Gold Is Sound Investors Hold Their Ground

The big question about America is how much more money the Fed can print while the government runs a program of borrowing money to infinity… before hyperinflation turns the fading empire into a fire pit.

The debt-themed empire is in tatters already, but it has yet to become an inferno. The world watches aghast, as Americans blow each other away on the streets and the government loses yet another war (this time Corona).

The big caveat is that if the Fed keeps the stock market levitated and races to the rescue after each crash, the US empire train somehow doesn’t completely derail.

The US stock market chart.

After a Fed-juiced rally from my key 21,700 and 18,300 buy points for investors, the Dow has stalled out at my first sell point of 27,000.

Can Fed chief Jay once again save the stock market day, as states like California close big parts of the economy again?

Ominously, the start of my annual stock market “crash season” (Aug 1-Oct 31) is now just two weeks away.

Whether the stock market breaks higher or lower from here is likely to be determined by the number of state closures and the response (or non-response) to those closures by the Fed.

Because it’s an election year, the Fed is likely to “fix” any breakdown.

I don’t see the Dow going to a new low this year, but a scary pullback to the 22,000-23,000 range could occur.

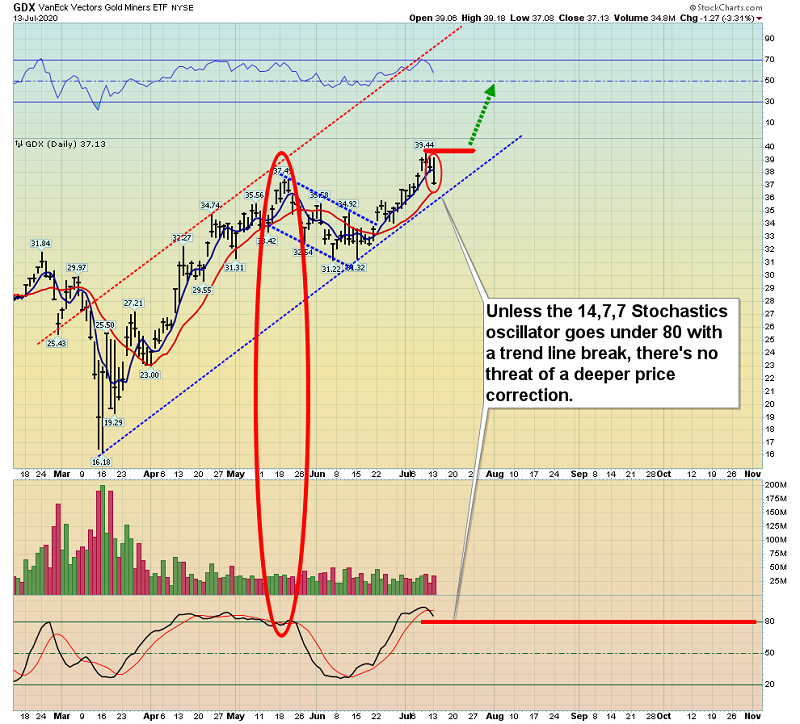

The important GDX chart.

The short-term outlook for gold stocks may appear shaky after yesterday’s hard sell-off, but the strength of gold bullion and the “Fed Fix” are supportive factors.

These two price drivers could create one of the most spectacular buying opportunities in the history of gold stocks.

The uptrend is intact. Tactics? Well, at my https://guswinger.com swing trade service, we sold all leveraged gold stock ETFs last week. For the short-term, we are focused on holding just modest positions in some big senior producers.

If GDX can trade above the recent $39.44 high, we’ll rebuy NUGT and JNUG, but with Corona-related closures accelerating, and the Fed yet to act, I want to see the market prove itself.

Gold is technically solid, and there are numerous lines of support just below the current price.

The recent breakout above $1800 was important, and the ensuing pullback is orderly.

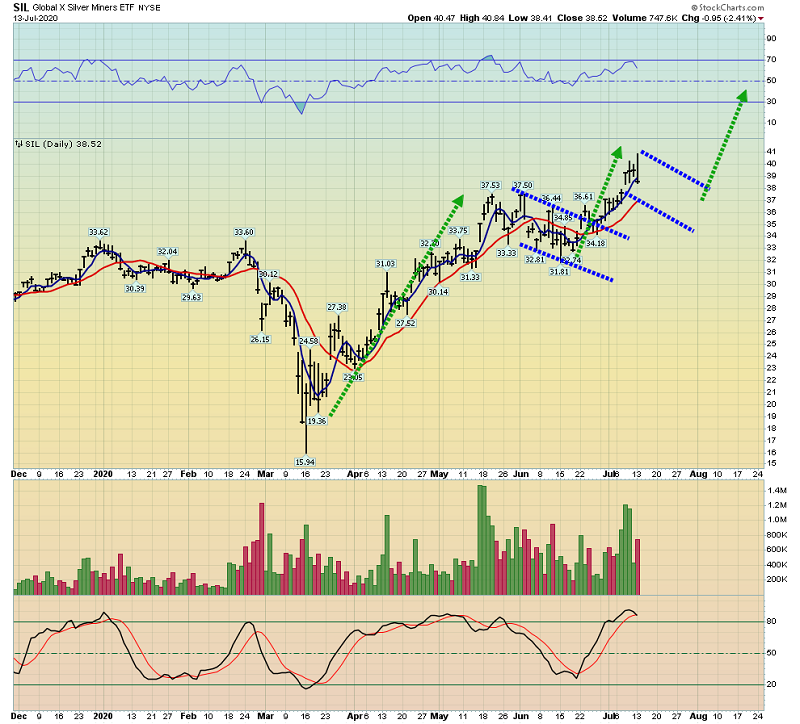

The SIL silver miners ETF chart.

A lot of amateur investors don’t understand that while the price of a stock making a new minor trend high demonstrates great market strength…

A modest pullback soon after making that high is usually the next price action that occurs.

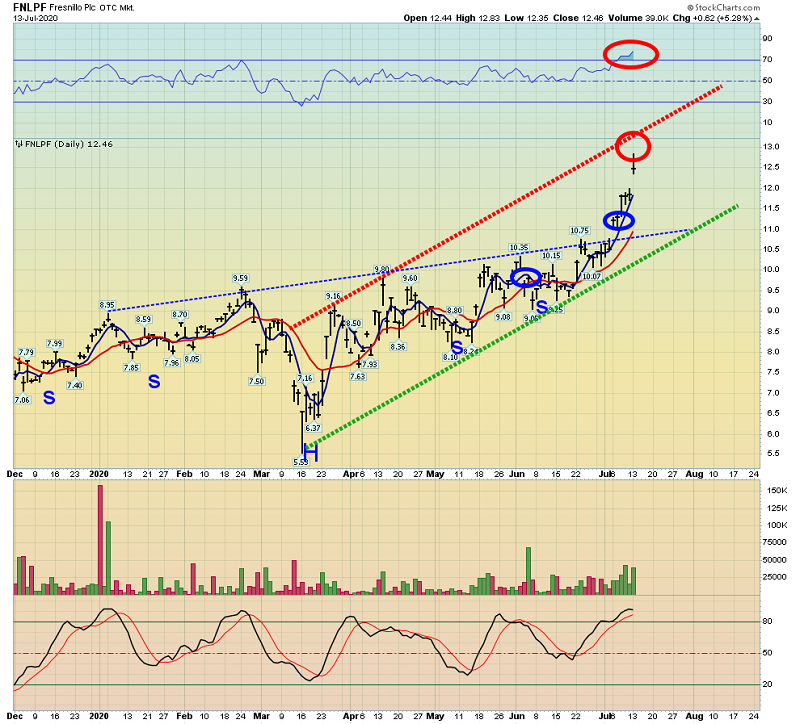

My most recent key recommendation for investors who want senior silver production and mid-tier gold production has been Fresnillo. The stock soared higher yesterday, while most big miners swooned.

A key mantra for gold stock traders is this: Sell trading positions when the mood is joyous and account profits are great. That time is now for companies like Fresnillo.

Core positions need to be held with an iron hand, and accumulated on a break above GDX $39.44, or during the current price dip.

The bottom line: This gold market is sound, and investors can confidently hold their ground!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Stock & Gold Market ETFs: Tactics For Crash Season!” report. I highlight my major buy and sell points for the big gold and stock market ETFs, to help investors get richer, and stay richer!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

*********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: