Gold Price: The Wait For Inauguration Day

At this time last year, most gold investors and analysts were predicting lower prices for gold. Many of them were shorting it.

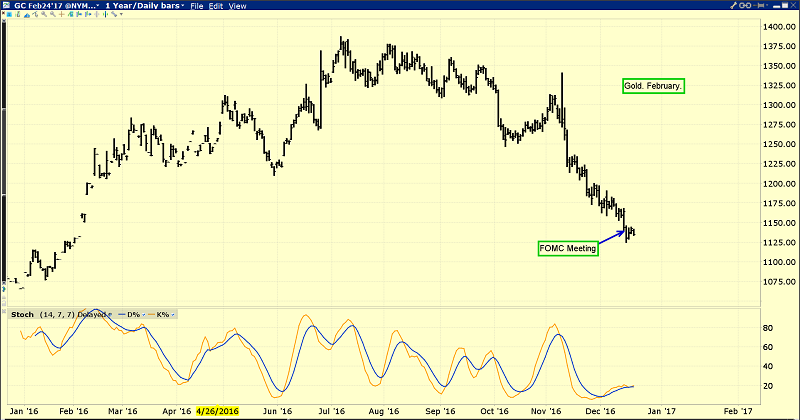

The shorts were obliterated, because gold bottomed the day after the December 2015 FOMC meeting. It soared about $330 an ounce, from about $1045 to above $1375.

It’s been said that history doesn’t exactly repeat, but it does rhyme. This is the daily bars gold chart.

Gold has a cyclical tendency to decline ahead of a rate hike, and rally after it is announced.

This time, the US election may delay the rally, but create one that is bigger and more sustained than the rally of 2016. Here’s why:

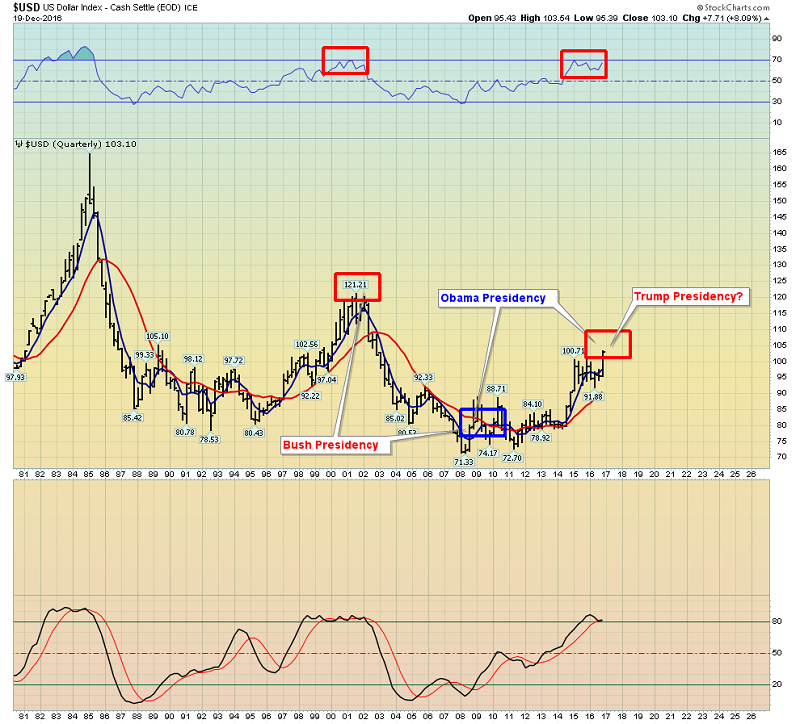

Republican parties have cyclically been associated with significant US dollar downtrends. The next presidential inauguration occurs on January 20, 2017.

Donald Trump has repeatedly stated that he wants a lower dollar. He’ll have control of both the senate and the congress, putting him in a position of tremendous power to impose his will on US markets.

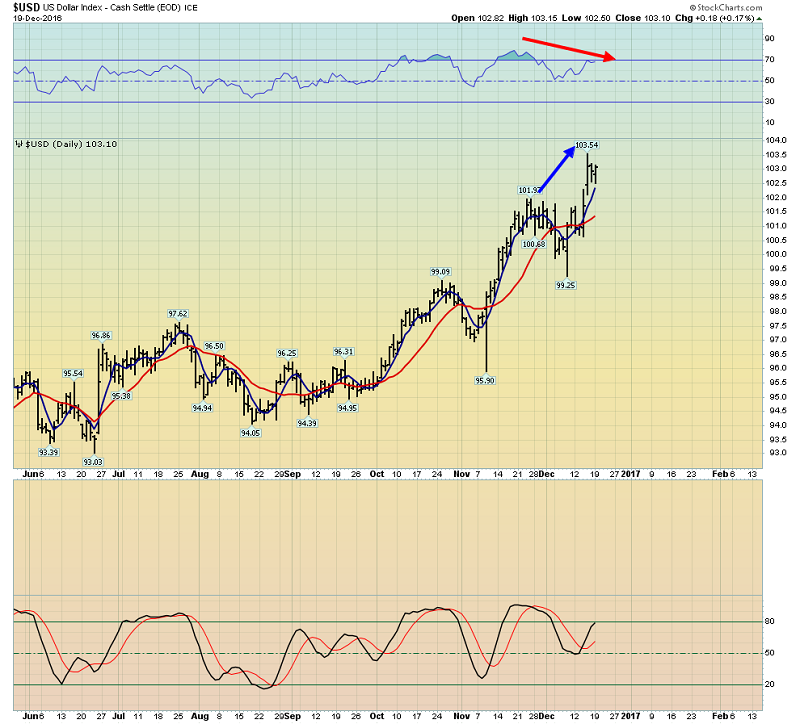

Most technicians are now wildly bullish on the US dollar index.

They are excited about what appears to be an “upside breakout”, and there’s no question that the US dollar index could move higher until inauguration day.

Note the RSI non-confirmation with the price on that daily bars US dollar index chart. The dollar’s technical strength is weakening quite dramatically.

The big picture view of the dollar’s price action during the past few presidencies.

As rates rise, and Trump increases government debt while cutting taxes, the US government’s credit rating could get downgraded, adding more downwards pressure on the dollar.

Janet Yellen initially endorsed a “high pressure” economy, but after the latest FOMC meeting she said that she’s not necessarily looking for easy money policy to continue.

That’s superb news for inflation enthusiasts, because higher rates incentivize banks to move money out of government bonds and into the fractional reserve banking system.

Trump’s tax cuts will further incentivize the banks to make loans to the private sector, and move even more money out of the US government bond market.

The bottom line is that Janet Yellen can create a higher pressure economy with rate hikes than without them. With Donald “The Golden Trumpster” in power, inflation may rise much faster than anticipated, regardless of what Janet does.

I expect US money velocity to bottom by the summer of 2017 and begin a long term bull cycle, mainly because of the policies of both Trump and Yellen.

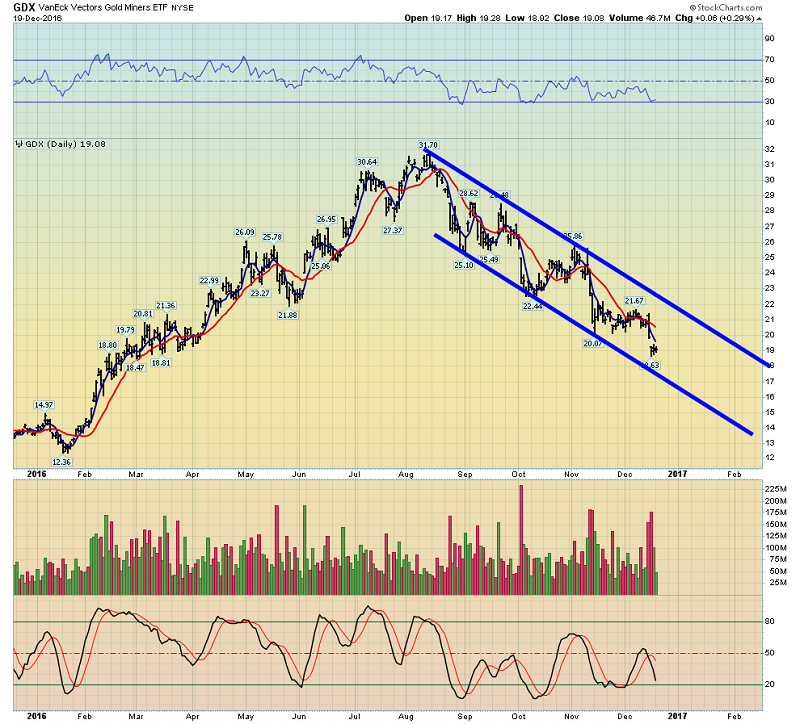

Gold stocks can dramatically outperform gold in that environment. This is the GDX daily bars chart.

There’s no question that GDX is in a downtrend. The pattern of lower minor trend lows and lower highs is what defines a downtrend in any market.

That’s another look at the GDX daily chart. In strong uptrend, the RSI oscillator tends to oscillate between the 70 area and 50. In a downtrend, RSI tends to oscillate between 20 and 50.

Amateur investors tend to be obsessed with trying to figure out whether a market is making a major bottom, top, or about to accelerate its trend. I would argue that such an obsession doesn’t build wealth that is sustained. It’s a subtle form of gambling, and gamblers tend to lose money on an ongoing basis.

Rather than trying to gamble on whether GDX will continue its current pattern of lower highs and lower lows or not, my suggestion to the world gold community is to simply wait for a pattern of higher highs and higher lows to appear. That’s what defines an uptrend.

That’s a third view of the GDX daily chart. There is support in the $17 - $18 area, and an important buying area. Importantly, this chart shows that there was no uptrend in place in the days following last year’s rate hike. GDX declined to a final low in January of 2016, but it wasn’t until the spring that an uptrend was apparent. The bottom line:

Professional investors have a lot of patience, and amateur investors need to focus on developing it. It’s highly likely that a new and sustained uptrend in precious metals will begin, once the weak dollar policy of the Trump administration becomes clear!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my “Golden Big Boys!” free report. I summarize the prospects of seven top senior miners, with a focus on relative strength and buy and sell tactics for each stock!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: