Gold Price Forecast Among Multiple Bullish Factors

The first one is the situation in crude oil. Namely, it plunged below $30 overnight as Saudi Arabia ramped up production following Friday's OPEC+ collapse. At the same time, treasury yields plunged to fresh record lows and the USD Index plunged once again, moving very close to its 2019 lows.

The current market expectations regarding the upcoming Fed meeting are very dovish.

The rates were just slashed by 0.5%, and yet - today – people are expecting the Fed to slash rates by either another 0.75% or (most people) another 1%.

Low crude oil price are generally positive for the US economy as this implies lower production costs. So, why would people expect the Fed to take VERY aggressive measures now?

Fear.

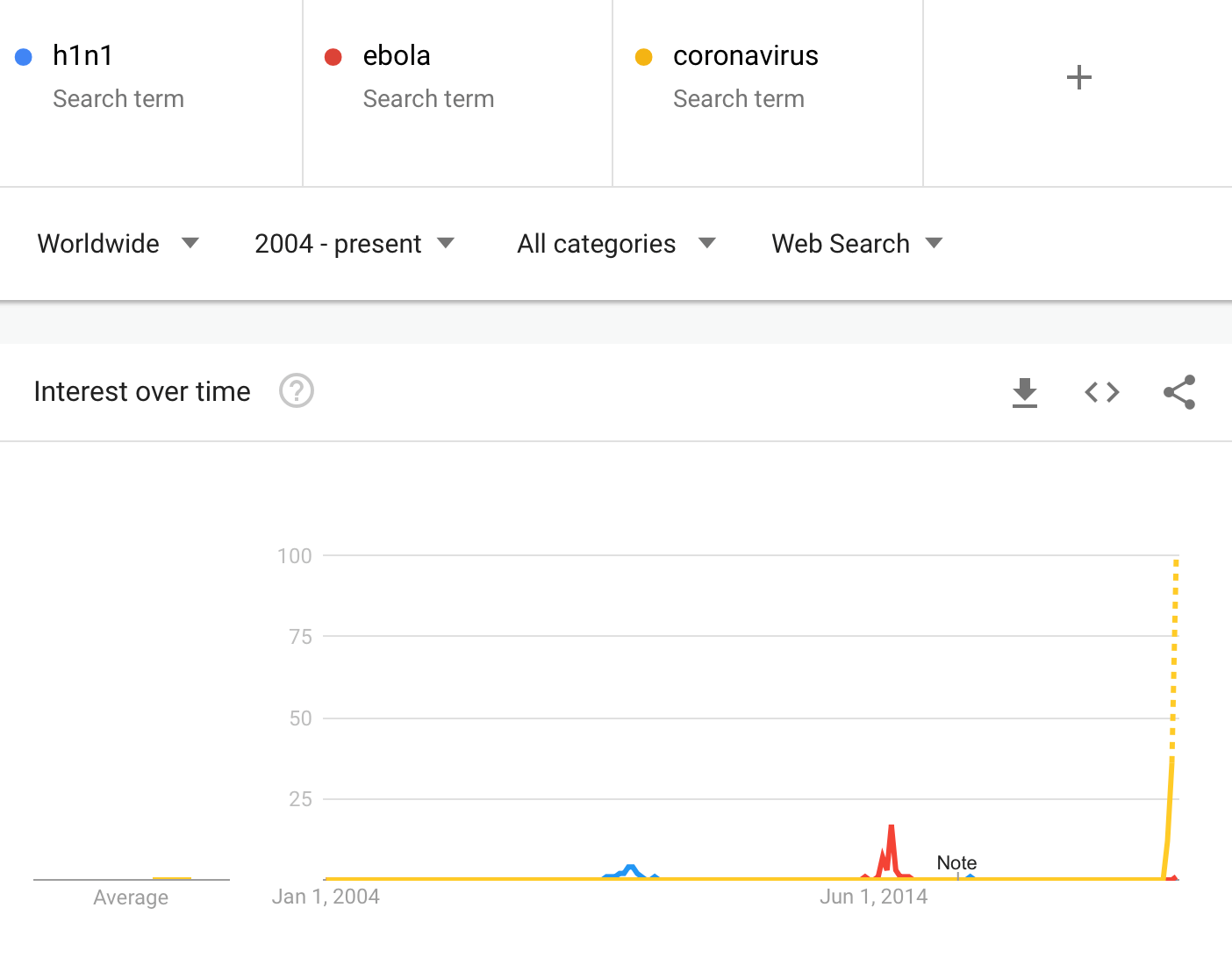

People’s fear of the coronavirus as measured by the search interest in “coronavirus” has gone through the roof - it’s over 5x as big as the interest in “ebola” was in 2014. Please take alook at the chart below for details (courtesy of Google Trends).

Crude oil just dropped over $10 overnight, the USD Index dropped over 1 index point (almost 5 index point drop in just a few weeks). People’s expectations regarding interest rates have dropped extremely (since markets are forward-looking this is practically almost as important as if the rates were already lower) - almost 2% in just one month. Also, the stocks are plunging - the S&P 500 futures are down by about 17% from their recent high.

Isn’t this excellent time to buy gold?

No. Everything that we wrote in the previous paragraph has already happened, which means that gold has already reacted to it. And in what way did it react? It just moved to its previous high. This week started with an attempt to move above it, and this move failed as gold reversed its course and at the moment of writing these words, it’s only 0.18% higher. On the other hand, silver is over 2% lower and it’s once again trading below $17.

Given all that happened in the last 2 weeks, and especially given what happened overnight gold “should be” trading MUCH ($100+) higher. Gold just failed to react to a series of very positive events, which tells us that it’s about to move in the other direction. It’s one of the key gold trading tips – to monitor how gold is performing relative to what should make it move. If it doesn’t, it tells you something.

The technical confirmations - weakness in silver and mining stocks - are already present. Silver is already attempting to break lower, while miners have not yet started trading today. Still, they refused to rally close to their previous highs on Friday, even though gold was moving temporarily above its previous high. That’s a clear underperformance sign and one that tells us that lower precious metals values are to be expected in the following months and weeks.

Plus, what can the Fed do on its next meeting? It already panicked and stimulated the economy based on something that might have been just a temporary fear-driven correction. People got scared even more and they now expect the Fed to deliver at least (!) a 0.75% cut. Some expect more, which means that - on average - if the Fed cuts the rates by 0.75%, it will likely still be viewed as hawkish. To some people that will be normal, and to some, it will be a hawkish surprise as they expect an even bigger cut.

The decline in crude oil is not a factor that supports interest rate slashing.

Regardless of the above rate discussion, based on how gold is reacting to the increased fear of coronavirus, it seems that people are starting to realize that gold will not save them from a virus. It might be very useful in case of an economic collapse, or a new World War. But in case of a virus? Not really. People’s initial reaction to every shock might be to buy gold, but after the initial reaction, the logic comes into play, and it doesn’t necessarily imply the need to protect oneself with gold against the virus. In fact, if the virus becomes even more widespread, then people would likely prefer to stay and home as much as possible, avoiding contact with others. This means that they will also prefer doing business and shopping online, without cash, or gold. There are many crises in which gold gleams strongly, but it might not be one of them.

Summary

Gold investment might seem like a good idea at this time, but in our view, it isn’t. It seems that what was likely to happen based on the increased fear of coronavirus, crude oil turmoil, decline in interest rate expectations, has already happened. And gold failed to soar well above its previous 2020 highs. Instead it just attempted to break higher. Even plunging USD Index didn’t make gold soar above $1,700 in a sustainable manner.

This means that the following months are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. Forecasting gold’s rally without a bigger decline first is thus likely to be misleading. The times when gold is trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. You’ll also get free 7-day access to most of our premium services, including Gold & Silver Trading Alerts, and Gold Investment Updates. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,