Gold Price Forecast: The Gold Market Is Turning

Last week's trading saw gold forming its low in Monday's session, here doing so with the tag of the 1721.60 figure. From there, strength was seen into later in the week, with the metal pushing all the way up to a Thursday high of 1759.40 - before backing off the same into Friday's session.

Last week's trading saw gold forming its low in Monday's session, here doing so with the tag of the 1721.60 figure. From there, strength was seen into later in the week, with the metal pushing all the way up to a Thursday high of 1759.40 - before backing off the same into Friday's session.

Gold Market, Short-Term

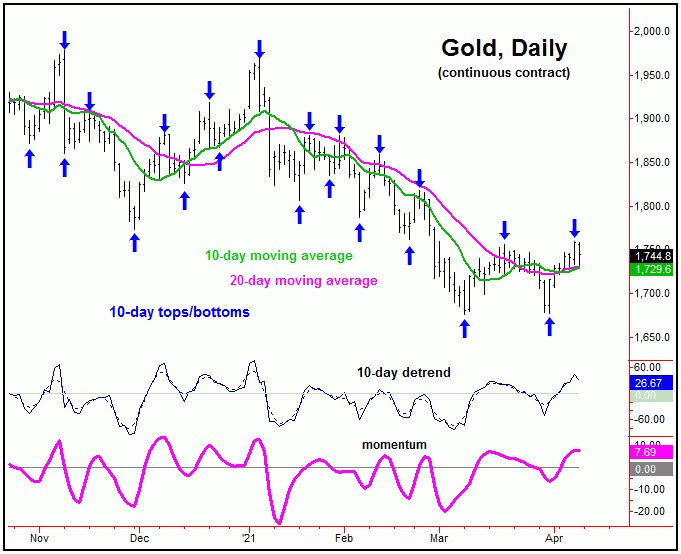

For the very short-term, the recent rally came, in part, as a result of the upturn in the 10 and 20-day cycles in gold. Here again is the smaller 10-day wave:

Normally, a cycle will revert back to a moving average of the same length approximately 85-90% of the time, and with that - following the sharp rally seen into late last week - Gold was due for a short-term pullback, coming from this same 10-day component. In terms of price, Friday's action saw the metal dropping right back to our 10-day moving average, with the next short-term bottom expected to come from this 10-day wave.

In terms of patterns, due to the newly-viewed configuration of the larger 72-day cycle, the downward phase of the 10-day cycle is expected to end up as a countertrend affair - holding above the prior 10-day trough of 1677.30.

The chart below shows our 72-day wave:

In terms of price, with the recent action, we have our best indication that the 72-day cycle bottomed back in early-March - and with that is headed higher in the coming days/weeks. In terms of price, the ideal path is looking for a rally back to the 72-day moving average or higher, currently around the 1798 figure (but declining).

Stepping back, however, until proven otherwise, the probabilities will favor the next upward phase of the 72-day cycle to end up as a countertrend affair - holding below the prior 72-day peak of 1968.80 - registered back in January. Resistance to that move looks to be centered around the 154 and 310-day moving averages - a range which encompasses the low-to-mid 1800's for gold.

If the upward phase of the 72-day wave does end up as countertrend, then the probabilities will favor another decline phase into the month of May, one which sees either some re-test of the recent lows - or else makes a marginal new low for the bigger swing. Should the latter materialize on a good technical contraction, it should set the metal up for what is expected to be the largest percentage rally of this year.

The chart below shows our Mid-Term Breadth index for the gold market:

As mentioned in prior articles, at the early-March low this indicator was showing a divergence from price - with gold making new lows for the swing, but the indicator holding well above the prior (November) bottom. This was viewed as bullish - and supportive of additional short-term strength, some of which we have obviously seen over the past month.

A secondary note in regards to the above is that our Mid-Term Breadth index is nearing its 'zero' line. A move above the same in the coming days - should it be seen - is often accompanied by a sharp price rally, which is right in line with our analysis of the 72-day time cycle.

Take a look at the next chart:

The chart above shows a long-term momentum indicator that I have developed. Of note is that the indicator is starting to flatten out with the action seen in recent weeks - and looks to be closing in on a turn back to the upside. A turn higher in this indicator - if seen going forward - would be an added indication that the metal is turning, for what is favored to be a pretty good rally in the coming weeks.

Gold's Mid-Term Outlook

For the mid-term picture, the next low of significance is expected to come from the 310-day cycle, with the same currently projected for the mid-May timeframe:

Having said the above, due to the larger plus or minus variance with this 310-day cycle (which can be plus or minus a month or two in either direction), there is the potential its bottom could have already formed - or that it could come slightly later, such as into the month of June.

Going further with the above, a turn in our long-term momentum indicator - should that materialize - would be our first 'hint' that the larger 310-day cycle is turning. We would need to see other technical indications as well, but this is one that we will be watching going forward, as the action plays out in real-time. Stay tuned.

Jim Curry

The Gold Wave Trader

http://goldwavetrader.com/

http://cyclewave.homestead.com/

Jim Curry is the editor and publisher of The Gold Wave Trader and Market Turns advisories - each of which specializes in the use of cyclic and statistical analysis to time the gold and U.S. stock markets. He is also the author of several trading-related e-books, and can be reached at the URL's above.

*********