Gold Price Forecast: One Helpful Tool To Pick Gold Lows And Highs

“Buy low, sell high!” Bada-bing, bada-boom and the money rolls in. If only it were that simple, we’d all be rich fairly quickly. However, after looking past the myths, there are strategies that can help in determining a bottom or a top, and one of them is to look for reversals.

The buy low and sell high mantra has become so widely repeated that everyone from your car mechanic to the all-knowing uncle we seem to have in every family swears by it. No doubt, they apply it daily and cash in on the wisdom. But jokes aside, how do we really know when gold or a stock has reached a low or a high?

Gold and silver both reversed on Monday (Jan. 11), which might seem bullish at first sight, but it isn’t.

Reversals are the key moments in any market, because they often mark tops and bottoms. And – of course – everyone wants to buy at the bottom and sell at the top. That’s much easier said than done though, because tops form exactly at the moment when the urge to buy is at its peak, and the opposite is true for bottoms. So, in order to make money, one needs to decide on not following what they “feel” is going to happen, but what the objective tools that have proven effective in the past suggest. If enough of them suggest the same thing, the odds are that the market is going to do something – regardless of how one “feels” about the market at a given time.

Reversals are particularly interesting, because they allow one to enter the market almost right at the bottom and exit right at the top. And they work over and over again. They’re easy to spot too – the price was going up for days and now it moved up and then back down. Easy as that… Or is it?

You already know the answer. No, it’s not that easy. It may look simple, especially at first glance, but it’s not easy, and the emotional factors are not the only obstacle in determining whether or not a reversal was really important.

The thing about reversals that’s hidden in plain sight is that they are not only about the price. The key thing to look for during these reversals is volume.

We should see a fierce battle between bulls and bears, leaving one side overpowered – in the case of bottoms, bulls should overpower bears. Low or average volume means that the battle was not fierce, or that there was very little fighting done on a given day. The implications would likely be nonexistent.

So, what happened on Monday in gold and silver with regard to volume?

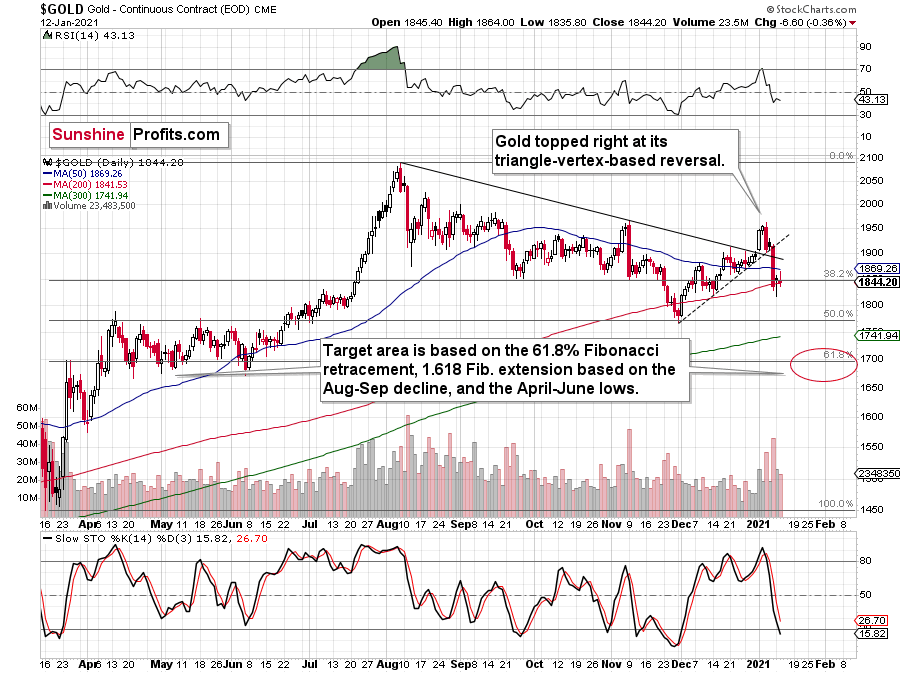

Figure 1 – COMEX Gold Futures

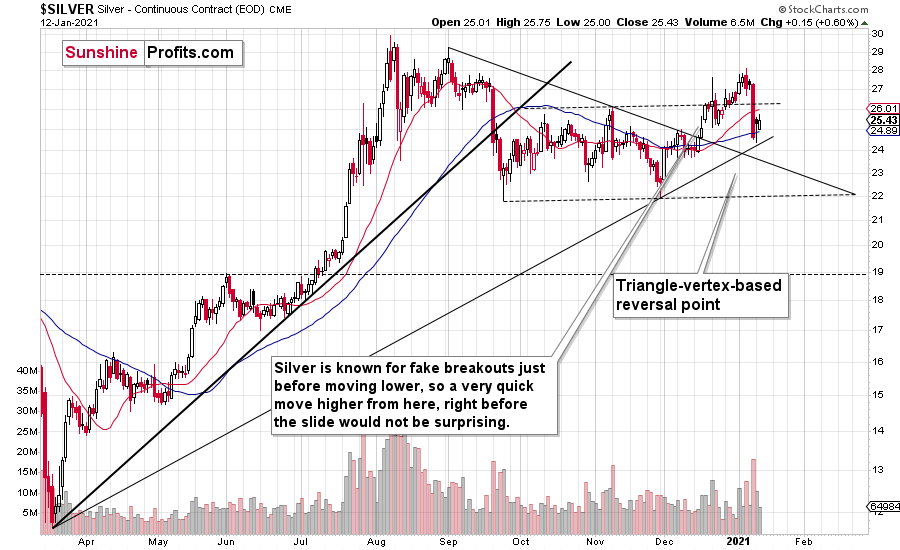

Figure 2 – COMEX Silver Futures

The volume was notable, but it was not huge. So, did gold form a critical reversal? Not really. It corrected some of its declines and took form of a reversal, but it didn’t have the reversal’s “spirit”. The bulls didn’t seem to have overpowered the bears. What seems to have happened instead, is that bears took a break after a massive daily victory.

You can see a good example of a clear reversal in silver, on Sep. 24, 2020. The volume was the second biggest in a month and slightly bigger than what accompanied the previous day’s decline. And indeed, that was a bottom for months.

Gold doesn’t feature any crystal-clear reversal example in recent history, but the closest to it would be the Aug. 12, 2020 session. Back then, gold reversed, but the rally was over in a week. So, did the reversal really work? It did, but only to some extent. And what kind of volume preceded it? It was big, but not huge. It was big enough to show a bull’s strength, but it was not truly groundbreaking. Thus, a limited reaction was perfectly justified – and that’s what we saw.

Getting back to the current situation on Monday, the volume was relatively average, so I don’t think one should focus on the “default, bullish” implications, because this is not a “default bullish” reversal. It’s a suspicious reversal that might have actually been a breather, so forecasting gold’s rally here would likely be a mistake. The volume doesn’t indicate that it was an important reversal – it’s only the price that indicates that.

So, will gold and silver plunge immediately? Perhaps, and perhaps not. Friday’s (Jan. 8) decline was quite profound, so a few extra days of back-and-forth movement or even a small rally, wouldn’t be surprising. The overall trend is down, and since the USD Index has already (most likely) bottomed, more downside should be expected for the precious metals.

Speaking of the USD Index, it’s breaking above increasingly more resistance lines.

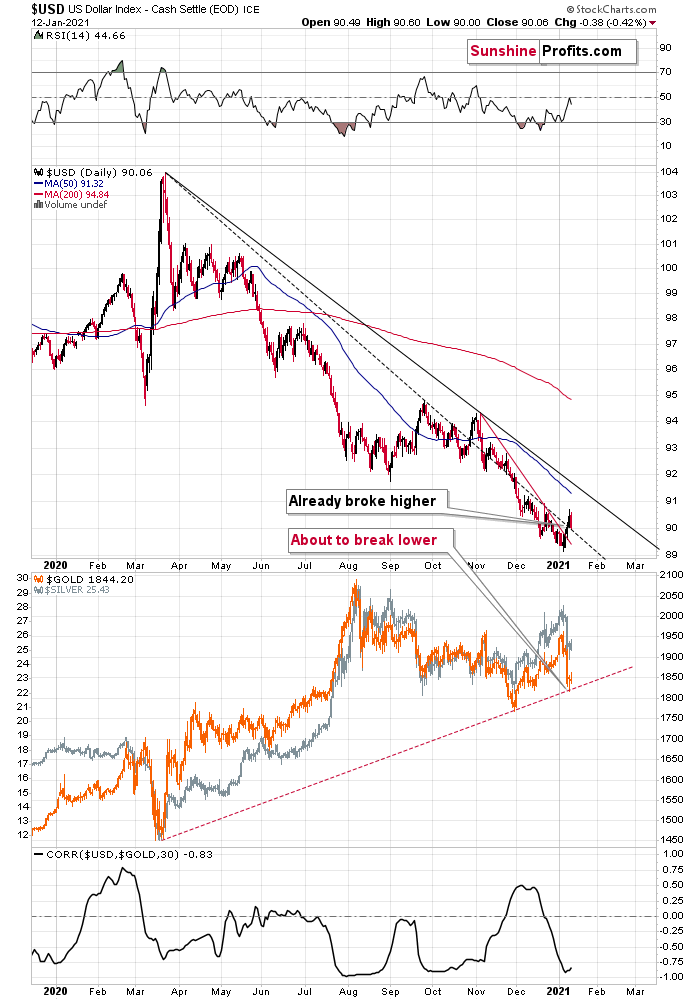

Figure 3 - USD Index, USD, GOLD and CORR Comparison

After confirming the breakout above the very short-term declining resistance line, the USD Index has now broken above the declining dashed line that’s based on the March 2020 and September 2020 tops.

With the correlation between the USD index and gold (bottom part of the chart) being strongly negative, the USD’s breakouts are bullish for gold. Namely, they tell us that after a breather, the USD Index is likely to continue its rally, while precious metals are likely to fall.

The next big move in the PMs is likely to take place once gold breaks below its rising support line, and that’s likely to happen relatively soon. Moreover, please note that the existence of the support line is – by itself – a reason for gold to correct before sliding. This makes the theory of Monday’s (Jan. 11) reversal not being a true reversal even more valid.

All in all, it seems that the precious metals sector is about to decline once again, if not immediately, then shortly.

Summary

The next time someone tells you to buy low and sell high, tell them it’s a little more complicated than that. A powerful repertoire of tools exists – including identifying reversals – for anyone who’s willing to look at technical analysis.

The top is in and the following days are not likely to be pleasant times for anyone who jumps on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. As silver often moves in close relation to the yellow metal, forecasting rally in the PMs without a bigger decline first is thus likely to be misleading. Silver is likely to slide as well. The times when gold is continuously trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,