Gold Price: Fresh Upside Breakout Is Imminent

The US dollar is coming under severe pressure vis-a-vis the Japanese yen this morning. That’s good news for gold.

This is essentially a financial train wreck. This is the daily chart of the dollar versus the yen.

The dollar is falling towards its Brexit event low in the 99 area, and that has gold poised to stage a nice upside breakout.

This is the daily gold chart. Gold has essentially traded sideways against the dollar since the Brexit event in a symmetrical triangle pattern. That triangle can serve as an upside Launchpad that pushes gold to $1392, and higher!

I realize that many gold investors are somewhat shocked that gold has not had a serious sell-off in 2016, but that’s because the dollar has not been able to mount a serious rally against the yen.

This is the daily silver chart. Like gold, silver looks strong against the dollar - and is consolidating in a rectangular price pattern.

An upside breakout for both gold and silver looks imminent. It may not occur until Janet Yellen makes her speech in Jackson Hole later this month, but if the dollar collapses further against the yen, the breakout is likely to happen very quickly!

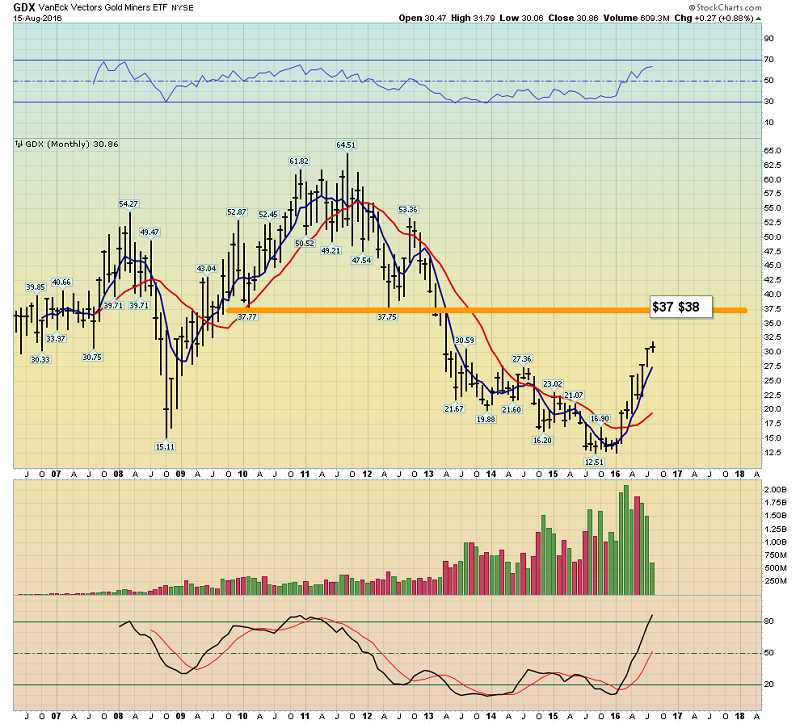

This is the GDX daily chart.

Gold stocks are in a fabulous uptrend channel. Note the inverse H&S bull continuation pattern now in play. A fresh rally towards $37 looks like it will be the next significant price movement for GDX.

There is not much retail participation in Western stock markets, or in gold stocks. I believe that’s because most investors have suffered through what is really a 15 to 20 year rolling super crisis.

Many citizens are working from paycheck to paycheck, and have multiple part-time jobs. They don’t have much capital for investing. This is a different situation from past markets where analysts used the arrival of the public to signal a “top phase” for a market.

Now, the average Western citizen can’t invest money in the market even if he feels greedy. The capital simply doesn’t exist. Markets are dominated by institutional money managers, pension funds, central banks, and governments. For gold to have a major sell-off against the dollar, a fundamental catalyst is required that will cause institutional money managers to lighten up on their holdings.

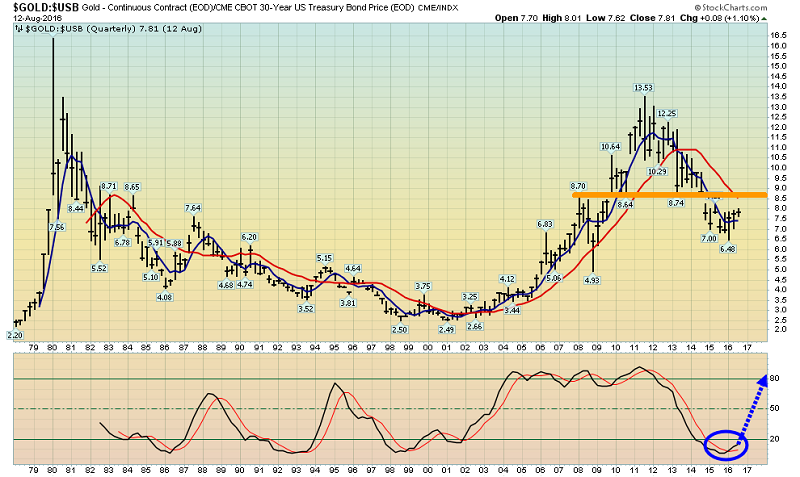

This is the important gold versus T-bonds quarterly bars chart. A rise in real interest rates can cause money managers to book profits in the gold market.

Note the 8.70 area on that chart. This is the GDX monthly bars chart.

There is significant correlation between the 8.70 resistance area on the gold-bond chart and the $37 - $38 resistance area on the GDX chart. That is likely where institutional money managers will book some profits on their gold stock positions.

For now, the upside fun appears to be alive and well, and institutions are strong buyers of most minor sell-offs. I think amateur gold investors need to have a similar mindset.

This is the daily oil chart.

Between now and the end of the year there are a number of events that could stop any significant sell-off in gold against the dollar from happening. A major oil market rally is one of them…and I’m predicting it will happen.

Oil is also the largest component of most commodity indexes. Janet Yellen watches oil carefully, and she has predicted that low oil prices are temporary. Amateur investors should not bet against her. It’s hard to know how Janet would respond to a major oil price rally that raised the inflation rate significantly, but I’ll suggest that whatever she did, it would be good news for gold. Here’s why:

In the event she hiked rates, it could cause the fragile US stock market to crash, as it did when she hiked in December of 2015. The dollar crashed against the safe haven yen and gold then. Consequently, I would expect the same thing to happen again.

If Janet lets oil run higher without raising rates, money managers could go on a gold stock buying rampage. Subsequently, the US stock market is likely to gyrate sideways in stag-flationary mode, as it did in the 1970s.

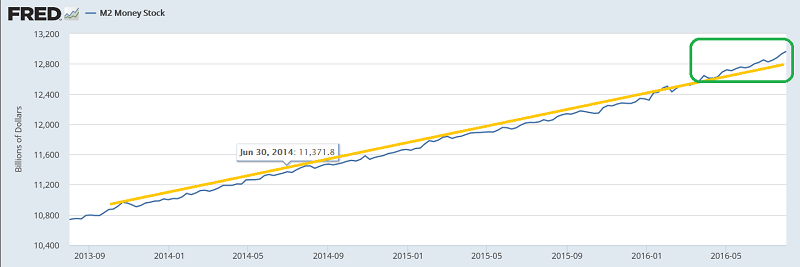

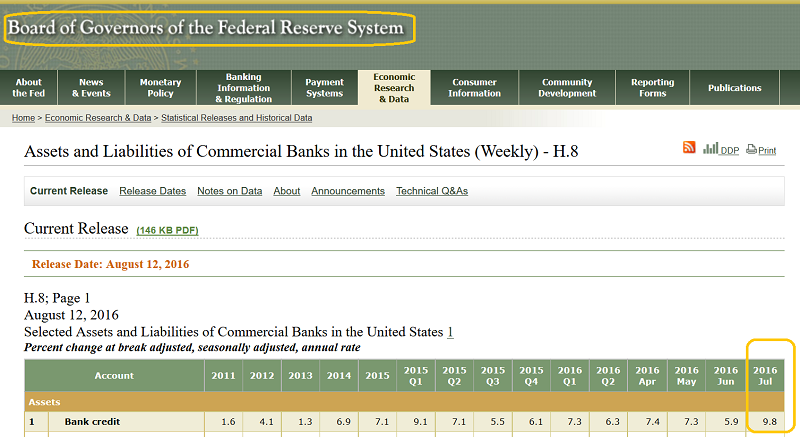

There’s been a subtle but substantial rise in the slope of M2 money supply growth recently, together with a stunning jump in bank credit in July.

Bank loan profits, money velocity and gold stocks versus gold have all been in multi-decade bear cycles. However, the winds of inflation are beginning to blow -- and gold stocks are the biggest canary in the inflationary coal mine!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Show Me The Gold & Oil Money Now!” report. I highlight seven super gold and silver stocks that are poised for immediate upside price action! I include key buy and sell points for each, and I cover the hottest oil market ETFs!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by credit card, click this link:

https://app.moonclerk.com/pay/a0es7yliyhw

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: