Gold Price Forecast Per US Federal Reserve Balance Sheet

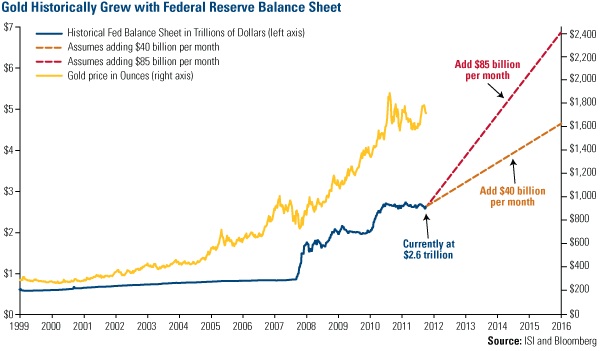

Since 1999 the gold price has moved in concert with the growth in the US Federal Reserve Balance Sheet…including the recent correction in both during the past three years. Accordingly, the following objective analysis will forecast the gold price out to 2016…based solely on historical Central Bank data.

Since 1999 the gold price has moved in concert with the growth in the US Federal Reserve Balance Sheet…including the recent correction in both during the past three years. Accordingly, the following objective analysis will forecast the gold price out to 2016…based solely on historical Central Bank data.

The above chart estimates two Balance Sheet growth rates from 2012-2016 (when Obama leaves the Presidency):

- Adding $40 Billion per month…equating to a Compound Annual Growth Rate (CAGR) = 14.8%

- Adding $85 Billion per month…equating to a Compound Annual Growth Rate (CAGR) = 26.6%

Another Federal Reserve Assets vs. Gold Price Chart:

http://www.macrotrends.net/1448/fed-balance-sheet-vs-gold-price

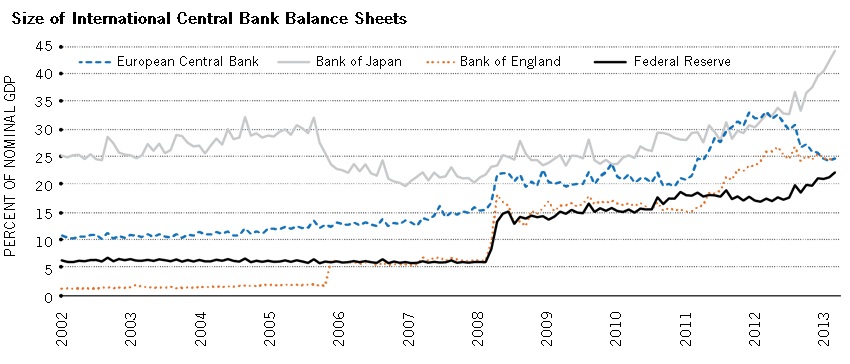

Moreover, it’s noteworthy that the Balance Sheets of major international central banks have likewise been growing in tandem since the beginning of the millennium. The chart below clearly shows steady Balance Sheet increases in the Euro Central Bank, Bank of Japan, Bank of England and the US Federal Reserve.

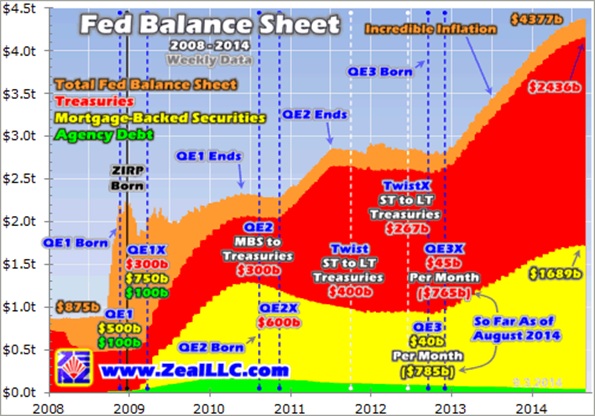

Likewise, internationally acclaimed market analyst Adam Hamilton observes: “ This chart shows the Fed’s balance sheet accelerated growth since 2008 when QE was initially born. This data is stacked within the Fed’s total balance sheet (orange), with US Treasuries (red) sitting on top of mortgage-backed securities (yellow).”

Per market pundit Hamilton’s detailed chart, the increase in the Fed’s Balance Sheet has been dramatic during the past seven years. And despite the fact the Republicans now hold a majority in both houses, it is hard to imagine that the Fed’s Balance Sheet will not continue to expand during President Obama’s last two years in the White House. To be sure this would translate into a higher price for the shiny yellow…well into 2016.

Gold Price Forecast Per US Federal Reserve Balance Sheet Projected Growth:

Based upon the above historical data, it is estimated the price of gold may reach either of the following values by 2016:

- Projecting the gold price at a CAGR of 14.8% yields an estimated value of $3,022.

- Projecting the gold price at a CAGR of 26.6% yields an estimated value of $4,470.

Obviously, these future gold price estimates are NOT set in stone…as many, many factors can affect the gold value up or down. Here are just a few material influencing factors:

- The possibility of a recession in the US.

- The probability the Euro Union will implode, thus trashing the value of the Euro currency.

- Russia’s Putin sparks World War III over the growing turmoil in the Ukraine.

- Inflation and interest rates might soar as they did in the late 1970s under President Jimmy Carter, when gold price soared +507% ($140-$850) from 1977 to 1981 (a CAGR = 56.9%).

- Other countries may follow Switzerland’s lead in voting to establish a Gold Standard.

- Peoples Bank of China accelerates its covert objective to replace the US$ with the Renminbi as the world’s reserve currency.

********

Related Readings:

Gold And Silver…A Change In Suppressed Down Trend?

Golden Opportunity For Global Investors

Close To The Bottom But Not There Yet

China Goes For The Gold As Beijing Gold Demand Goes Parabolic

Why Chinese Citizens Invest In Gold

Keep Your Powder Dry…There May Be A Great Opportunity Coming In Gold

Fed Ends QE? Greenspan Says Gold “Measurably Higher” In 5 Years

GOLD: Will Bulls Or Bears Prevail?

********