Gold Rallying As Tariffs Create Inflationary Conditions

Strengths

· The best performing metal this week was silver, nearly flat with a drift lower by just 0.06 percent. Sharp’s Pixley notes gold demand is on the rise while supply has begun to fall, signaling a potential increase in the gold price. Many see gold as appealing in the medium and long term due to the sustained demographic move into the middle class in China and India, the world’s two most populous nations.

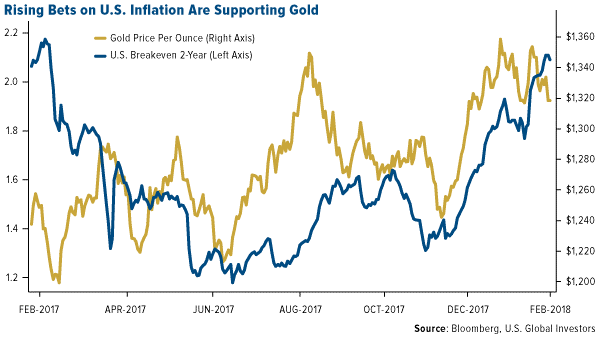

· President Donald Trump announced tariffs of 25 percent on imported steel and 10 percent on aluminum. This aggressive position angered manufacturers and trade partners across the globe, resulting in a weaker U.S. dollar and declining equity markets across the U.S., Europe and Asia, according to Bloomberg. Gold, however, rallied on Friday after the market digested the news as inflationary. The formal order is expected to be signed next week and continue for “a long period of time.”

· Earlier this year, the price of Bitcoin plunged, along with the number of daily transactions. And while the cryptocurrency’s price has made a 50 percent comeback, reports Bloomberg, the trading level has not recovered, leaving some investors puzzled. The confusion on this decline hasn’t stopped the use of cryptocurrencies globally, though. In fact, Swiss gold trader Degussa Goldhandel is now allowing clients to pay with digital coins including Bitcoin, Ethereum and Litecoin, Bloomberg reports. Increased inflows into another popular investment, ETFs, were also recorded this week with the largest flows going toward commodity-focused products. Based on data from Bloomberg, the ETF asset class with the biggest inflows was precious metals.

Weaknesses

· The worst performing metal this week was palladium, down 5.25 percent. Both gold and copper futures fell on Tuesday as the dollar rose shortly after Federal Reserve Chairman Jerome Powell gave a statement indicating interest rates will continue to rise, according to Bloomberg. On Thursday, the U.S. dollar hit its highest level in seven weeks, on the heels of Powell’s testament to the strengths of the economy, while gold slipped to a three-week low.

· The platinum price fell below $1,000, and platinum group metals were hit as well after a German court ruled that the cities within the eurozone can ban diesel cars. Palladium also fell as the steel and aluminum tariffs might slow down auto demand as Canada will be hit the hardest by the new proposal and they are vital supply link in the automobile supply chain.

· Due to a boom in metals to fill battery demand, huge gold producers are struggling to compete for investments. At the BMO Metals & Mining Conference this past week, many executives echoed this sentiment as cobalt companies were flooded with interest. David Harquail, CEO of Franco-Nevada and chairman of the World Gold Council, said in an interview at the conference that “right now, gold has been so boring and asleep that nobody cares.”

Opportunities

· Newcrest Mining, Australia’s largest gold producer announced that it will invest $250 million for a 27.1 percent stake in Lundin Gold to increase its presence in Ecuador, which is known for untapped metal deposits, writes Bloomberg Markets. During the BMO Global Metals & Mining Conference this week in Florida, Ron Hochstein, CEO of Lundin Gold, told Kitco News that although gold mining is not in an exciting space right now, “We’ll get there.”

· Interest in North American-based gold equities has hit its lowest point since 2015, when the gold price came close to hitting $1,000 per ounce. Scotia Mining Sales believes this means that, despite bullion prices holding very well through the first two months of the year, the generalist investor doesn’t care about gold equities. As a result, the market as a whole is underweight in gold equities.

· Iamgold reported positive findings from its drilling program near the Rosebel Gold Mine in Suriname, with results showing high-grade intersections. Craig MacDougall, senior vice president for exploration at Iamgold, said that the project was upgraded to reserve status and that they are advancing toward production in 2019.

Threats

· The University of Texas Management Co. (Utimco), which manages the largest public university endowment in the U.S., will examine its $1 billion gold position in the portfolio, reports Bloomberg. The gold position is around 3 percent of the total portfolio, and Utimco CEO Britt Harris said, referring to the position, “We’re in no rush to sell, but it may not be a long-term strategic hold.”

· In his state-of-the-nation speech, Russian President Vladimir Putin warned that “efforts to contain Russia have failed,” as their latest nuclear weapon technology can supposedly overcome American defenses. His presentation included underwater drones, intercontinental missiles and a hypersonic system. Despite these reported developments, Putin stated that Russia is “not threatening anyone.”

· Saudi Arabia hopes to significantly grow its defense industry during the next decade, according to Bloomberg. This oil-rich country has a long history as a customer of arms sellers; however, Crown Prince Mohammed bin Salman wants to make these weapons in Saudi Arabia instead. Its goal is producing half of its weaponry at home by 2030, as opposed to 2 percent now. Should the U.S. and European governments be reluctant to assist, Saudi Arabia has other options through Russia, where it is already planning to purchase the S-400 air-defense system, according to Bloomberg.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of