Gold Sinks Slightly as Silver Skirts Sixty

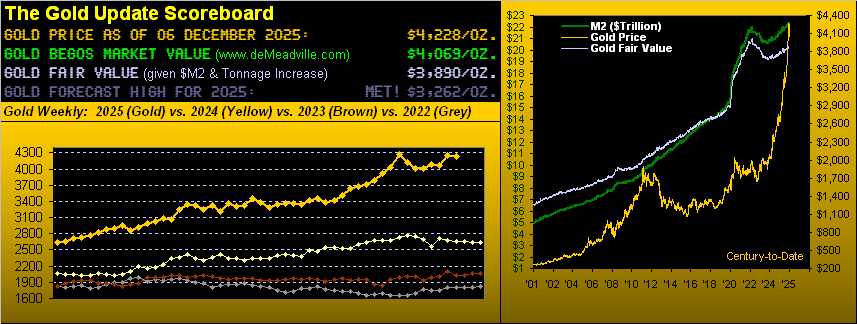

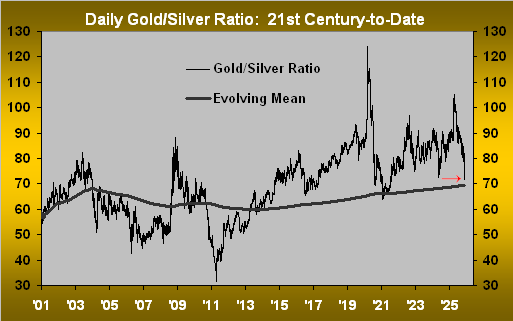

So let’s begin with the Gold/Silver ratio, by which these last several years we’ve gone on time-and-again as to the white metal being “the better buy” over the yellow metal. Thus straight away from the “Everything Reverts to the Mean Dept.”, we’ve our century-to-date run of that ratio replete with its evolving mean. And given yesterday’s (Friday’s) respective settles for Gold (4228) and Silver (58.80), their ratio today is down to 71.9x, its lowest level (prior to this past week) since 05 August 2021 and its closest approach to the mean (currently 69.4x) since 12 July 2021 (the mean then 66.3x). Here’s the current ratio per the red arrow:

Indeed “the better buy” has been Sweet Sister Silver, coming yesterday within a hair’s breadth of touching the 60.00 milestone. From 2024’s settle at 29.29 to yesterday’s all-time high of 59.90 saw her up +104.5% year-to-date, whereas Gold at best (4398) has achieved “only” a +66.6% gain, (oh darn).

Yet we query: what is Silver really worth?

Because we have a Fair Value for Gold and a mean for the Gold/Silver ratio, the arithmetic (a lost science in finance today) otherwise can be performed for those of you scoring at home. From the opening Scoreboard we have Gold’s Fair Value (“GFV”) now 3890. The noted Gold/Silver ratio mean (“GSM”) is now 69.4x. Therefore (at the risk of you WestPalmBeachers glazing over down there), we can solve for Silver’s Fair Value (“SFV”):

- GFV ÷ GSM = SFV … ► … 3890 ÷ 69.4 = 56.05

Fairly riveting stuff, what?

“That’s cute, mmb, but what does it really mean?”

Two answers, Squire:

- By anchoring Silver to Gold’s Fair Value with the ratio’s mean, Silver today at 58.80 is overvalued by +4.9% (“ought be” 56.05);

- However, priced purely to today’s actual Gold price (4228) and the ratio’s mean, Silver in fact remains undervalued by -3.5% (“ought be” 60.91).

Thus buying parties of the second persuasion might take the other side of the trade from those of the first persuasion who are selling, in turn driving Silver above the 60.00 milestone. Else solely by these measures — and barring Gold getting a substantive launch from here — Silver’s amazing run (for now) may be done.

Too, like Gold, Silver is money (just ask your Anatolian ancestors), albeit as we oft caution, she is at times substantively influenced by Cousin Copper, to the extent that he can subversively seduce her. ‘Tis always an annoying affair.

All that stated, Gold’s ongoing Short stint nonetheless has (so far) been bullish. Having “officially” commenced back per the open on Monday, 24 November at 4069, Gold has only declined by as much as -33 points (to 4036) and instead has risen by as much as +230 points (to 4299). As we’ve depicted in recent missives, such weekly parabolic Short trends for some two years have been Gold buying opportunities rather than exit signals. And thus to the weekly bars and Parabolic trends from a year ago-to-date we go, featuring the rightmost red-dotted Short “Up” stint:

‘Course, “Short” could kick in to the downside, especially should next Wednesday’s Policy Statement from the Federal Open Market Committee maintain the Funds Rate in the 3.75%-to-4.00% target range.

“Well ya know they’re gonna cut, eh mmb?”

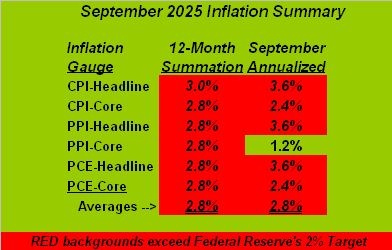

Squire just saw the piece from the ever-venerable Reuters: “Economists double down on December Fed cut despite policymaker divide.” Notably weakening jobs data, (regardless of never-to-be-resolved “shutdown” reporting gaps) favours a rate reduction. However: inflation favours a rate rise given price increases remaining above the Fed’s 2% target range as we next see in September’s at long-last completed puke-green summary:

Thus the “…policymaker divide” — i.e. a few of the FOMC voters may recommend no rate move — can be supported by inflation offsetting jobs creation (or lack thereof). And have we this year on occasion mentioned the “s” word “stagflation“? Oh yes.

Specific to the Economic Barometer which — “with government out of the way” — had been on the move up, this past seek decidedly recorded a move down. 14 metrics — in arrears or otherwise — found their way into the Baro this past week, of which just four improved period-over-period, the big stinker (favouring a Fed cut) being ADP’s Employment reading for November that showed job shrinkage for the fourth month in the last six. Here’s the graphic, still with 49 metrics missing:

And yes, Virginia, in that display the price/earnings ratio of the S&P 500 truly is now an “off the edge of the bell curve” 58.0x, the mighty Index having settled yesterday at 6870, a mere -50 points below its all-time intraday high of 6920 (29 October). ‘Tis too bad earnings are not sufficient enough to keep pace with price, (let alone an “M2” money supply of $22.4T that is vastly unsupportive of the S&P’s $60.8T market capitalization). Reprise:  “When the levee breaks…”

“When the levee breaks…” –[McCoy/Minnie ’29; Led Zeppelin ’71].

–[McCoy/Minnie ’29; Led Zeppelin ’71].

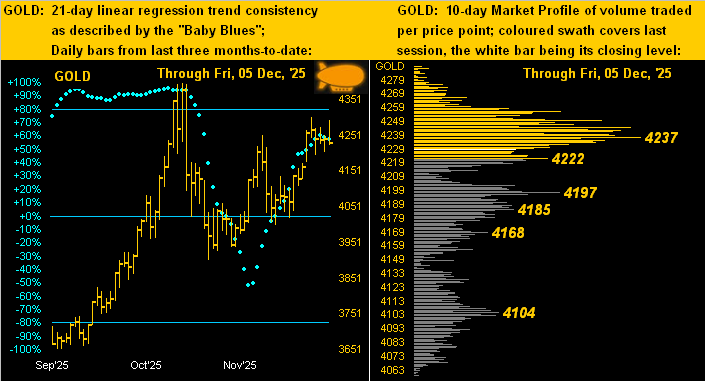

However, hovering of late as if a zeppelin unto itself has been Gold. But as we turn to the two-panel display of Gold’s daily bars from three months ago-to-date on the left and 10-day Market Profile on the right, one senses some descent. Note therein the “Baby Blues” of regression trend consistency having ticked lower for the past two days. Too, price has slipped below its most volume-dominant Profile support level of 4237. Not that this absolutely turns the tide, but it does remind us that hardly do markets move in a straight line:

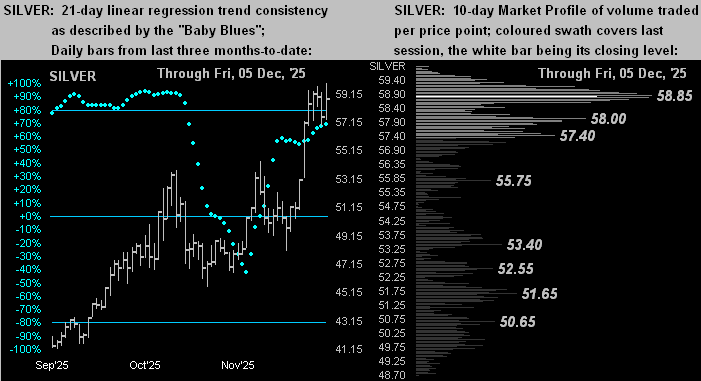

Silver’s like picture appears a bit more healthy, albeit her just-recorded all-time high (below left) lacks confirmation from Gold. And she’s presently-priced right ’round that Profile apex of 58.85 (below right), with nearby underlying support as labeled at 58.00 and 57.40:

To wrap, per our title, Gold sank slightly (-0.7% net for the week) as Silver skirted sixty (+3.0% net for the week). And now Sister Silver sits at 58.80, a mere 1.20 points from 60.00, with an expected daily trading range of now 2.24 points. By such yardstick, Silver can grab 60.00 come Monday. But then there’s Wednesday and the aforementioned FOMC Policy Statement on the Funds Rate. A cut almost surely shall see Silver eclipse 60.00. But what if the Committee instead abstains?

To wit: as longtime readers of The Gold Update know, our microphones are just about everywhere, including last week at the Eccles Building in D.C. wherein a small contingent of Silver traders came down on the bus from the COMEX in N.Y. to plead Powell for another rate cut. Squire even arranged for an inconspicuous MINOX camera to capture the moment:

But should such plea fail a cut by which to abide — and prices thus decide to slide — keep Gold and Silver for the ride!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

*******