as it came under pressure from the stronger dollar. The precious metal has gained amid cooling inflation in the U.S., which backs the case for the Fed to be less aggressive in raising borrowing costs.

- Orla Mining reported strong second quarter numbers, with record production and lower-than-expected costs. Earnings, however, were a miss. In a quarter that saw consumable costs spike for many industry peers, Orla was able to reassuringly maintain its 2022 cost and production guidance.

- Steppe Gold reported its second quarter financials after pre-reporting production of 10,300 ounces last month. Adjusted EPS was $0.05 versus consensus of $0.07; operating cash flow was $0.06 per share versus consensus of $0.11 per share. The miss was driven by timing of sales and higher processing costs, somewhat offset by lower taxes and depreciation along with a higher realized gold price.

Opportunities

- RBC anticipates incremental addition of larger-cap names back into the GDXJ ETF in part driven by 1) greater investor interest in larger, more liquid names and 2) continued industry consolidation, particularly within the Intermediate space. The appetite for acquisitions to gain significant market presence appears to be back on the menu.

- Millennium Precious Metals published the first drill results from its Wildcat property that returned good grades, with mineralization confirming strong continuity, no overburden, and rock competency. While continuity should support a high degree of resource conversion from inferred low overburden results in a low strip ratio, which in conjunction with favorable pit angles arising from rock competency, ultimately highlights the potential for low mine operating costs.

- Gold Road Resources acquired another 4.67% of De Grey Mining, bringing its ownership stake to 19.99%. Gold Road noted it does not intend to make a takeover bid for De Grey. It’s an interesting situation. Gold Road can continue to creep up in ownership, in limited steps over time, without making a compulsory offer. The company may, in some way, be competing with the royalty companies in that it could offer cash for just an equity share in the project’s future gold production. De Grey likely has no interest in such a deal structure as this has been one of the most significant gold discoveries in recent years.

Threats

- Zimbabwe’s gold miners say they can only invest the $1 billion required for development over the next five years if they can retain a greater share of their foreign exchange earnings. In January 2021, Zimbabwe’s central bank announced that exporters must hand over 40% of their foreign currency earnings, which is then paid out in the local currency. Isaac Kwesu, CEO of the Chamber of Mines of Zimbabwe, said the government should ease those rules as local financial markets have limited capacity to finance such large capital requirements.

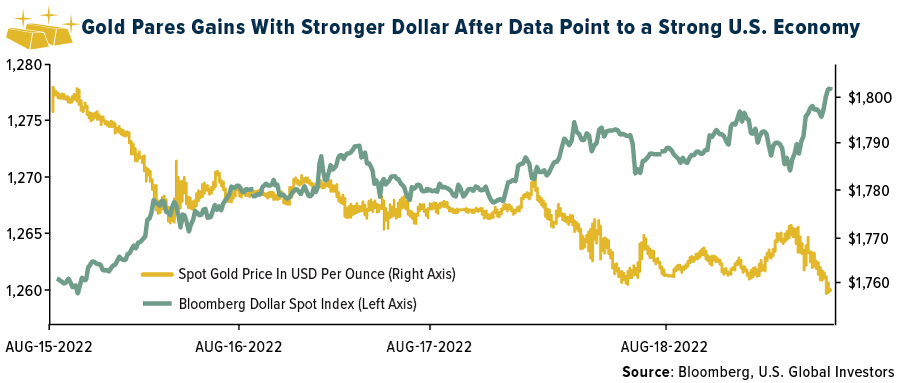

- Gold pared gains as the dollar advanced after latest data pointed to a still-healthy U.S. labor market, reports Bloomberg, potentially leaving the door open for the Federal Reserve to continue carrying out an aggressive path of interest rate hikes. Applications for U.S. unemployment insurance fell for the first time in three weeks. Gold’s main headwind “has been continued dollar strength only being partly offset by softer yields,” said Ole Hansen, Saxo Bank head of commodity strategy. “The claims support the strong job market view, giving the Fed room for more aggressive rate hikes.”

- Pure Gold Mining’s gold production dropped 42% to 3,509 ounces following disruptions linked to "significant cash preservation measures" Pure Gold introduced while it negotiated financing agreements in May. The company reported second quarter revenue of $8.53 million, which is down 43.5% year-over-year.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of