Gold & Silver Trading Alert: Euro’s Breakdown and Its Implications

Briefly: In our opinion (full) speculative short positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

Briefly: In our opinion (full) speculative short positions in gold, silver and mining stocks are now justified from the risk/reward perspective.

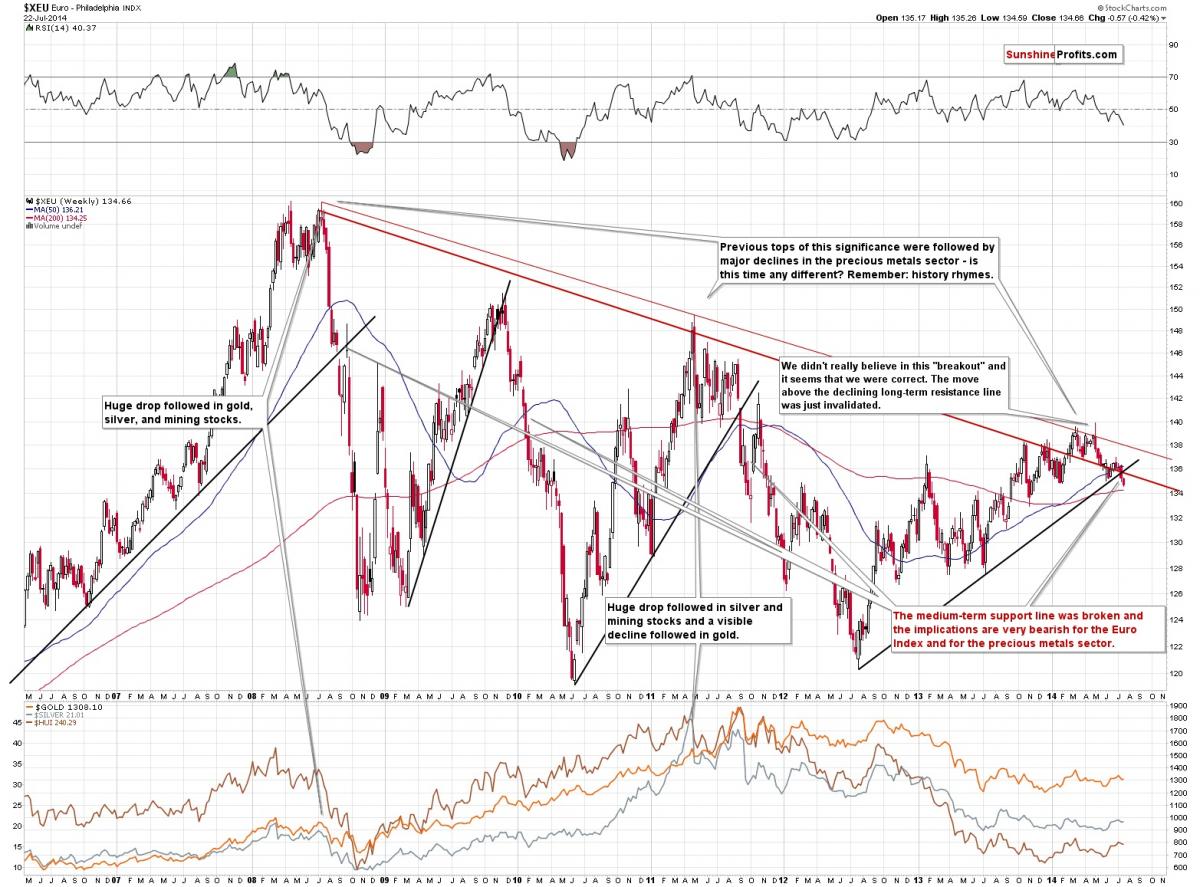

The Euro Index broke decisively below the rising long-term support line (based on the 2012 and mid-2013 bottoms) and this is a major event not only for the currency itself, but also for the precious metals sector. Let’s see why (charts courtesy of http://stockcharts.com).

It was only a few months ago that the Euro Index invalidated a breakout above the very long-term resistance line, and at that time it was likely that the next big move would be to the downside. However, as long as the rising support line remained unbroken, there was still a significant possibility that the currency would move higher. This month and – in particular – this week this changed. We saw a key breakdown. Of course, as it is always the case with long-term charts, we would like to see a confirmation in the form of at least a weekly close below the broken line, but it’s already likely that we will see it.

The situation has deteriorated and it will deteriorate further each day the Euro Index remains below the rising support/resistance line.

Why is this breakdown so significant? In short, because previous similar breakdowns led to massive declines in the value of the European currency (and in other currency markets) and they were also followed by huge declines in the precious metals market. These implications are of medium-term nature, so we may not see the reaction on the very next day, but it’s likely to be seen this or next month.

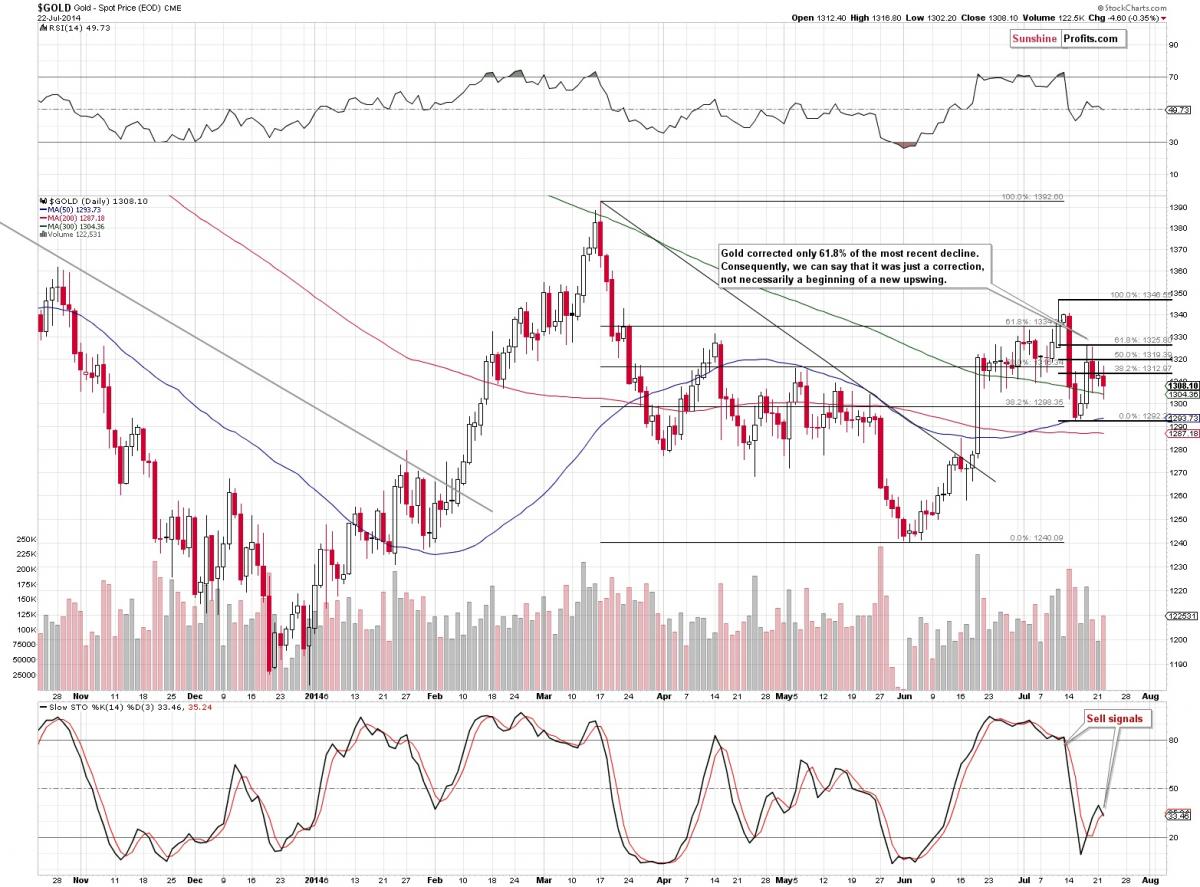

Meanwhile, not much changed from the long-term perspective, so today we’ll focus on the short-term one. On the above chart you can see that we have just seen another sell signal from the Stochastic indicator. These signals were quite useful in the previous months, so it seems to us that paying attention to it is useful also at this time.

We would like to once again emphasize the fact that even though gold rallied last week, it hasn’t moved above the 61.8% Fibonacci retracement level, which suggests that the move was just a counter-trend correction, nothing more. Please note that we can say the same about the June – July rally – it was a correction of the March – June decline.

The situation in silver, mining stocks and the USD index didn’t change yesterday, so our previous comments remain up-to-date.

Summing up, the outlook for the precious metals sector remains bearish.

To summarize:

Trading capital (our opinion): Short (full) position in gold, silver and mining stocks with the following stop-loss levels:

Gold: $1,353

Silver: $21.73

GDX ETF: $28.30

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep our subscribers updated should our views on the market change. We will continue to send them our Gold & Silver Trading Alerts on each trading day and we will send additional ones whenever appropriate. If you'd like to receive them, please subscribe today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,