Relative Performance Of Gold…And The China Factor

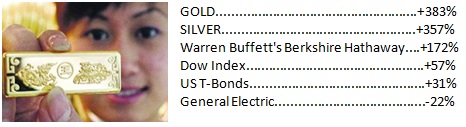

Relative Performance: Gold, Silver, Buffett, Dow, T-Bonds & GE

Here is the Relative Performance (appreciation) of 6 prominent assets since 2001:

Not even the richest man in the world Warren Buffett could compete with GOLD & SILVER.

And I perceive no reason why this relative performance will not continue in the future...especially with all major countries printing money like there is no tomorrow. Global Quantitative Easing is - and will continue - to devalue (debase) all currencies...thus further fuelling GOLD & SILVER to ever higher all-time record highs.

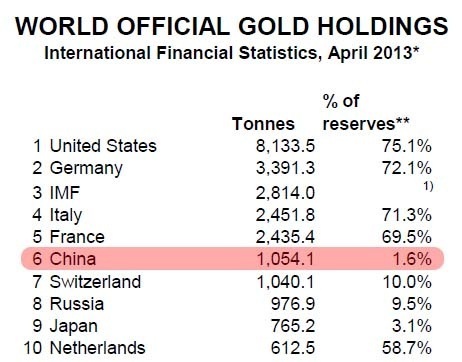

And then there is the China Factor. The Sino country is the world’s largest holder of US T-Bonds with over $1.3 TRILLION ($1,300,000,000,000). MOREOVER, the Renminbi has the lowest backing of gold than all other major countries. Ergo, financial logic dictates that the Peoples Bank of China will methodically divest itself of Uncle Sam's (toilet) paper, and buy gold with the proceeds.

YES! China has less than 2% in gold backing its currency...vs an average of about 70% gold backing of the major countries of the world.

Rest assured China will be playing 'catch-up' in the next few years regarding gold backing of its Yuan.

Related Analysis:

Will China Back The Yuan With Gold?

Will China Make the Yuan a Gold-Backed Currency?

Does China plan to use gold to internationalize the Yuan?

Does China Plan To Back The Yuan With Gold And Make It The Primary Global Reserve Currency?

Gold To Rise Like The Proverbial Phoenix In 2014-2015

A Gold Backed Renminbi (Yuan) Looms On The Horizon

Gold Price Prediction Based On Technical Analysis & China Demand

-----------------

Toward a Golden Yuan

Toward a Golden Yuan

“Consider China's call for a new international reserve currency, nearly $1 trillion in trade swap deals, and their relentless gold buying.

It's not a stretch to figure when China floats its currency, they'll do so with a partial gold backing.

Zhang Bingnan, market analyst for China Central Television and vice president of the China Gold Association, had intriguing things to say at a financial conference last year. As a result of his studies on gold's place in the modern economy, he concluded it has an essential role in the current monetary system.

Shortly thereafter Tan Ya Ling, president of the China Foreign Exchange Investment Research Institute, spoke at a Beijing gold conference last May. She told delegates that gold is a currency - perhaps even the next world reserve currency - and therefore China has to dominate the world gold market.

Suddenly, a gold-backed Yuan would carry intrinsic value, something absent from every other currency today.

The world would quickly want the Yuan, pushing up its value and rapidly spreading its ownership and acceptance.” (Source: MoneyMorning)

---------------------

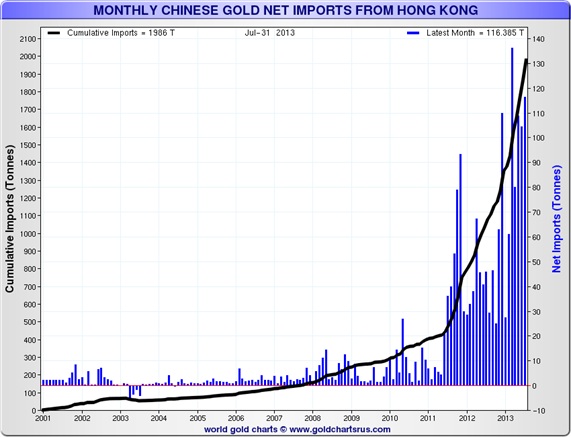

China Stimulates Gold Demand, Becomes World’s Largest Gold Importer

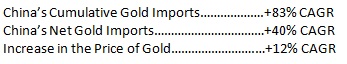

China has seen an incredible rise in physical gold demand in 2013. The following chart shows the Chinese import data until July of this year. We wrote earlier that, between January and July of this year, China imported a staggering 633.94 tonnes of physical gold. The country is on its way to reach 1,000 tonnes of imports over the whole year, as forecasted by the World Gold Council. Chart courtesy: Sharelynx.

It is quite obvious China has been one of the primary driving forces fuelling higher gold prices since 2001. Consider the following about the above chart vis-à-vis the price increase in the shiny yellow.

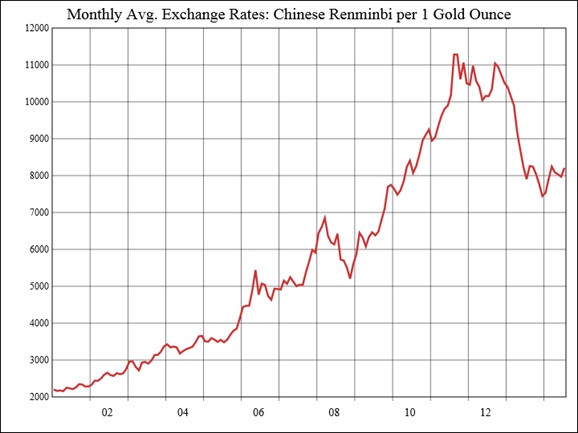

Compare the Compound Annual Growth Rates (CAGR):

Taking into account China’s Objective to make the Renminbi the World’s Reserve Currency (by replacing the US Dollar), the Sino nation must obviously accelerate its gold imports with a view to dramatically increase the gold backing of the Renminbi…which translates to exponentially growing demand for gold. It is imperative to remember China’s currency has less than 2% gold backing today.

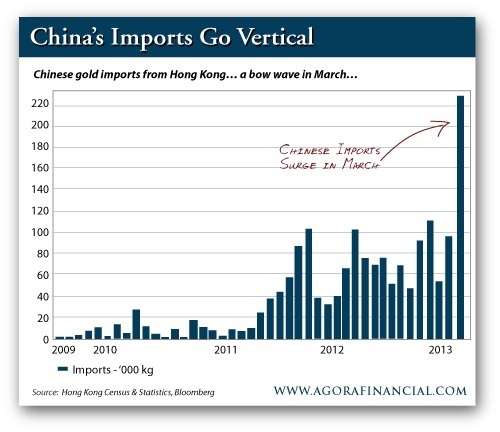

Another Cardinal Demand Source Is An Ocean of Global Investors

Very few investors in the entire world have claim to gold protection. Admittingly, the following information is overtly redundant proof that preciously few smart investors have the protection that gold affords. Less than 1% of total global investments are in GOLD or Gold Mining Companies. The following two charts are mind-boggling in showing the potential monumental potential demand for gold and gold mining companies stock.

Soon Chinese Renminbi will replace the US$ as global Reserve Currency

China is clearly trying to position the Renminbi/Yuan as the alternative global reserve currency. Beijing authorities surely realize that they will need to surpass the U.S. Federal Reserve’s official, but unaudited, gold holding of 8,133.5 tonnes.

China has today approximately only 1,050 tonnes of gold. This means China must buy 7,000 tonnes of gold. Needless to say this is a daunting task, because the total yearly global mine production of gold is only about 2,600 tonnes. Literally, China needs to buy nearly THREE years of worldwide gold mine production. Indubitably, China's stated objective to have Renminbi/Yuan backed currency will send gold price into orbit around sun.

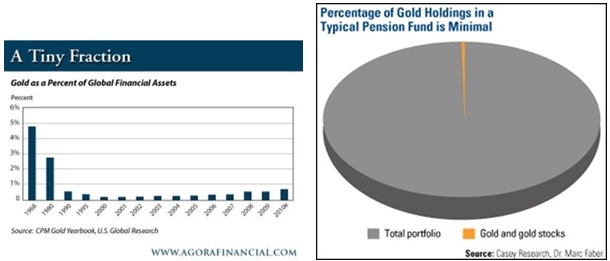

Since 2001 the Yuan price of gold has soared almost 300 percent. No other comparable investment return in China exists today. This is WHY 1,300,000,000 China citizens are stampeding to buy gold every day.

(Source: FX-sauder)

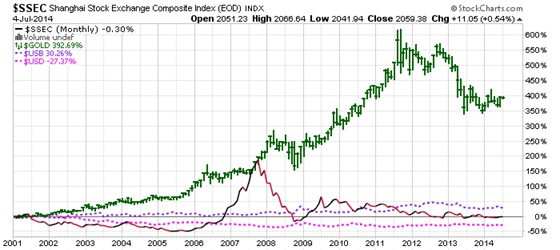

Investment Alternatives for China Investors

Profitable Investment alternatives for Chinese citizens are as scarce as hens’ teeth (except for gold). Here are the total performances for the 14-year period since 2001: