Gold & Silver Trading Alert: Lower Prices Once Again

Briefly: In our opinion, a speculative short position (half) in gold, silver and mining stocks is justified from the risk/reward point of view.

Precious metals declined once again yesterday. The move was particularly visible in silver. Is the white metal telling us something? We think that it is, but the message is not that straightforward.

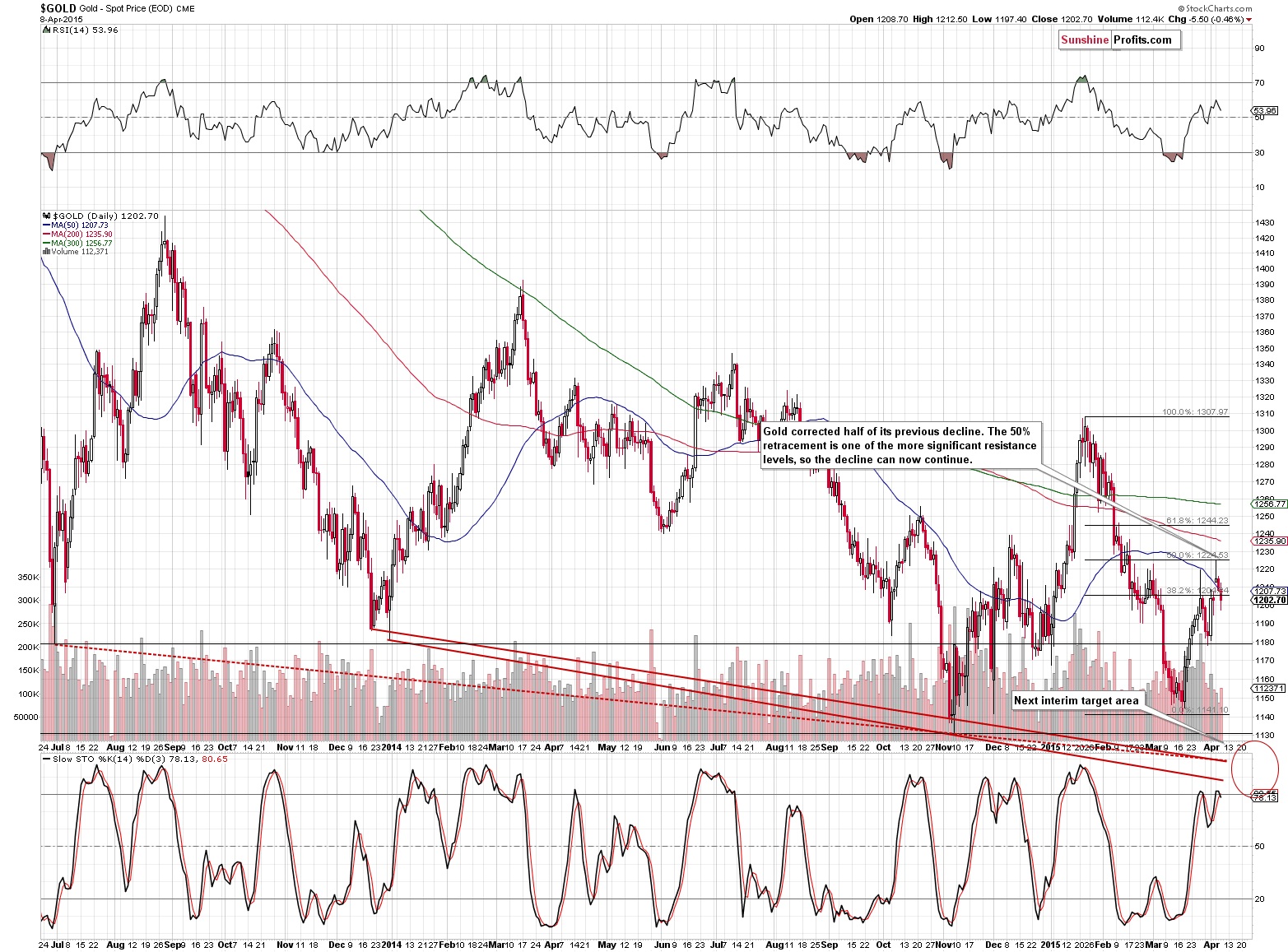

Before we move to silver, let’s take a look at gold (charts courtesy of http://stockcharts.com).

Gold had declined on relatively low volume on Tuesday, but the volume during Wednesday’s downswing was bigger, so the direction of the move is somewhat confirmed. Gold closed below the 38.2% Fibonacci retracement level based on the Jan.-Mar. decline and it continues to move lower also today (having declined $7 at the moment of writing these words). The outlook remains bearish and it seems that re-opening short positions based on the April 6 session was a good idea.

The white metal declined on significant volume yesterday, which is a bearish sign. However, the silver’s decline (along with today’s pre-market move lower to $16.30) didn’t result in a breakdown below the lower of the declining red lines. These lines are important because they are the borders of a possible flag pattern. The “problem” with this pattern is that it’s a sign of a continuation of the move preceding it, which in this case, was up. If we see a move above the upper of these lines, a further rally will become probable. However, that’s not what seems likely to happen. We think that the likely outcome is that we will see a confirmed breakdown below this level and it will be this event that will make further declines more likely. We will consider doubling the size of the short position at that time.

Mining stocks moved lower on relatively low volume, which means that the situation is bearish but not very bearish. Other than that, there’s not much new that we can say about the above chart – the outlook simply remains bearish.

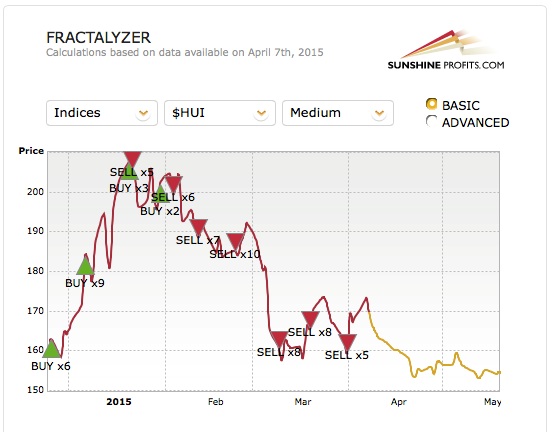

The last, but not the least important, chart for today is the one from our latest tool that is based on the fractal gold analysis – the Fractalyzer.

The above chart features the recent signals and the projected price path for gold stocks. Fractalyzer has been bearish (it’s an investment tool, but from an analytical point of view, one might think about it as a separate analyst and you can learn more about it and see how it works in the Fractalyzer video) on the HUI Index since early February and it currently points to lower prices as well. Please note that the price path is updated on each trading day, so just because at this time we see that the decline is likely to pause in the middle of April, it doesn’t mean that the Fractalyzer will be making the same price prediction tomorrow or next week (again, just like an analyst, it can either keep everything unchanged, change its prediction slightly or even in a meaningful way).

The current price path in the case of silver points to much lower prices but it points to higher prices in the case of gold, so overall the indications for the precious metals sector are bearish, but not very bearish.

Summing up, our yesterday’s and Tuesday’s comments remain up-to-date and the outlook for the precious metals market remains bearish for the medium and short term but has not become very bearish just yet.

To summarize:

Trading capital (our opinion): Short (half position) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (!) target prices:

Gold: initial target price: $1,115; stop-loss: $1,253, initial target price for the DGLD ETN: $87.00; stop loss for the DGLD ETN $63.78

Silver: initial target price: $15.10; stop-loss: $17.63, initial target price for the DSLV ETN: $67.81; stop loss for DSLV ETN $44.97

Mining stocks (price levels for the GDX ETN): initial target price: $16.63; stop-loss: $21.83, initial target price for the DUST ETN: $23.59; stop loss for the DUST ETN $12.23

In case one wants to bet on lower junior mining stocks' prices, here are the stop-loss details and initial target prices:

GDXJ: initial target price: $21.17; stop-loss: $27.31

JDST: initial target price: $14.35; stop-loss: $6.18

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment & Silver Investment at SunshineProfits.com

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,