Rising Gold Prices Will Be Fueled By China Dumping U.S. Treasuries

The T-Bond Bull Market is probably the longest running Bull Markets in history. To my knowledge no other asset class has sustained a constantly rising bull trend for over 33 years (since 1980). The following chart clearly shows this record breaking bull, who is unquestionably today very long in the tooth. That is to say all bulls eventually grow old and die…ALWAYS…ALWAYS!

The T-Bond Bull Market is probably the longest running Bull Markets in history. To my knowledge no other asset class has sustained a constantly rising bull trend for over 33 years (since 1980). The following chart clearly shows this record breaking bull, who is unquestionably today very long in the tooth. That is to say all bulls eventually grow old and die…ALWAYS…ALWAYS!

This begs the question: What will be the catalyst that will bring this monumental BOND BULL down? Who or what will kill this historical record breaking BOND BULL?

In a word…CHINA !

Indeed the demise of this aging U.S. T-Bond bull is inevitable. Furthermore, the subsequent ramifications will be mind-boggling and will materially affect many markets –- In addition to soaring interest rates and roaring inflation, the U.S. Dollar Index will be hammered downward as gold and silver will go into orbit (as they did in the 1976-1980 blow-off period). Historical Note: In the 1976-1980 period, T-Bond prices plummeted -41%, while the U.S. Dollar Index fell -22% --- But gold soared +750% with an intra-day high of $850 in January 1980. Surpassing even gold, silver went viral upward +875% during the same hyper-inflationary period of President Jimmy Carter’s administration. Oh…BTW, President Obama has publicly stated that Jimmy Carter was his role model.

(Courtesy Kitco.com)

And here is the WHY and the HOW this will play out.

What is China’s motive…indeed its objectives?

- Diversity its FOREX Risk

- Replace the US Dollar as world’s reserve currency, and

- Eventually become the number one Economic Power in the world

To Diversity Its FOREX Risk

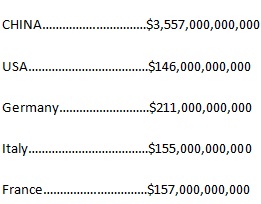

Currently, China has 24 TIMES MORE the total Foreign Reserves than the USA. In fact CHINA’ s Total Foreign Reserves are MORE THAN 5 TIMES GREATER than the combined Total Foreign Reserves of the USA, Germany, Italy and France…together. China is truly the world’s Goliath of Total Foreign Reserves.

CHINA SUFFERS A DIRE NEED TO DIVERSITY ITS FOREIGN RESERVES

Compare the Total Foreign Reserves of the world’s major countries:

(Source: http://en.wikipedia.org/wiki/List_of_countries_by_foreign-exchange_reserves )

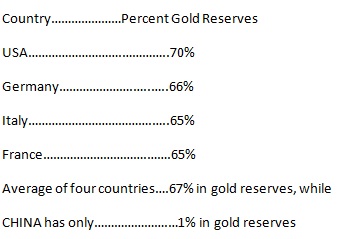

NEVERTHELESS, China’s FOREX risk is infinitely greater as only a tiny fraction of its Total Foreign Reserves are in gold.

( Source: http://en.wikipedia.org/wiki/Gold_reserve )

China is sorely short in gold reserves as percentage of its Total Foreign Reserves. Moreover, China's ever increasing gold necessity will grow apace with its relentlessly bigger Trade Surpluses, which inexorably rise year after year after year.

China’s monetary goal is to replace the US$ with the Renminbi as world’s reserve currency.

Renminbi Is Destined To Replace The US Dollar as the Global Reserve Currency. Two articles analyzing this subject are Must Reads in order to comprehend the monumental magnitude of this daunting task:

“A Gold Backed Renminbi (Yuan) Looms On The Horizon”

https://www.gold-eagle.com/article/gold-backed-renminbi-yuan-looms-horizon and

“China Gold Dragons”

https://www.gold-eagle.com/article/china-gold-dragons

China Will Soon Panic…when the price of U.S. Treasuries falls below the trendline.

Undoubtedly, China has been slowly and methodically selling off its huge stash of $1.3 TRILLION in U.S. Treasuries. In doing this the Sino nation is trying to accomplish two vitally important objectives:

- To dramatically reduce its FOREX risk, and

- To accumulate enough gold to back the Renminbi in order to replace the US Dollar as the world’s reserve currency.

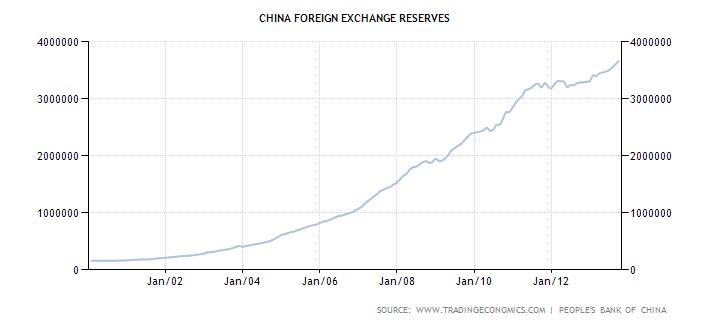

Rest assured China has the money (ie Total Foreign Reserves) and will-power to accomplish these herculean tasks. Since year 2000 China’s Total Foreign Reserves have enjoyed an astounding CAGR of 26%. Absolutely no other country in the world can boast this magnitude of compound yearly growth rate. To be sure one of the upshots of China’s ambitious endeavors to reduce its FOREX risk will be fuelling the gold price into orbit to new all-time highs for the next few years…as it builds the gold backing of the Renminbi. See China’s incredible annual growth in Total Foreign Reserves in the chart below.

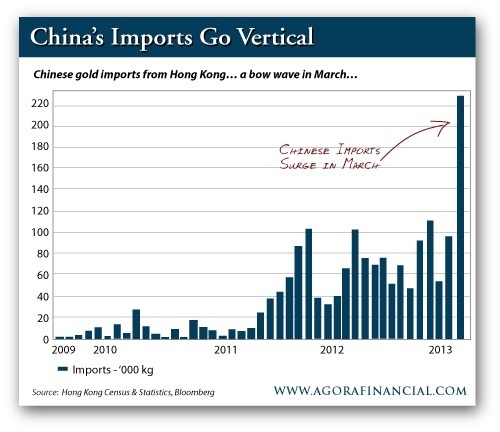

All the above is rational explanation why China’s gold imports have gone viral, and why individual Chinese investors are snapping up gold at today’s bargain basement prices. See chart:

WITHOUT QUESTION China’s gold demand is insatiable…and will never end!

(Chinese Word for Gold)

(Chinese Word for Gold)

More by vronsky: https://www.gold-eagle.com/authors/vronsky