Gold Stocks: An Inflationary Money Train

Technically and fundamentally, gold is poised to resume its magnificent rally that is taking investors into what I call a “bull era.”

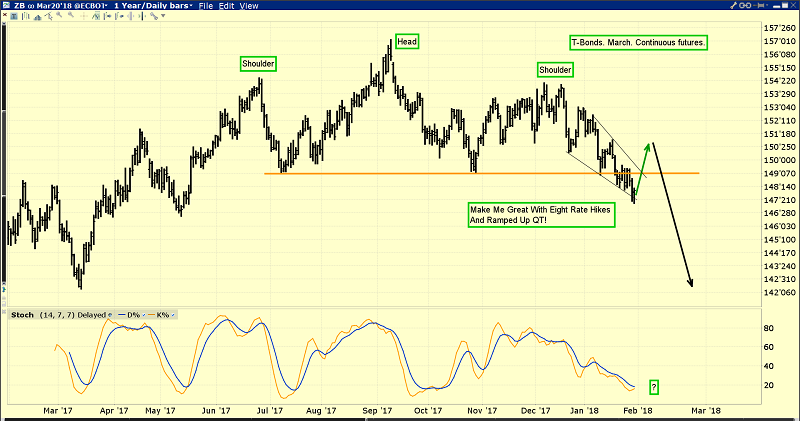

The next FOMC meeting announcement is tomorrow. I expect the Fed to strongly signal more rate hikes and ramped up quantitative easing. There’s an outside chance that bank deregulation is addressed, but that’s likely going to happen in the next meeting.

Regardless, everything the Fed is doing is positive for inflation, negative for government bonds, and negative for the dollar.

Nothing is more terrifying to institutional bond market analysts than the prospect of significant inflation.

The US government is on the ropes. Rates are rising, QT is creating bond market liquidation, and wages are starting to surge. The inability of the US government to finance itself in an inflationary environment means rate hikes and QT are negative for both the bond market and the dollar.

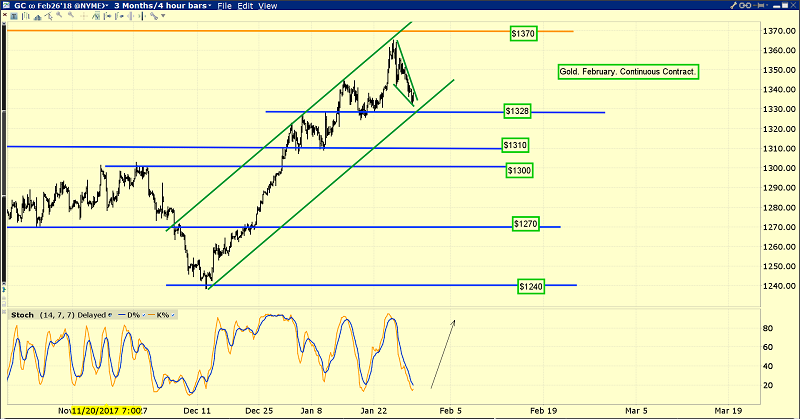

This is the key short-term gold chart.

Even though gold has rallied more than $100 an ounce in a very short time frame, the pullback action is very positive. It’s taking the shape of a small positive wedge formation. Solid Chinese New Year demand is likely behind the positive nature of this soft pullback. Global gold investors should be buyers at $1328, $1310, and $1300, with a bigger focus on gold stocks than bullion.

During deflationary times, bullion is the leader. During the inflationary times that are beginning now, mining stocks are poised to dramatically outperform bullion.

Global growth with inflation and the end for the great global bond market should create at least a decade of gold stock outperformance against gold. These stocks are essentially poised to enter a period of growth much like Main Street America experienced in the 1950s.

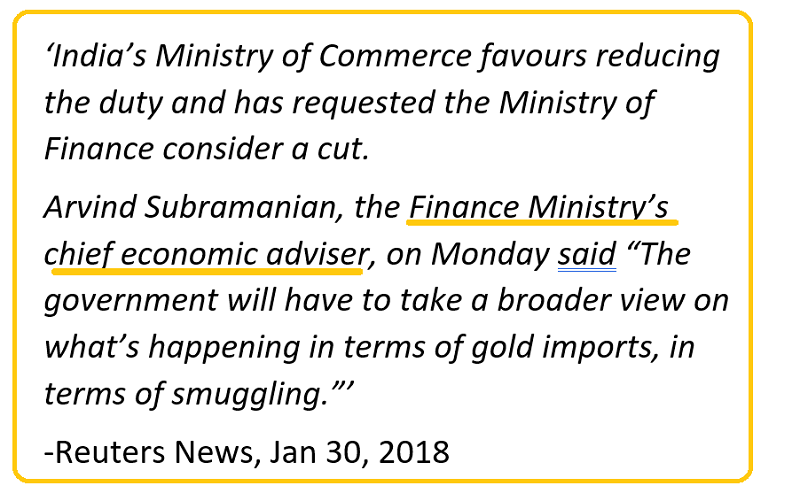

While all the current news is very positive for gold market investors, the best news of all may be coming on Thursday. On Thursday, India’s national budget is announced and a duty cut may finally happen!

Gold’s uptrend against US government fiat ended in 2011 – 2012 as India began increasing the import duty aggressively. This essentially put millions of jewellery workers on the bread line and shuttered hundreds of thousands of small jewellery shops.

The bottom line is that Indian government duty hikes basically nuked Western gold mining stock enthusiasts and put the survivors in a horrifying gulag.

For the past several years, jewellers have begged the government to begin reducing the duty. Unfortunately, the government has shown no interest in announcing even a tiny cut.

Until now. While the commerce department has called for a duty cut for years, this is first time the all-powerful finance department has addressed the issue in a positive way. So, a cut on Thursday is not a “done deal”, but the odds of it happening are now vastly higher than at any time since the import duty peaked at 10% in 2013.

Jewellers and dealers are not buying gold in any size now, because they are anticipating the government will finally give them a cut. That’s created some gold price softness over the past week. I’ve suggested that a duty cut could be the catalyst that blasts gold over the $1370 area highs. In turn, that would usher in the start of a rally to massive resistance at $1500.

For gold, a duty cut in India has truly gargantuan ramifications. It is the equivalent of a corporate tax cut in America. It restores confidence amongst citizens and shows that the government understands not just sticks, but carrots. When citizens feel good they are more productive. GDP grows, bringing the government more tax revenues. Thursday could be a truly epic win-win day for gold and all its global stakeholders. Are investors prepared?

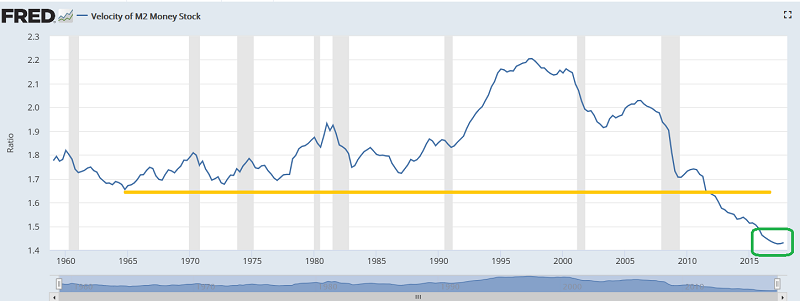

Institutional money managers are starting to see the myriad of inflationary lights flashing that I predicted were coming.

Money velocity is starting to rise. The upturn is subtle, but it’s there! As Powell takes over the Fed and ramps up QT, I expect money velocity to surge aggressively from the 60-year lows that it sits at now. As this happens, gold stocks should essentially “run rickshaw” over bullion.

Also, key Chinese gold mining stocks that I use (and own) as key lead indicators for Western miners are staging what can only be described as massive long term chart breakouts.

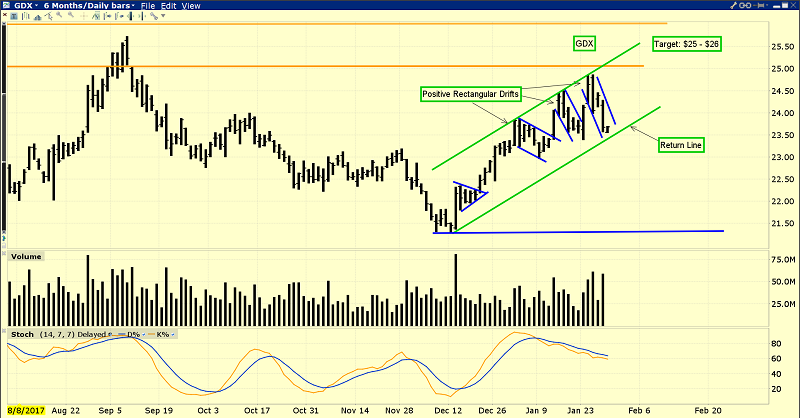

This is the GDX chart.

In the summer of 2017, I outlined the $23 - $18 price zone as a key buying area for all gold stock enthusiasts. Investors who took my recommendation are looking good now.

Note the return line that I’ve highlighted on the chart. The price is almost there now. Solid rallies often begin from these technical return lines.

Chinese “Golden Week” holidays begin around Valentine’s Day. That’s still two weeks away. Gold markets close for a week, and the price usually softens. The jobs report is this Friday. Gold typically rallies in the days following the report. A duty cut, gold-positive statements from the Fed, and post jobs report market strength could see GDX reach my $25 - $26 target by Valentine’s Day.

From there a significant market correction would be expected, followed by a major surge to multi-year highs. This is the GDX weekly chart. In 2018, GDX should surge out of the significant symmetrical triangle that I’ve highlighted. With powerful institutions buying, it should easily reach my $30 - $32 target zone. Gold stocks investors are basically sitting on an inflation-themed money train that the Fed is going to turbocharge with rate hikes, QT, and bank deregulation. All aboard!

*********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Gold Stocks & Rare Earths, Mano A Mano!” report. I highlight five junior gold stocks and five rare earth stocks that should surge higher in an inflation-themed bull era, with major buy and sell points for each stock!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: