Gold Price And Gold Stocks Nearing A Big Move

Gold and especially gold mining stocks rebounded on Wednesday and trended higher into the weekend. This is giving some investors renewed hopes that the bull market that began roughly 18 months ago is about to reassert itself. We cannot know for sure yet but what we can say is precious metals are nearing a big move. Gold and gold stocks have traded in tight ranges which will compress further while volatility indicators approach multi-year lows. This is the setup for a break and then a powerful move with increasing momentum and volatility.

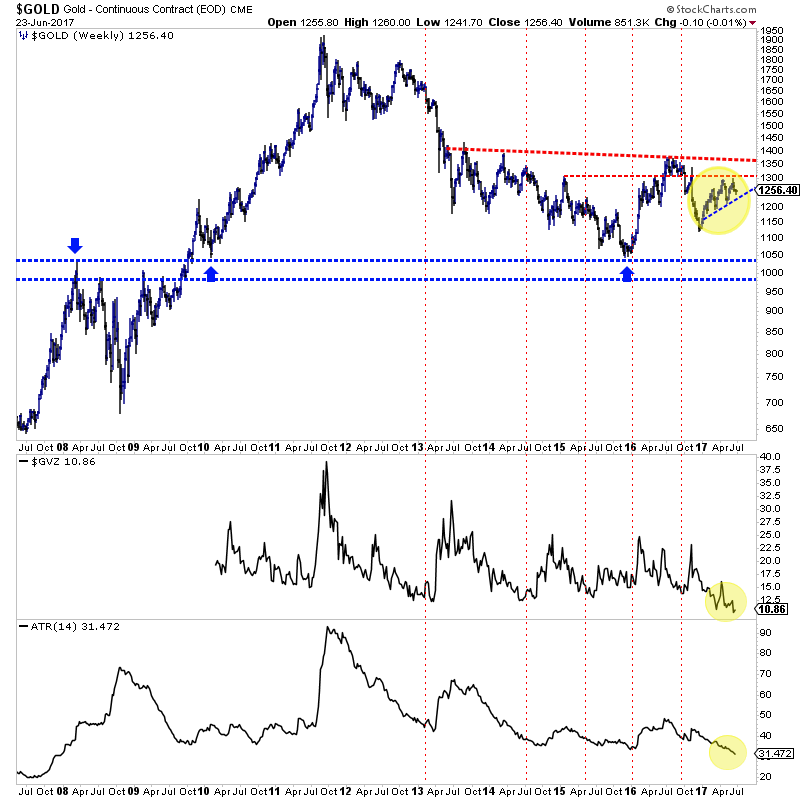

First let’s take a look at Gold. Its weekly bar chart is shown (going back 10 years) with two volatility indicators at the bottom. One is the GVZ contract and one is the average true range (ATR) indicator. The ATR indicator is at a 10-year low while GVZ is near an 8-year low. Gold has tested major resistance ($1300) twice and failed both times. If Gold loses its 2017 uptrend (support is around $1230) then it is susceptible to an accelerated decline with increasing volatility and momentum. On the other hand, if Gold could bust through $1300 and then consolidate around $1350, it could setup that anticipated breakout through $1350-$1375.

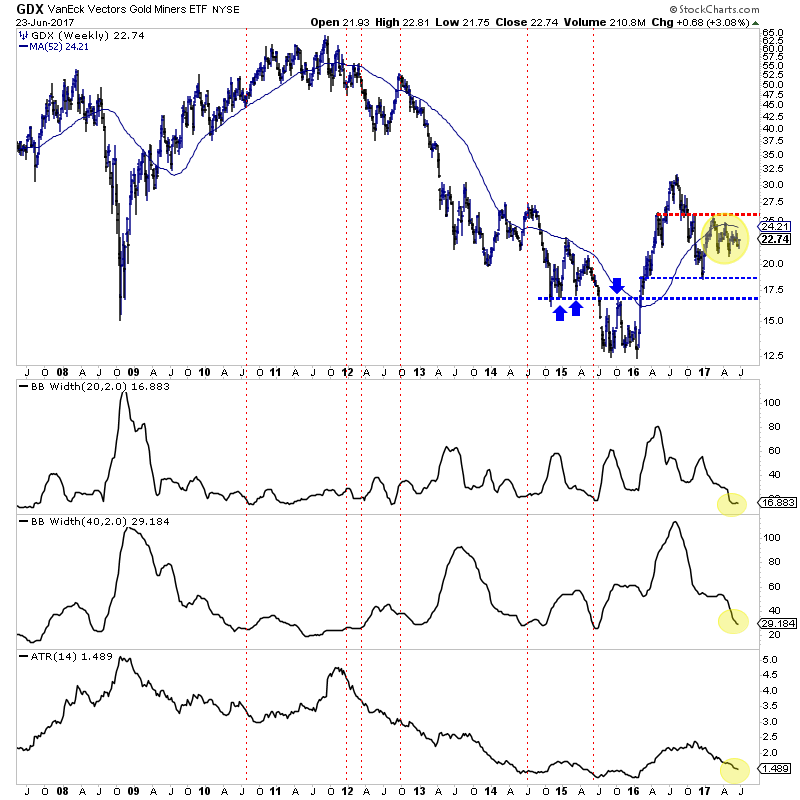

Turning to the gold stocks, we plot a 10-year bar chart of GDX along with the ATR indicator and the bollinger band width for two periods (20 and 40 weeks). These volatility indicators are trending down and approaching multi-year lows. This is not a surprise as GDX has traded in a tighter and tighter range since January 2017. Specifically, GDX has traded in a descending triangle pattern which, if GDX breaks $21 to the downside has a downside target of $17. The bullish outcome would entail GDX rallying to $25 and then breaking higher after a consolidation.

The bulls are cheering this latest rebound but they have a lot more work to do if the next big move is going to be higher. First things first, Gold needs to break $1300 and GDX needs to retest $25 again. The short-term trend could be higher now but until the Gold sector can attain those marks then the bias for the next big move (due to among other reasons the relative weakness in Silver and gold stocks) should remain to the downside. That is why we remain cautious.

********

Jordan Roy-Byrne CMT, MFTA