Gold Price Forecast: The 1929 Market Crash Versus Now

The stock market continues to price in a V-shaped recovery, which I find unlikely. More and more companies are filing for bankruptcy weekly, and that trend appears to be accelerating. The devastation to the economy could take one to two years to fully realize.

Some consider the period we are going through "creative destruction." That is where old businesses that have become inefficient or irrelevant (Blockbuster), are replaced by the next generation (Netflix). This happens every decade or so as the economy evolves and adapts to emerging trends.

It is during times of difficulty and upheaval that give birth to new concepts. Entrepreneurs capitalize on these trends, and innovative businesses appear. I see massive potential in online education, domestic robotics, as well as new forms of food delivery/production services.

Unfortunately, the current period of creative destruction is just getting started and could drag on for a couple of years. To illustrate my point, I have constructed a quick study of the 1929 stock market crash broken into three phases.

The 1929 Crash

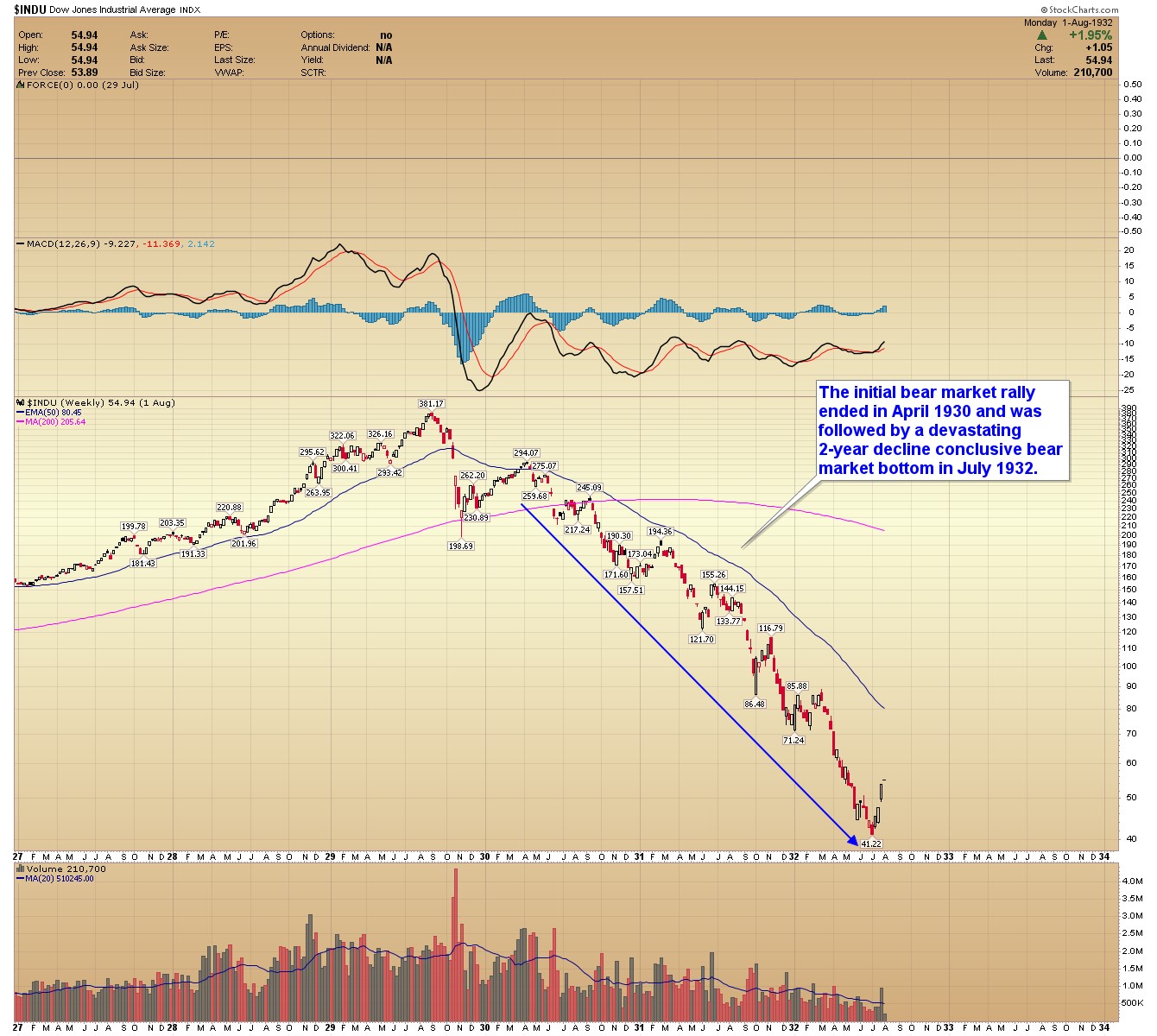

Phase 1) The stock market dropped nearly 50% over ten weeks before bottoming in November of 1929.

Phase 2) After bottoming in November 1929, the stock market rallied approximately 48% over the next 5-months.

Phase 3) The initial bear market rally ended in April 1930 and was followed by a devastating 2-year decline and conclusive bear market bottom in July 1932.

DOW 2020

The initial crash is over, and stocks are rebounding (phase 2) in anticipation of a V-shaped recovery. How high prices go is anybody's guess, there is massive liquidity hitting the markets. However, I would be surprised if this rebound exceeds 27,000.

As more and more companies file for bankruptcy, I think people will begin to realize the economy will not experience a V-shape recovery. Soon after that, stocks will turn lower and presumably drop to new lows. Depending on fiscal and monetary policy, and of course, a vaccine for the coronavirus, I do not foresee the stock market bottoming until 2021 or 2022.

Note, I doubt stocks will lose 90% of their value as they did during the great depression, there is too much money creation this time.

Gold Near-Term

Prices are consolidating, and this could go on for another 1 to 3-months. I see two potential outcomes.

Scenario 1) Gold breaks above $1800 and attempts to breakout above $2000.

Scenario 2) After consolidating, prices break below $1660 and drop back towards $1500 - $1550.

Longer-term, gold has no choice but to go much, much higher. How high is anybody's guess - I have a minimum target of $8500. If governments lose all credibility, and the national debt exceeds 40-trillion, gold could reach insane levels well above $10,000.

Silver Prices

Silver is a bit trickier as prices are more sensitive to the economy and industrial demand. I believe in silver long-term, and see prices rising well above $100, at some point. But in the meantime, deflationary forces could keep prices under pressure. It would take a decisive breakout above $20.00 to establish the next bull run.

Conclusion

In conclusion, governments around the world have painted themselves into a corner. The only way out is to devalue their currencies or outright default. In my opinion, this guarantees much higher gold prices.

The birthing period we are in will be challenging, and people will suffer. To save the old, unproductive parts of the economy, governments will print vast sums of money. Their efforts will fail, ultimately leading to a currency crisis.

Too often, we focus on what is happening next week or next month. Forget about that! Short and medium-term trading is unpredictable and manipulated - consider a long-term, structured approach instead.