Gold Stocks: The Frenzy Begins

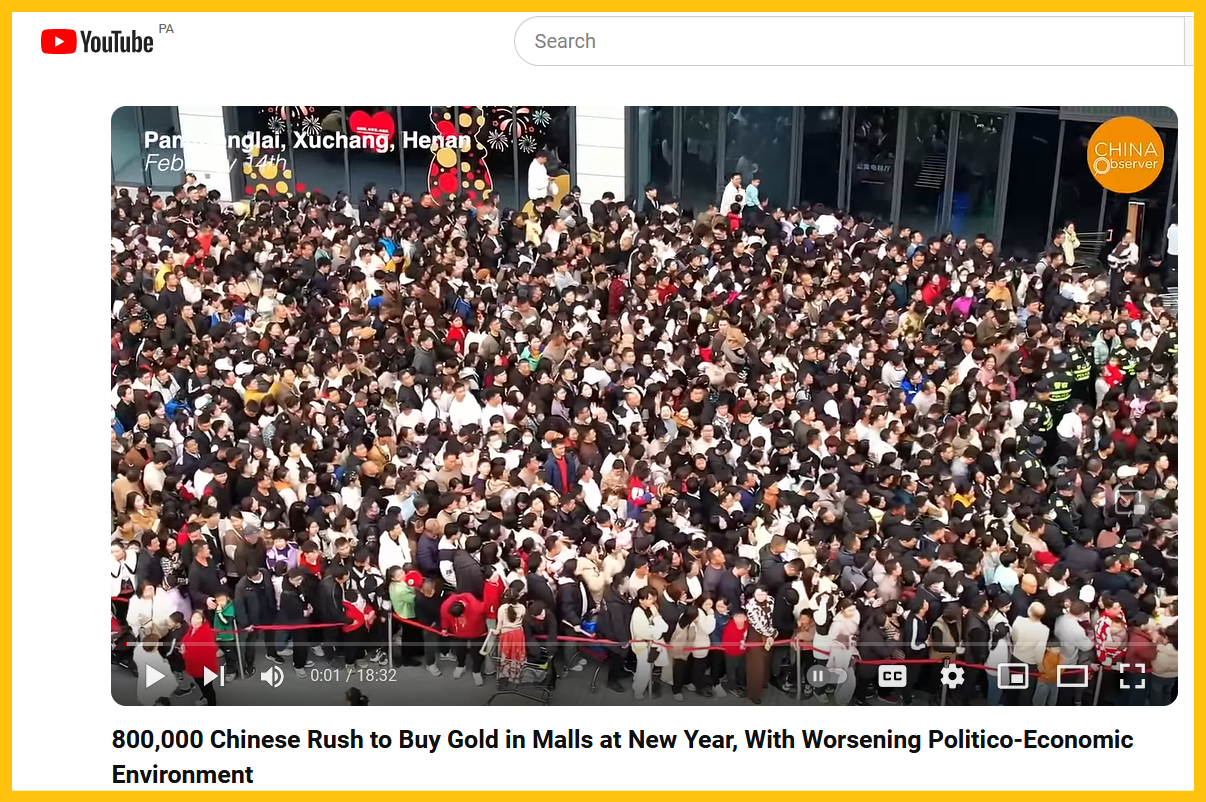

To feel the adrenaline rush of the gold bull era check out this incredible picture.

It defines what lies ahead… for the whole world.

This is the key weekly chart for gold.

In the volatile fear trade for gold, line charts are important because they remove a lot of the excessive noise that often comes with candlesticks and bars.

An impressive broadening pattern breakout and inverse head and shouldering action is in play. The target is a minimum of $2200, with an “overshoot” to $2500 being possible too.

A week ago, I urged all gold bugs of the world to prepare for the US PCE inflation report to act as a “Golden Trigger” for gold, silver, and the miners… and that’s exactly what has transpired!

Almost daily, more mainstream analysts are noticing the decoupling of gold from the US usury (rates) trade.

US rates are still incredibly low, especially given the outrageous growth of the debt of the US government and its closely-associated entities.

Inflation is still sticky. The CPI, PPI, and PCE do not properly indicate the severity of the “boots on the ground” inflation being experienced by the average working-income citizen; grocery prices have not eased much, and the price of many items continues to rise.

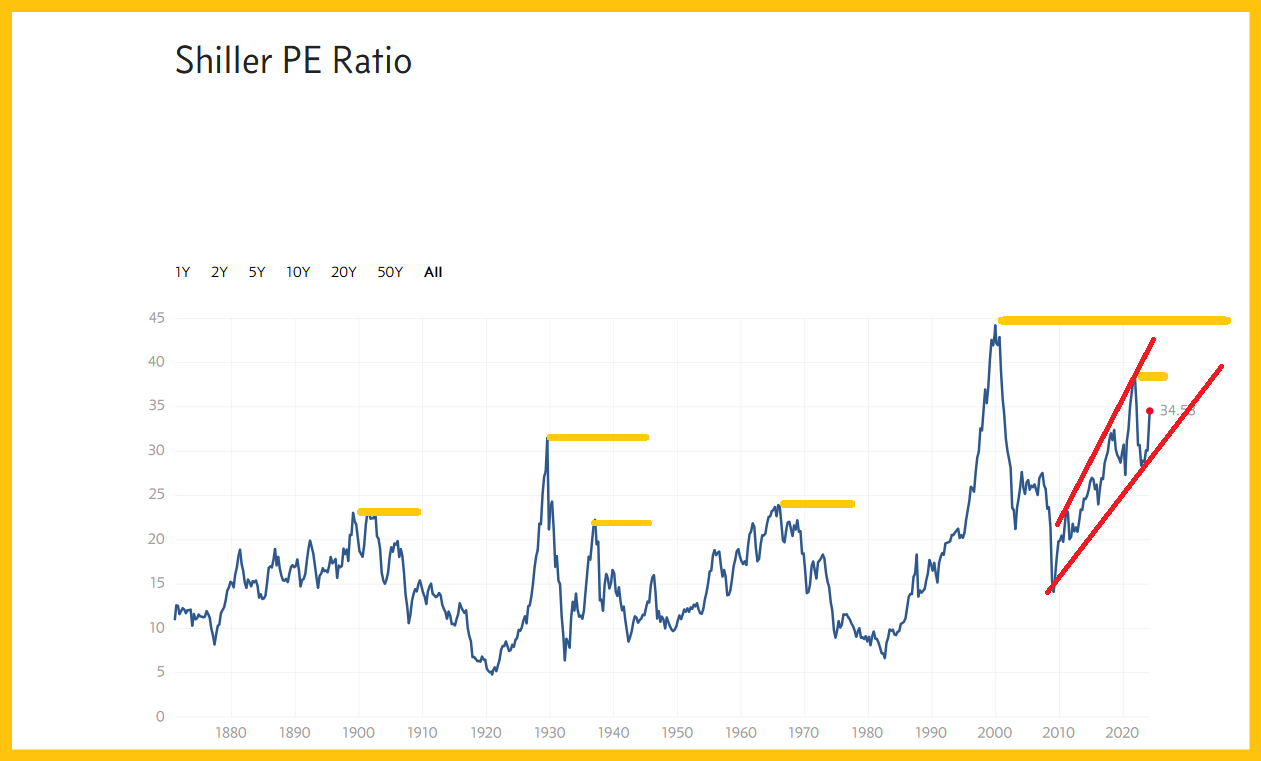

Stock market inflation is also in play. Basis the Shiller (CAPE) ratio, the US market is one of the most overvalued in history.

Rate cuts would make it even more overvalued… perhaps the most overvalued of all time! Rich preppers like Zuckerberg are reportedly loading up bunkers with gold. US money managers are getting concerned that rate cuts could unleash a new round of (uncontrollable?) inflation… and it’s likely to happen anyway.

To view another key gold price chart,

This is the weekly bars chart. Note the phenomenal action of the 14,5,5 series Stochastics oscillator at the bottom of the chart.

What about the dollar? View this monthly chart,

Double-click to enlarge this disturbing dollar versus gold chart. Support is failing (again) and a massive leg lower appears imminent.

A huge H&S bear continuation pattern is in play for the dollar, and if it plays out gold would be trading at its next major pitstop of about $3000.

There’s nothing that deranged chickenhawk and debt worshipper “Chucky Doll Joe” Biden can do to stop empire transition from the fiat-oriented West to the gold-obsessed East.

There’s nothing that “Super Trumpy Tarriff Taxes Man” can do either. Trump could end the horrifying woke joke schemes and he may even temporarily stop the wars, but he can’t stop the awesome fiat West to gold East transition from playing out… in textbook fashion.

The only question that US government officials from both parties need to ask themselves today is whether they are ready to stop acting like fiat currency brats, act as adults, and embrace the awesomeness of gold!

Sadly, it’s unlikely that they make the transition, but their failure is spectacular news for all gold and silver enthusiasts.

Speaking of silver:

This is the weekly silver chart. There’s a massive inverse H&S bull continuation pattern in play.

A daily focus on the big picture is critical for investors as stagflation, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week along with the key technical action in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

Like Rodney Dangerfield, silver hasn’t gotten the respect it deserves, but I’m predicting that 2024 sees that change.

This is the GDX daily chart. GDX could build an inverse H&S pattern right shoulder ahead of the US jobs report. That’s very bullish.

To view an even more positive (and realistic) scenario:

When a flagpole forms on a chart, a flag is likely to follow. Like silver, gold stocks have also struggled versus gold, but they are now coming to life in a major way. Newmont’s CEO calls this price zone a “generational buy”... and I’ll dare to suggest he may be understating the opportunity!

Here’s the bottom medium-term line: Huge numbers of “dumb money” call options were written around the $27 strike price zone for GDX. The smart money buyers bought the calls.

Now price has surged through that $27 line in the option writers’ sand… and done it like a solid gold chainsaw ripping through a block of rancid fiat butter! There’s only one thing left to say to all the world’s gold and silver stock enthusiasts. Enjoy!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: