Gold Price Forecast: Deep Roots Of The Gold Miners

Despite gold’s recent rally, the gold miners barely moved or even declined. The downward pressure must have taken root in the miners – will it hold?

Despite gold’s recent rally, the gold miners barely moved or even declined. The downward pressure must have taken root in the miners – will it hold?

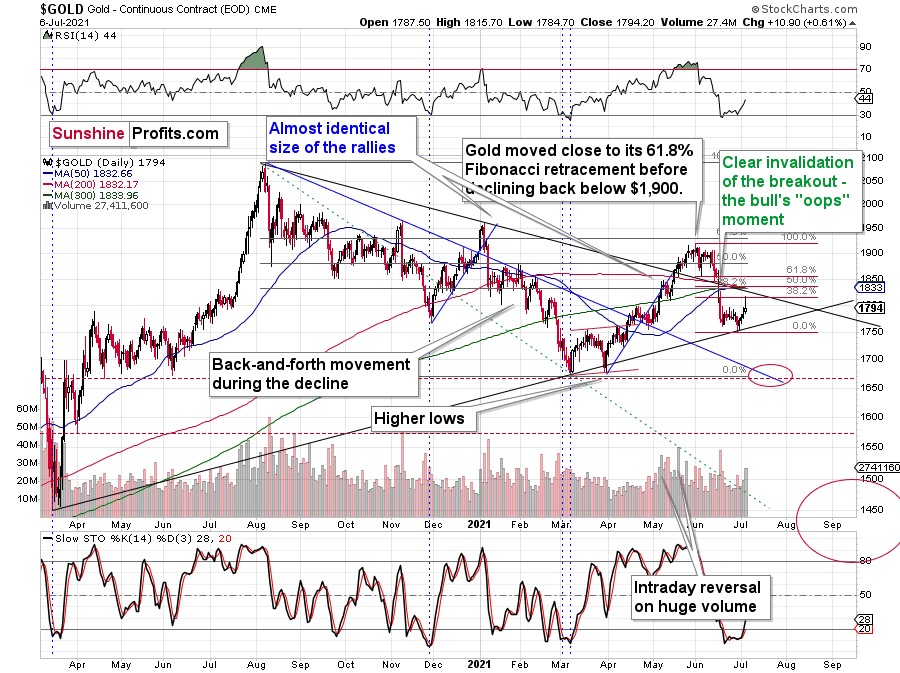

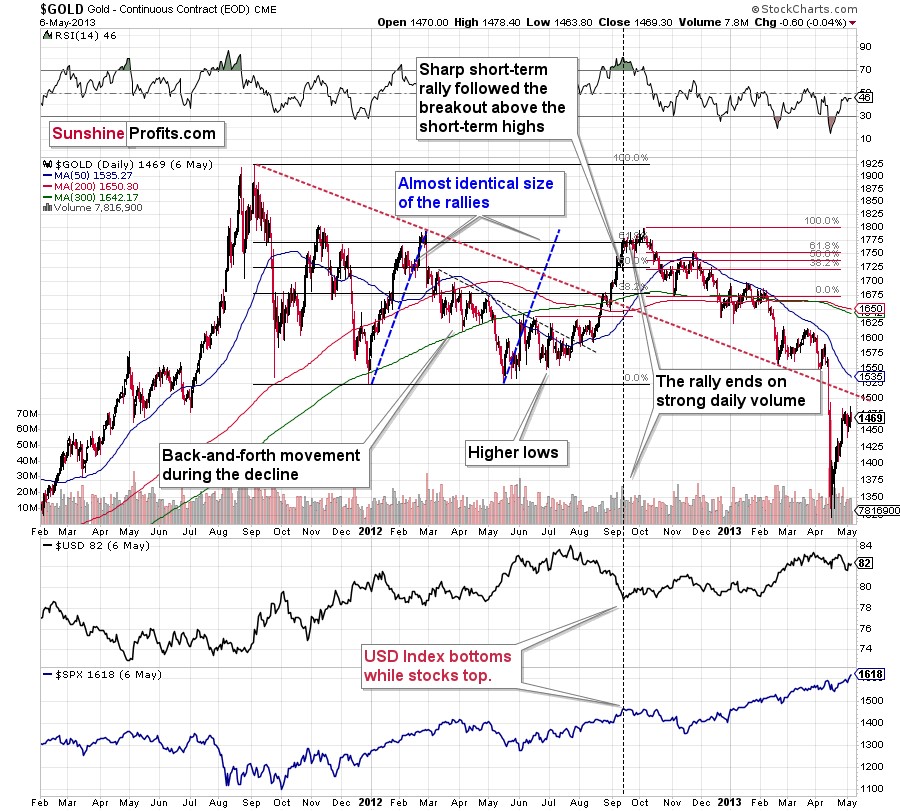

In my previous analyses, I wrote about the possibility of seeing another move higher in gold, and that it wouldn’t last long – if we saw it at all. I also wrote that mining stocks would likely disappoint, just as they did in 2012. And what happened yesterday was in tune with the above.

Namely, gold did move higher, but only on a very temporary basis.

In fact, the rally ended even before the closing bell, as gold futures reversed their course and ended the session only $10.90 higher (after being even ~$20 higher intraday). This price action created a bearish reversal candlestick called the shooting star. Such candlesticks tend to be important if they form on relatively big volume. And indeed, yesterday’s volume was relatively big, which means that the implications are bearish.

Well, they were bearish even before yesterday’s session, but seeing confirmations adds credibility to the bearish narrative.

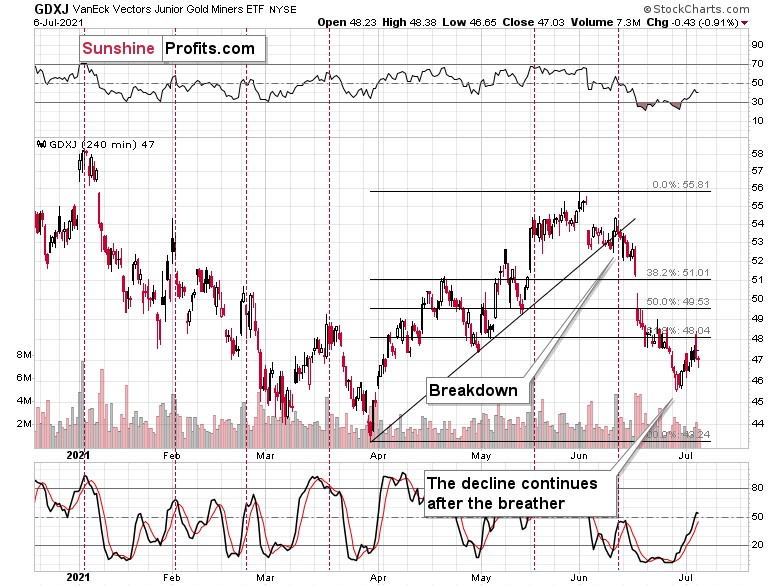

Another detail that serves as a bearish confirmation is the performance of the mining stocks.

The senior gold stocks were barely up yesterday. Unlike gold, they didn’t move above their recent intraday highs (which is exactly what happened in 2012 at the end of the corrective upswing).

By the way, back then, gold corrected to its 61.8% Fibonacci retracement, and this time it moved slightly above the 38.2% retracement (intraday) before declining.

This time the market is weaker, but the similarity between both periods remains intact.

Getting back to the mining stocks, while senior miners moved slightly higher, junior miners declined. This is most clearly visible on the 4-hour chart.

After an intraday attempt to rally back above its recent low, the GDXJ turned south once again and ended the session lower.

I’ve already written why the junior mining stocks’ bearish potential is bigger than the one of the senior miners, and yesterday’s session provides yet another confirmation.

Hence, the outlook remains bearish.

Silver and the USDX

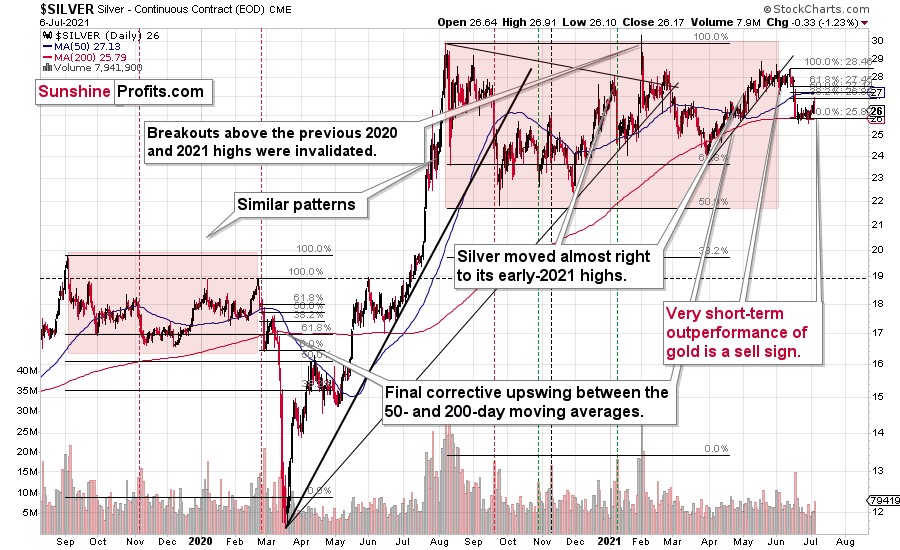

Let’s keep in mind the sell signal from silver too. Quoting yesterday’s analysis:

As further evidence, with silver outperforming gold, the behavior often serves as a prerequisite to significant tops. As a result, the white metal’s outward strength on Friday (silver rallied by $0.40 while gold gained only $6.50) has extremely bearish undertones and the 2012 analogue remains the most likely predictor of silver’s medium-term path.

Silver ended yesterday’s session lower but not before rallying. The above-mentioned sell signal remains intact.

The situation in the USD Index is quite specific as well.

On one hand, we have a situation in which the USDX is just below the medium-term resistance line, so it suggests some difficulty in moving higher from here. On the other hand, we see that the USDX already corrected yesterday and rallied back up immediately. This could be a sign that it’s ready to break above the neck level of the pattern. This would be a major development as the target based on the head and shoulders pattern is equal to the size of the head (I marked it with green, dashed lines). The breakout here would, therefore, imply a move to about 98 –approximately the late June 2020 highs.

Naturally, the above would be very bearish for gold and the rest of the precious metals sector.

It seems quite likely that the USD Index will break higher, if not soon, then shortly. And when that happens, gold will likely slide to its previous 2021 lows. That’s when we might see a short-term rebound before a huge price plunge to $1,500 or lower.

Summary

To summarize, the corrective upswing seems to be over, and gold seems to have started its big decline – one similar to what we saw in 2008 and 2012-2013. Even though gold could still move somewhat higher in the near term (like this week), it seems more likely that we are witnessing a long consolidation before a further decline.

And as silver often moves in close relation to the yellow metal, Silver is likely to slide as well. The times when gold is continuously trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,