Gold Price Forecast & Inflation Update

Overall, the December inflation numbers came in near expectations. Annually, consumer prices are up 7.0%, while energy is seeing the fastest rise with gasoline rising 49.6% in the past 12-months.

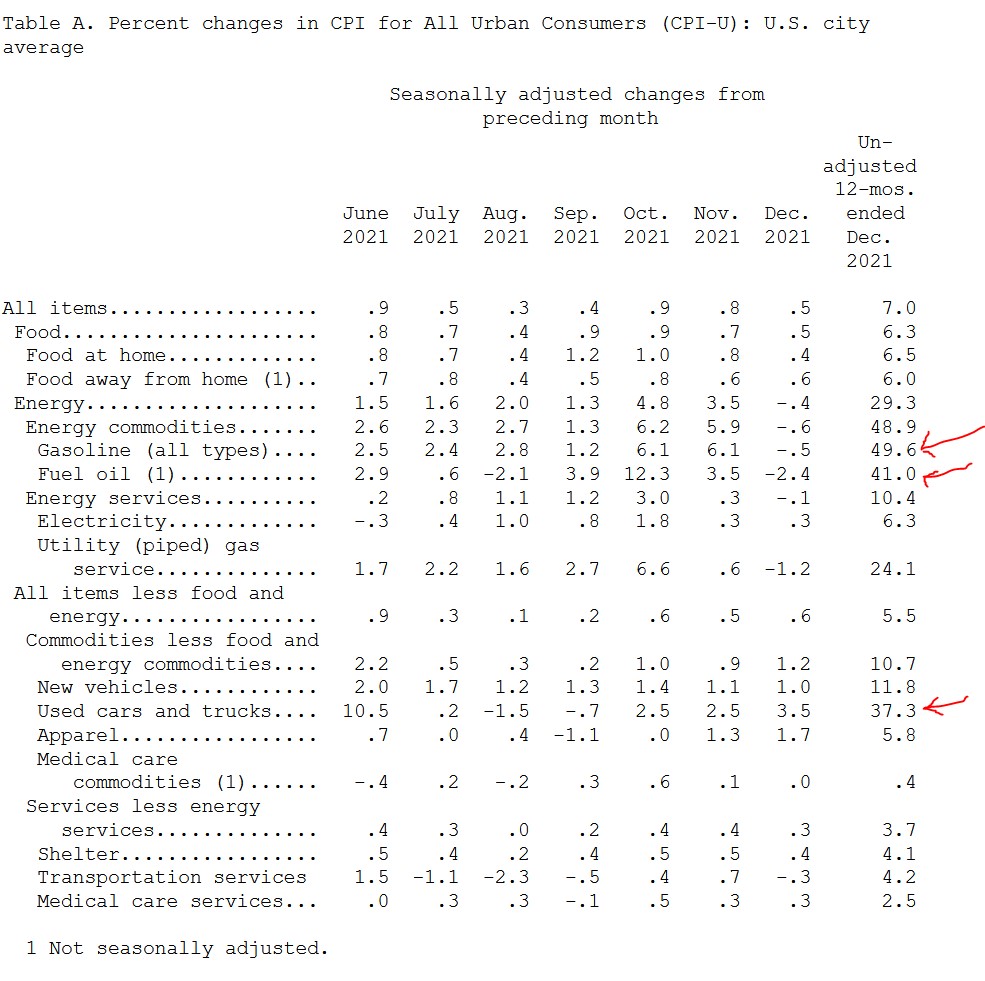

Below are the headline numbers from today’s report:

- CPI (monthly) 0.5%

- Annual CPI 7.0%

- Core CPI (annual) 5.5%

In the snippet below, note the 49.6% year-over-year increases in Gasoline and 41% in Fuel oil. The 37.3% rise in used vehicle prices is also worth pondering.

Source: https://www.bls.gov/ces/

Is Oil the New Fed Funds Rate

The Fed can manipulate interest rates, but they can’t produce one drop of oil. To that point, energy and oil markets are beyond their control. Are spiking oil prices telling the Fed to raise rates? I think they are.

Households Getting Pinched

Energy makes up a large part of household budgets. With energy prices up 29.3% (year-over-year), that is a huge problem for anyone barely getting by. Add in the expiring child tax credit and it won’t be long before people start missing payments.

Expiring Tax Credit

Millions of American families received their final enhanced child tax credit on December 15, 2021. They will soon be looking for alternative ways to pay higher rent and energy bills. Some will dip into savings and retirement funds, while others will use credit cards or default. Either way, it will take more liquidity out of the system. Our work supports a 20% to 30% decline in the S&P 500 sometime for 2022.

Medium-Term Head Winds

Vital liquidity leaves the markets as the Fed completes tapering.

- Interest rates rise as the Fed takes its thumb off the scale (ends tapering).

- A potential energy crisis leads to a spike in crude oil above $100 per barrel.

Gold Price Update

GOLD 1-HOUR FUTURES CHART: Gold futures are rising after today’s inflation report. Near-term, resistance arrives between $1825 and $1835. A strong move above $1835 through $1840 would be near-term bullish. Whereas a bearish reversal would be considered on a daily close below $1815.

I’m expecting gold to breakout above $2000 in 2022 and approach $2800 to $3000 by year-end.

AG Thorson is a registered CMT and expert in technical analysis. He believes we are in the final stages of a global debt super-cycle. For regular updates, please visit here.

********