Gold Speculators Increased Their Bullish Net Positions For 2nd Time In 3 Weeks

Gold Futures Non-Commercial Speculator Positions:

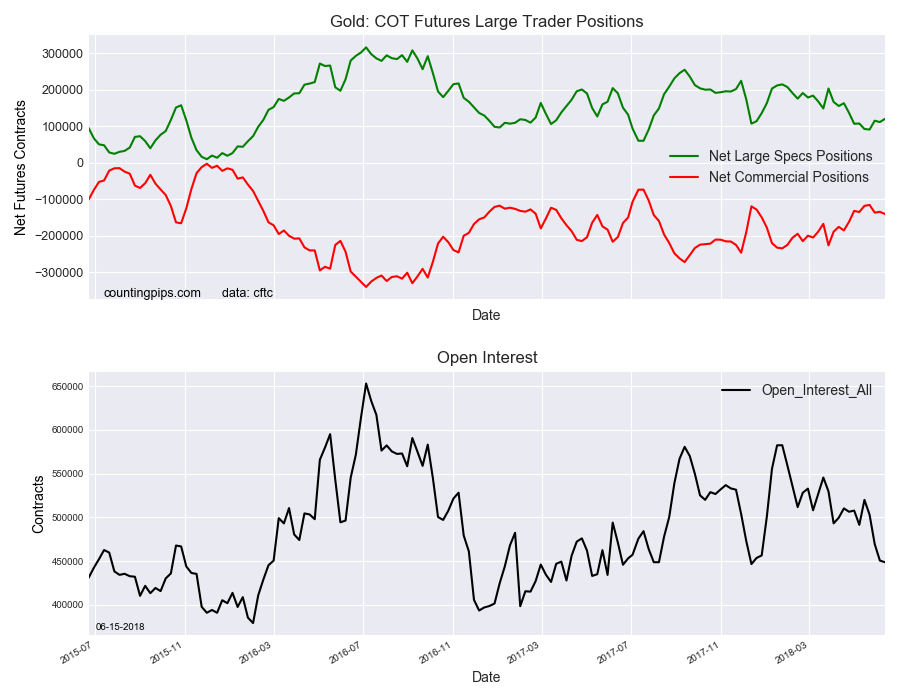

Large precious metals speculators raised their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 120,240 contracts in the data reported through Tuesday June 12th. This was a weekly lift of 8,824 contracts from the previous week which had a total of 111,416 net contracts.

Speculative bets have been mostly directionless over the past ten weeks with a one step forward and one step back activity. This week’s rise brought gold bets higher for the second time in the past three weeks and the overall net position remains above the +100,000 contract level for a third straight week.

Gold Commercial Positions

The Commercial Traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -140,587 contracts on the week. This was a weekly loss of -6,240 contracts from the total net of -134,347 contracts reported the previous week.

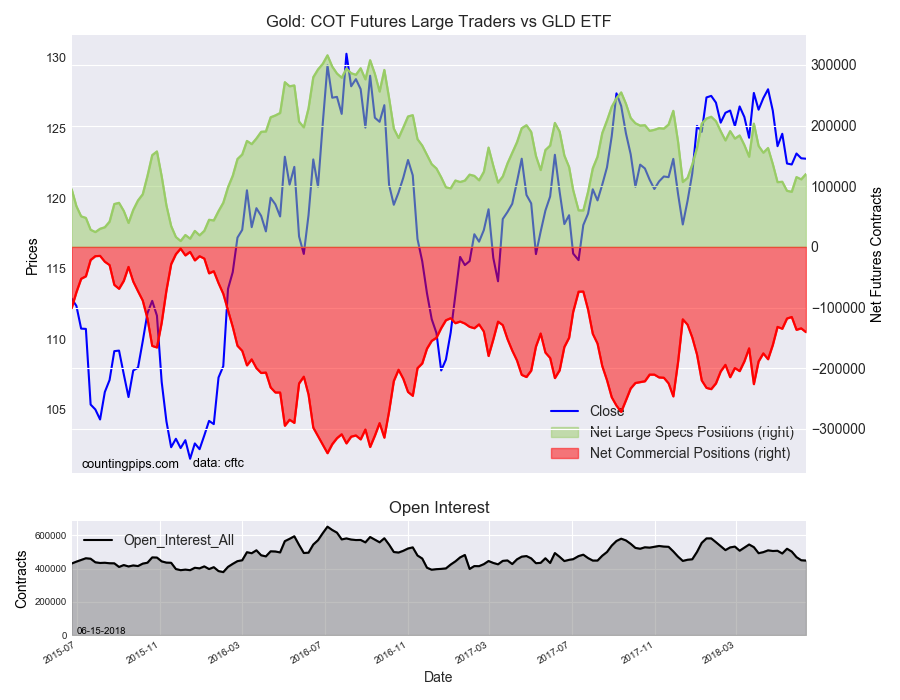

Gold COT Futures Large Trader Vs GLD ETF

SPDR Gold Shares (NYSE:GLD):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the GLD ETF, which tracks the price of gold, closed at approximately $122.82 which was a drop of $-0.03 from the previous close of $122.85, according to unofficial market data.

*********