Gold Stocks & A 100 Yard Dash

The progressive movement (restoration of gold as the money of the world) has been hijacked, and pretenders to the gold money throne now claim that fiat credits, massive debt, rampant destruction of free speech, and vicious war mongering are “progressive.”

Fiat is a barbaric relic, and the world’s governments resemble cavemen with debt-funded clubs. The real progressive movement is about gold, a savings mentality, personal humility, general goodwill, and common sense. Perhaps a man named Simon said it best: Keep it simple.

Double-click to enlarge this enticing BPGDM sentiment chart. It doesn’t get much simpler than buying low and selling high! Buy gold stocks when the BPGDM is low (sub 30 on the index) and sell them high (when it’s above 70).

The BPGDM reached the 21 area yesterday. Also, note the positive position of the Stochastics oscillator at the bottom of the chart. It’s massively oversold.

On another progressive and simple note: Today is what I’ve dubbed, “BRICS Expansion Day”. For the past few weeks or so, I’ve been suggesting gold and silver are highly likely to begin their next move higher from around this day.

Double-click to enlarge. It appears that silver may be leading the way! A fabulous inverse H&S breakout is in play.

What about gold? Well, there’s some very positive action taking place on the short-term chart, and to view it,

Double-click to enlarge. Yesterday, gold broke above the downtrend line that’s been in play from the $1980 area highs of July.

A complex inverse H&S pattern of size also appears to be in play, targeting the $2080 zone.

Could a stock market tumble derail the imminent metals market rally? Well, August 1 to October 31 is what I call “US stock market crash season”. I always urge stock market investors (and nervous gold bugs) to buy put options around Aug 1, which helps to mitigate their risk for minimal cost.

For more insight into this key stock market matter,

Double-click to enlarge this SP500 chart. While a H&S top appears to be forming, there’s massive support just below the neckline of the pattern.

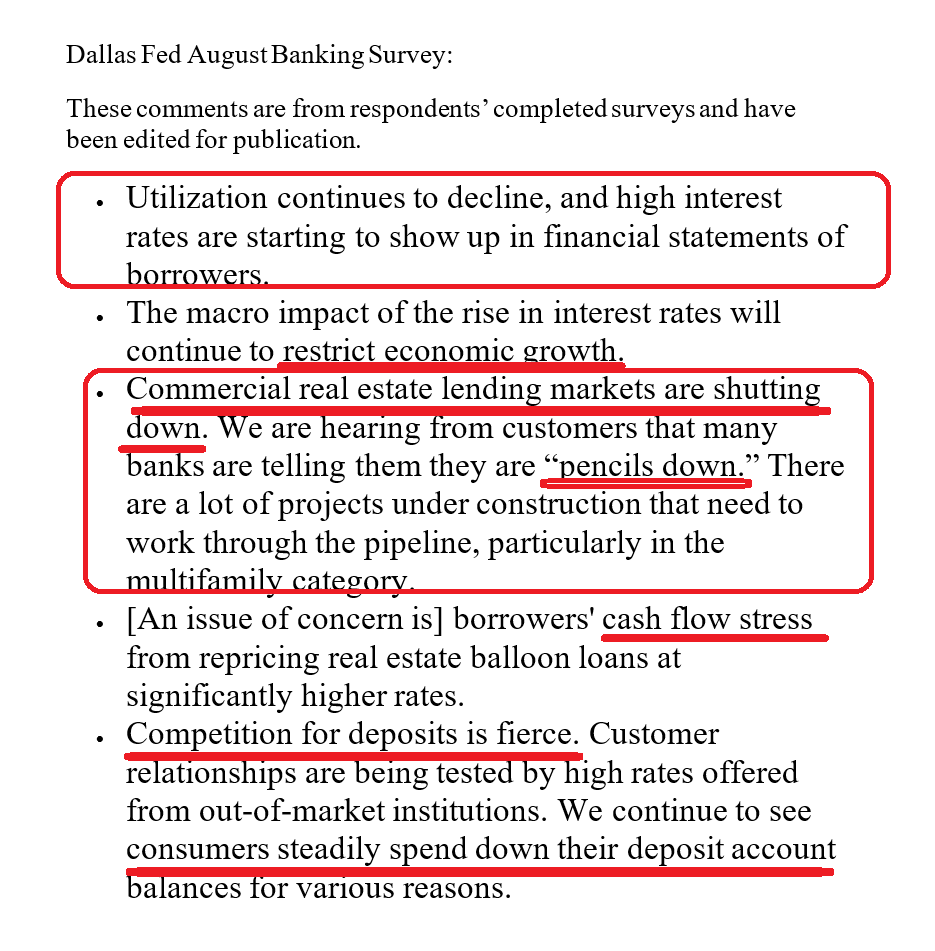

This doesn’t look good. Banks are projecting deteriorating business conditions over the next six months.

The Fed is already in de facto pause mode for rate hikes. The lull in inflation is likely temporary and could be followed with panic buying of gold when it spurts higher again…

But for right now, rates appear to near a temporary peak as bank loans dry up and consumers exhaust their tiny savings… savings that are mostly related to fiat handouts they got during the pandemic.

A consistent focus on rates and other key big picture items is critical for investors. I cover the big picture 5-6 times a week in updates just like this one, in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, and I’m doing a $179/15mths special offer that investors can use to get in on the winning action. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

Next, for a look at the key ten-year rates chart,

Double-click to enlarge. While rates could move a bit higher, they are in a big resistance zone. A significant reaction is likely to happen soon, and perhaps it starts right now.

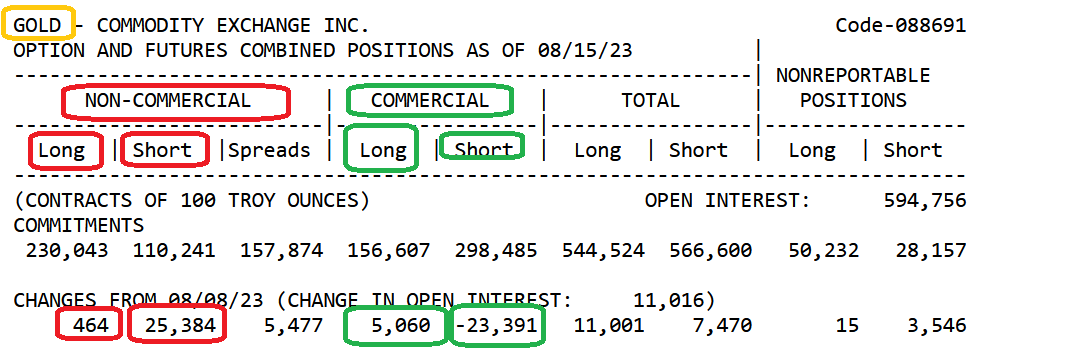

Double-click to enlarge this glorious COT report chart.

The smart money commercial traders are gobbling up gold long positions and offloading a veritable truckload of profitable shorts!

The dumb money funds loaded up on shorts just in time for the price to start surging higher.

I was an eager gold stocks buyer yesterday, as an ode to my “big five” indicators that are all flashing key buy signals for gold, silver, and the miners.

The big five indicators are: India buying (check!), COMEX commercials buying (check!), the BPGDM sub 30 (check!), rates at resistance (check!), and gold at big horizontal price support (check!).

Gold is at $1900 after a significant price sale, which gets the biggest checkmark of all.

What about gold stocks? Well, for a look at a fabulous daily chart for GDX,

Double-click to enlarge. A key reversal is in play, with all of my “big five” indicators suggesting that now is the time to buy the miners.

For a look at GDX from a candlestick perspective,

Double-click to enlarge. There’s a hammer-style candlestick in play, and it could mark the low or the area of the low.

All in all, I think stock market bears need to look further ahead (to January 2024) for their “big crash”. A modest swoon that’s accompanied by bank loan tightening is likely to put a cap on rates… and make gold stocks the leaders of an imminent and enticing metals market dash!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: