Why Chinese Citizens Invest In Gold

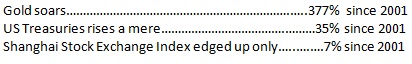

The US$ price of gold has soared +377% from 2001 to date. That’s a compound annual growth rate (CAGR) equal to 13.4%. Contrast gold’s monumental appreciation with the pathetic performance of the Shanghai Stock Exchange Index and the miserly return of US Treasuries.

The US$ price of gold has soared +377% from 2001 to date. That’s a compound annual growth rate (CAGR) equal to 13.4%. Contrast gold’s monumental appreciation with the pathetic performance of the Shanghai Stock Exchange Index and the miserly return of US Treasuries.

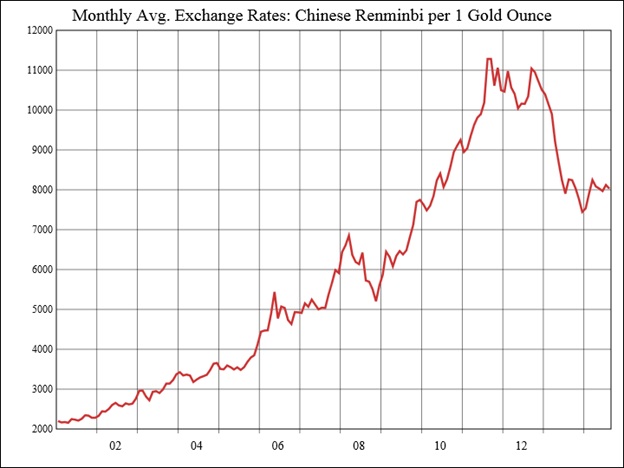

Gold’s CAGR in US$ and Yuan (Renminbi)

Since 200 the US$ price of gold has enjoyed a 13.4% CAGR.

Since 200 the Yuan (Renminbi) price of gold sports a 10.6% CAGR.

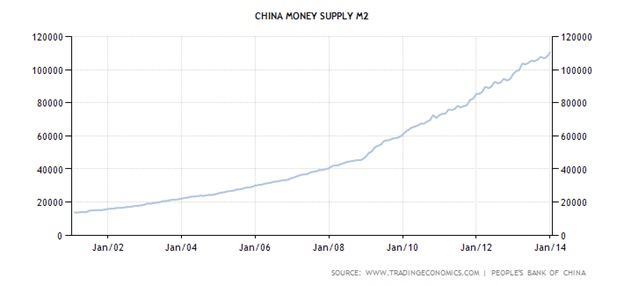

China’s money supply shows a 18.1% CAGR since 2001…one of world’s highest

China’s Future Gold Demand To Go Viral

“A major report published recently by the World Gold Council, “China's Gold Market: Progress And Prospects” suggests that private sector demand for gold in China is set to increase from the current level of 1,132 tonnes per year to at least 1,350 tonnes by 2017. Following the record level of Chinese demand in 2013, which saw the country become the world’s largest gold market, the report suggests that while 2014 is likely to see consolidation, the succeeding years are likely to see sustained growth.

The report examines the factors that have driven China’s rise to become the number one producer and consumer of gold since the market began liberalising in the late 1990s. It also highlights why despite this steep growth in demand, the market will continue to expand, irrespective of short term blips in the economy.

The next six years will see China’s middle class grow by over 60%, or 200m people, to a total of 500 million. Comparing this to the total population of the US, which stands at 319m, puts the size of this new market of affluent consumers, with the propensity to buy gold, in perspective.

In addition to these newly emerging middle classes, rising real incomes, a deepening pool of private savings and rapid urbanisation across China suggest that the outlook for gold jewellery and investment demand in the next four years will remain strong.

Albert Cheng, Managing Director of the Far East at the World Gold Council said:

“Since liberalisation of the gold market began in the late 1990s and the subsequent offering of gold bullion products by local commercial banks from 2004, we have witnessed astonishing increases in demand for gold from consumers across the country. The cultural affinity for gold runs deep in China and when this is combined with an increasingly affluent population and a supportive government, there is significant room for the market to grow even further. The country is now at the centre of the global gold eco-system.”

“Whilst China faces important challenges as it seeks to sustain economic growth and liberalise its financial system, growth in personal incomes and the public’s pool of savings should support a medium term increase in the demand for gold, in both jewellery and investment.”

The key findings from the research include the following:

- China’s continuing urbanisation means that it now has 170 cities with more than one million inhabitants3 - within these cities, the middle classes currently number 300million and are set to grow to 500 million by 2020. Demand for gold amongst those with a greater disposable income and limited investment opportunities will continue to grow.

- Chinese savings levels remain high - there is an estimated US $7.5 trillion in Chinese bank accounts and household allocations to gold remain small, around $300 billion. Gold is seen as a stable, accessible investment by consumers, particularly in the light of rising house prices and a lack of alternative savings options. Chinese investors have a preference for physical gold over paper, with investment focused on small bars, gift bars or Gold Accumulation Plans (GAPs). New gold investment products mean that medium term demand for bars and coins could reach close to 500tonnes by 2017 – a rise of nearly 25% above its record level last year.

- China has become the world’s number one jewellery market, nearly trebling in size over the past decade - at 669tonnes in 2013, it accounts for 30% of global jewellery demand. Estimates suggest that demand will continue to grow and reach 780t by 2017. There are now over 100,000 retail outlets selling 24k gold and thousands of manufacturers nationwide.

- Consumer sentiment toward gold is unwavering - although 40% of jewellery consumption relates to weddings, the appetite for gold in China goes beyond occasions and gift giving. 80% of consumers surveyed for this report planned to maintain or increase their spending on 24-carat gold jewellery over the next 12 months believing that gold will hold its long-term value and because they expect to have a higher level of disposable income.

- Chinese electronics demand for gold will see small gains in the next four years - industrial demand has grown with electronics being the key driver (climbing from 16 tonnes in 2003 to 66 tonnes in 2013). China is also the leading market for gold related patents such as the use of nanogold in healthcare.

- Official gold holdings in China totalled 1,054t at the end of 2013 making the country the world’s sixth largest holder of bullion - based on this declared stock, gold represents 1% of China’s total official reserves (down from a peak of almost 2% in 2012) due to the rapid growth of the country’s foreign exchange holdings which reached around US$3.8 trillion at the end of 2013. Speculation continues as to whether the Chinese government has increased its gold holdings.

- China has gone from being a minor producer to the world’s largest source of mined gold - in the past ten years production has doubled from 217 tonnes to 437 tonnes.

(Courtesy: World Gold Council)

Gold buying frenzy in China

Compelling Reasons Why the Sino Nations’ Citizens Will Increasingly Stampede Into Gold

- China’s economy is one of the fastest growing in the world.

- China’s per capita income is increasing apace with the country’s economy.

- Local alternative investments do NOT compare with enviable returns in gold since 2001.

- Growth in China’s money supply is the fastest of all major countries.

- The government of China encourages its citizens to invest in gold.

- China is today the number one producer and consumer of gold…worldwide.

- China must diversity its FOREX Risk as it owns more than $1.3 trillion in US Treasuries.

- National researches observe China covertly desires to eventually have a gold backed renminbi.

- China’s total foreign reserves have less than 5% gold backing vs 74% of major world counties.

- China’s exploding population will top 1,400,000,000 in not too distant future…world’s largest.

- China now has FOUR GOLD ETFs with a total value of more than 1.9 billion yuan.

- Pervasive communication via the Internet will effectively market gold consumption.

It is the considered opinion of this analyst that China is hell bent for leather to drive the price of gold to new all-time record levels for many years to come.

----------------------

Related China & Gold Editorials:

Relative Performance Of Gold…And The China Factor

China’s Role in the Gold Market

Rising Gold Prices Will Be Fueled By China Dumping U.S. Treasuries

China's Pressing Need to Buy Gold

Gold Price Prediction Based On Technical Analysis & China Demand

China Holds the Keys To The Gold Market