Gold Price Continues Moving West To East

· The best performing metal this week was gold, down 0.92 percent. This week was fairly negative for gold as the dollar held strong and the 10-year Treasury yield reached its highest since 2014 to 3 percent. A new use of blockchain technology will allow jewelers to track diamonds and gold from where they were mined to where they will be sold in retail. Four gold and diamond companies—Helzberg, Richline, LeachGarner and Asahi—will use the TrustChainInitiative, running on IBM’s technology, to prove to consumers that their purchases don’t include blood diamonds or other conflict metals, writes Bloomberg.

· We often get data points on U.K., Swiss or China/Hong Kong gold shipments, but one report on U.S. exports of gold caught our eye this week. U.S. exports of gold jumped 40 percent in February to 50.4 metric ton, roughly 25 percent of U.S. annual production that’s exported out in one month, with the largest percentage going to Hong Kong. China also imported 59.6 metric tons from Hong Kong in the same month. Gold is certainly moving from West to East.

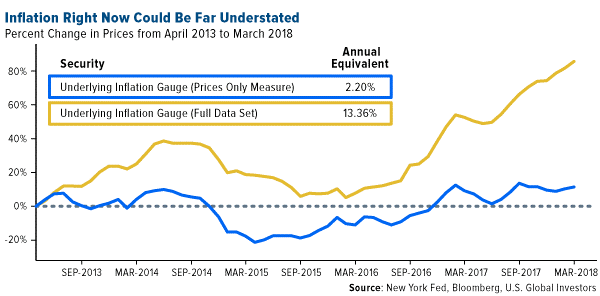

· With inflation talk starting to get more serious, we wanted to remind investors about the Underlying Inflation Gauge (UIG), which the New York Federal Reserve released last year. It has two parts to it: 1) a price-only index that has only been compounding at 2.20 percent for the last five years, and 2) a series that incorporates other non-price data, such as change in inventories. The research paper documenting all the variables is available on the New York Fed’s website. What is not talked about by the media is the UIG Full Data Set measure of inflation, which has been compounded at 13.36 percent over the last five years and really has been lifting strongly since 2016, the first year that gold had a positive return since 2012.

Weaknesses

· The worst performing metal this week was palladium, down 5.58 percent. Gold traders were bearish this week for the first time in four weeks, according to the weekly Bloomberg survey. Gold also broke its 13-day streak of inflows into ETFs; however, total gold held by ETFs rose 4.3 percent this year to 75 million ounces. Two-year Treasury yields are now at their highest in almost a decade, touching 2.5 percent this week. Mark Heppenstall of Penn Mutual Asset Management says that “in a rising-yield environment, it’s going to be hard to see out-sized gains for gold.”

· Palladium fell more than 5 percent on Monday to a session low of $971.72 an ounce, amid the U.S. hinting it might relieve sanctions on Russia, reports Reuters.

· Freeport-McMoRan, a Phoenix-based mining company, was blindsided this week by “shocking and disappointing” environmental claims from the Indonesian government, reports Bloomberg. The company announced that it would not be possible to continue mining at its flagship copper and gold mine in Indonesia unless it adopts new environmental standards imposed by the nation.

Opportunities

· Suki Cooper, analyst at Standard Chartered Plc, told Bloomberg in an interview this week that “investors are starting to look at gold again as a perceived inflation hedge.” Cooper estimates that the gold price may average $1,375 by year-end. Jeffrey Gundlach is also bullish on the gold price, saying this week that gold has broken its downtrend and is on the verge of breaking out to the upside. CPM Group is bullish on silver and said this week in its Silver Yearbook 2018 that “the enormous range of economic, financial and political issues facing the world and individual investors seems more likely to lead to a rekindling of silver demand from investors.”

· Although China’s gold output declined 6 percent year-over-year in 2017 and dropped 5.4 percent in the first quarter of 2018, it still kept its spot at number one in the world for production. China is also the world’s largest consumer of gold at around 1,089 tons last year, up by 4.1 percent. It’s important for investors to remember that China was a small player in the gold industry just 20 years ago and has gone through significant transformation due to a careful and deliberate strategy to expand the ownership of gold.

· Bloomberg Intelligence’s Mike McGlone writes this week that metals are in a bull market transition with stocks. McGlone also says metals are positioned to outperform the stock market and that increasing volatility is dragging on equities. He says current conditions mirror the decade-long metals bull run over two decades ago.

Threats

· HSBC has changed its forecast to include a strong U.S. dollar due to a shift in the relative dominance of cyclical drivers over structural and political drivers. Bloomberg also writes that the dollar is strengthening and could potentially have negative side effects such as repricing financial markets. This could reduce the pace of GDP growth and inflame the Trump administration’s focus on trade imbalances. A stronger dollar has historically been negative for the price of gold.

· Americans are growing pessimistic of the market, and for the first time since President Trump took office, a majority of consumers expect stocks to be lower in a year from now, according to the latest sentiment reading from the Conference Board. This is in stark contrast to a few months earlier in January when optimism was at a record high in the Conference Board survey. Apple’s costliest smartphone, the iPhone X, has struggled to attract new customers, and its manufacturing partners are feeling the downturn. Bloomberg writes that “Apple Inc.’s largest device assemblers reported a sharp slowdown after peaking at the end of last year, suggesting that demand for the high-end device may have faded just a quarter after its release.” For some of our readers who lived through the dotcom bubble, you might remember that forecasts of falling handset sales back in the year 2000 preceded the market downturn.

· U.S. debt continues to grow as Treasury officials are set to announce second-quarter funding plans on May 2 with bond dealers expecting another across-the-board boost to auction sizes, reports Bloomberg. According to JPMorgan’s estimate, government debt sales will more than double this year to a net $1.44 trillion. Andrew Lapthorne of Societe Generale SA says that interest rates have already been doing damage to the economy and that “leverage in the U.S. is grotesque for this stage of the cycle.” Lapthrone continued to say in an interview this week that “it’s not like you have to dig deep to find a problem.”

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of