Gold Price: Tactics For A Fourth Quarter Rally

Fresh statistics show that US gold jewellery demand is now about five times the size of US gold coin and bar demand. Back in 2014 I predicted this would occur…and it’s happening on schedule.

What’s particularly interesting is that mine supply is barely growing and likely peaking, while US, Indian, and Chinese gold jewellery demand is growing at about 6% - 8% annually.

This growth is relentless. Global jewellery demand is now more than 50% of total gold demand. I expect it to reach the 75% marker in the next decade, and it’s why I coined the term, “gold bull era”.

Excitingly, I’ve predicted that US gold jewellery demand will rise to about 40 tons a month during the next ten years. Investors who understand the basic math of compounding should realize that growth of 6% - 8% a year in gold jewellery demand versus flat mine supply is a very basic recipe for vastly higher prices.

That’s a look at some serious “American muscle” in the jewellery sector.

While most gold mining stocks in North America look somewhat pathetic against gold bullion, the jewellery stocks look like superstars.

Tiffany has blasted out of a gargantuan inverse head and shoulders pattern against bullion, and I think all gold stock enthusiasts in America should consider adding it to their portfolios.

Tactics? Buy some now and buy more on any dip towards the massive neckline zone!

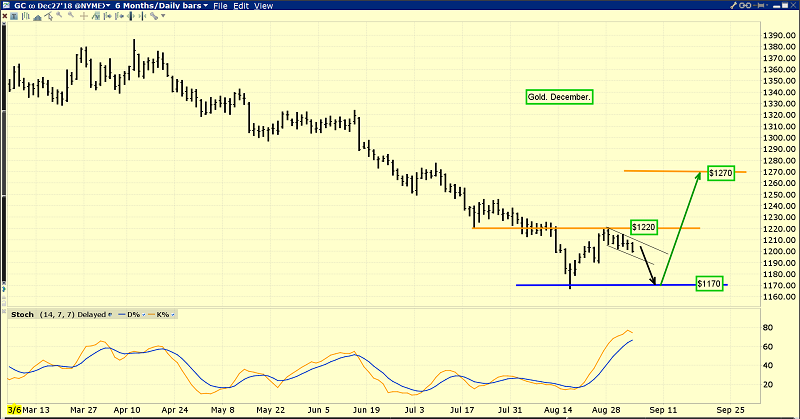

What about gold itself? What is the most likely scenario in the short and medium term? This is the key December futures gold chart.

Note the panic decline to about $1170 in mid-August. The rally of about $50 to the $1220 minor resistance was followed by a gentle swoon.

That’s typical action during the formation of double bottom patterns. An initial panic decline on high volume is followed by a rally and then a second low volume decline occurs. That’s exactly what is happening now.

General gold market weakness is likely to continue until Friday’s US jobs report. Gold tends to rally quite nicely after most US jobs reports, but the big upside action is likely to begin after the next Fed meeting on September 26.

Interestingly, that event coincides with the start of the strong demand season for gold in India.

Last week Commerzbank predicted gold would surge to $1300 by year-end, and now institutional heavyweight State Street suggests $1350 is possible.

This is the long-term gold chart. It’s clear that the solid fundamental analysis coming from these important institutions fits with my long-term technical work. A fourth quarter rally for gold could be surprisingly strong!

Tom Lee is former head of US equities for JP Morgan. He’s another institutional heavyweight who is predicting a strong recovery in emerging markets in the fourth quarter.

While a recovery in emerging markets creates a “wealth effect” that could send gold to $1300 by year-end, Tom believes that same wealth effect could help create a mind boggling three bagger surge during the same short time frame for bitcoin!

Bitcoin looks solid at about $7000 a coin, and I cover the intense action for this exciting “alt currency” at www.gublockchain.com. I’m a vociferous advocate of a strongly diversified portfolio for all precious metals investors, and items like bitcoin and jewellery stocks should be decent holdings in every serious gold bug’s portfolio.

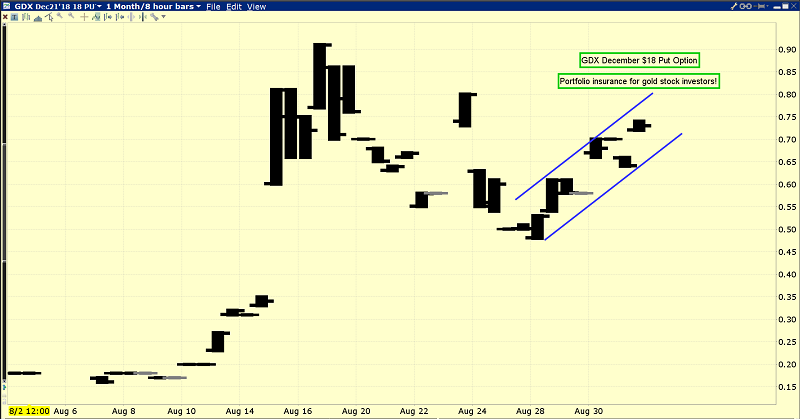

This is the GDX put option chart. The most exciting sector of the gold market is the gold stocks. These stocks are leveraged to gold and hated by many mainstream analysts.

Portfolio insurance is another “mandatory” holding for serious gold stock investors. Rather than wasting time trying to predict when a house could flood, catch fire, or get robbed, the simpler solution is to simply buy an insurance policy. If there’s a portfolio price fire and the policy is in effect, the investor is protected!

Right now, the GDX December $18 put option is my favourite way to insure a gold stocks portfolio against any downside price risk. Some gold bugs believe in “bankster manipulation” of gold stocks, some don’t, and put options can insure a gold stock portfolio against almost any risk that can be envisioned.

For bullion enthusiasts, my favourite portfolio insurance play right now is the GLD December $112 put option.

I suggested buying some puts as gold nudged into the resistance area at $1220, and that’s working well.

If they are unsure of how to act, amateur investors should consult financial advisors for advice about purchasing put option portfolio insurance. Once the investor understands the basics, it’s easier than riding a bike, and it makes the entire gold asset class investing experience one that investors can enjoy every day!

*********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Rock ‘N’ Rollers!” report. I highlight key intermediate producers that are poised for maximum price appreciation during what appears to be an imminent fourth quarter gold price rally. I include a put options portfolio insurance update so that investors can go into action with a smile! Email me today and I’ll send you the report tonight!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: