Gold Prices Up 10 Percent For 2017

Strengths

·The best performing precious metal for the week was platinum, up 2.64 percent. For the second week in a row gold traders are bullish as the year comes to a close, according to Bloomberg’s survey of traders and analysts. Additionally, the yellow metal saw a second weekly advance as bond yields climb with slower trading around the holiday period. Prices are up 10 percent for the year in comparison to 8.1 percent in 2016.

·UBS strategist Joni Teves reports that gold is showing considerable resilience to the recent rise in U.S. real rates and more players view gold as a valid asset for diversification and a hedge against risk.

·Tibet Summit Resources and partner NextView Capital are set to purchase lithium producer Lithium X Energy for a premium price of $C265. This deal is one of many as Chinese companies are looking to secure raw materials for electric car batteries.

Weaknesses

·The worst performing precious metal for the week was gold, although up 1.52 percent. Gold is trading low compared to oil as expanding global economic growth increases fuel demand, reports Bloomberg. The world’s largest ETF backed by gold, SPDR Gold Shares, is seeing a fall in investors as it dropped to its lowest in three months with holders pulling around $1.14 billion in assets since the end of September.

·Platinum shorts reached an all-time high this week, further raising short-covering risks with net longs declining by 684.90koz, the largest weekly outflow on record. Both gold and silver positioning fell as well, reports UBS. Hedge funds are moving away from gold and into other equities as gold gains are far from the excitement of record-breaking U.S. equity indexes and cryptocurrencies. Joe Foster, who manages the VanEck International Investors Gold Fund says, “Nobody cares about gold right now.”>

·Torex Gold faces labor issues as they suspended their Mexican employment contracts as competing labor unions fight for control of the employees of Torex. In response their target price was lowered to C$14 from C$25 by Coremark, reports Bloomberg.

Opportunities

·Bad news for bitcoin this week after its price plunged almost 30 percent today, down from its record high of $19k. Adding to the frenzy, digital currency exchange Coinbase had temporarily suspended all buying and selling for several hours. Lastly, the newly passed tax overhaul removed the tax break for investors in virtual currencies. New limits in the bill bar cryptocurrency owners from deferring capital gain taxes when trading one type of virtual currency to another, reports Bloomberg. This closes a grey area in the tax code on digital currencies.

·Two Federal Reserve governors expressed their doubts on the tax cuts actually spurring new investments and hiring. While president Trump has said that the fiscal overhaul will lead to higher growth, Minneapolis Fed President Neel Kashkari, among others, does not believe this will happen and said, “Very few CEOs that I’ve talked to in my district say that the tax package is going to lead to some dramatic change in their behavior.” The Peterson Institute believes that the new post-tax cost of research and development of large corporations reduces the incentive to develop new products relative to spending money on other activities as research and development will have to be amortized versus expensed, lowering the incentive for research.

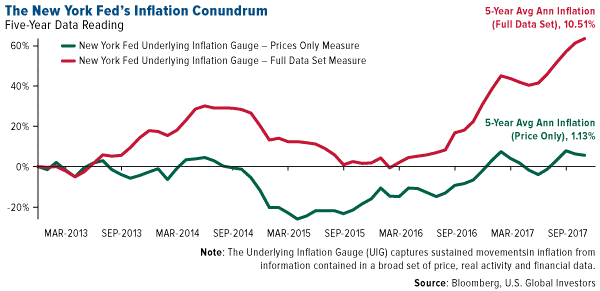

·Measuring inflation has its critics. Typically, policymakers have to rely on monthly data releases of the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE). To try and measure core or underlying inflation, often times the most volatile components of inflation, like food and energy, are stripped from the data. New research published by the New York Fed Staff on their construction of an Underlying Inflation Gauge (UIG) is now getting some attention. Historically, inflation measures only relied on price measures. The UIG measure includes a wide range of nominal, real and financial variables in addition to prices, and focuses on the persistent common component of monthly inflation. The Fed Staff concluded that the UIG proved especially useful in detecting turning points in trend inflation and has shown higher forecast accuracy compared with core inflation measures. What is particularly interesting is that the Fed compiles two data series, UIG using just price data and UIG using the Full Data Set (FDS) they have researched. In the graph below we chart both series over the last five years and the results are eye popping. The UIG Index using just price data has compounded at an average annual rate of inflation of just 1.13 percent while the UIG Index using the Full Data Set has compounded at an average annual rate of inflation of 10.51 percent over the last five years. This could be a game changer as the UIG FDS has turned sharply up in recent years indicating a change in direction for inflation, and the government just added a stimulus package with meaningful shifts in the tax base.

Threats

·South Africa’s ruling party ANC adopted a resolution calling for land expropriation without compensation and its more hardline members have voiced support for mines and banks to be state-owned. While state ownership of the mines is unlikely, such policies are a disincentive for foreign capital to invest in the country.

·Private equities firms might have trouble exiting the subprime auto lending space as delinquencies are soaring toward crisis levels, writes Bloomberg. Buyout firms pushed billions into auto finance after the mortgage crisis to capitalize on the profits associated with high-interest loans.

·Jared Dillian, investment strategist at Mauldin Economics, writes that the South will rise again as the tax cut plan moves forward. States with an already high income tax that will no longer be able to write it off on their federal taxes, such as New York and California, and we will likely see residents and businesses moving to cheaper states such as Texas and Florida. Dillian predicts that over time New York City will lose its status as the intellectual and cultural capital of America and that the real estate market in California will suffer greatly.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of