Gold Stocks: A Straight Run To Fresh Highs?

With a new tail wind of significant ETF tonnage growth, gold bullion continues to sport the best charts of all the major asset classes.

The $1800 area is significant resistance and gold arrived at this resistance zone as its weak price season began.

Rather than selling off in a major way, the price action has been neutral and bullish price patterns are in play.

Gold could trade sideways for longer than most bulls believe, but I’ve argued that gold stocks can rally higher anyways, given the enormous cash flows that many miners are pulling in now.

The GDXJ breakout chart.

Note the buy signal in play on my 14,7,7 Stochastics oscillator at the bottom of the chart.Volume is also picking up nicely.

The bear wedge Dow chart.My base case is that the “Creep State” (govts and central banks) will support the US stock market enough to push it to new highs, but without that Creep State support, the Dow would immediately implode… and the implosion would be much worse than it was in 1929.

While gold stocks don’t get the direct support from government and central banks that the “poster boy” stock markets get, they do benefit indirectly.

In 2009, the Fed coined the term, “green shoots”, and institutional money managers loved it.They believed that Fed money printing and government debt would empower the economy.

Now, the same money managers talk of a “zombie” stock market, where money printing and government borrowing are ultimately destructive actions that open the door to a 1929-style wipeout.

As institutions lose trust in the ability of government and central banks to “print” the economy and stock market higher, they are steadily turning to gold bullion.

I’m adamant that they will turn to gold stocks once they are comfortable with bullion.

When will that happen?When will institutional money managers surge into gold stocks and silver stocks?

The long-term gold chart.Here’s the bottom line:A rise above $2000/ounce for gold would create worldwide news headlines, and at that price level…

Gold miners would look like cash cows on steroids!

As institutional money managers become more concerned about the stock market, it will be carried higher mainly by individual investors who believe government propaganda about a V-bottom for “the mightiest economy of all time”.

An economic U-top (and maybe even a V-top) is really what is in play, and more and more institutional money managers are expressing their horror.

I don’t believe the Fed or government really cares about the “little guy”.When the stock market gets into trouble with small investors carrying the load, especially trouble related to a rise in inflation, the Fed will likely stop supporting the market, and leave individual investors to burn.

In 2009, Ben Bernanke said, “I see green shoots!”In 2021, Jay Powell may say of burning individual US stock market investors, “let them eat cake”.

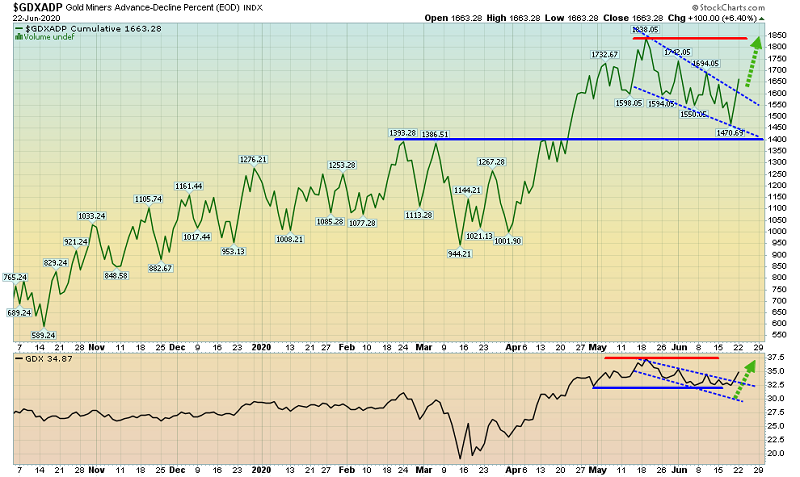

The GDX advance/decline line chart.A bull wedge breakout looks to be in play, and the GDX price line has broken out of a drifting rectangle.

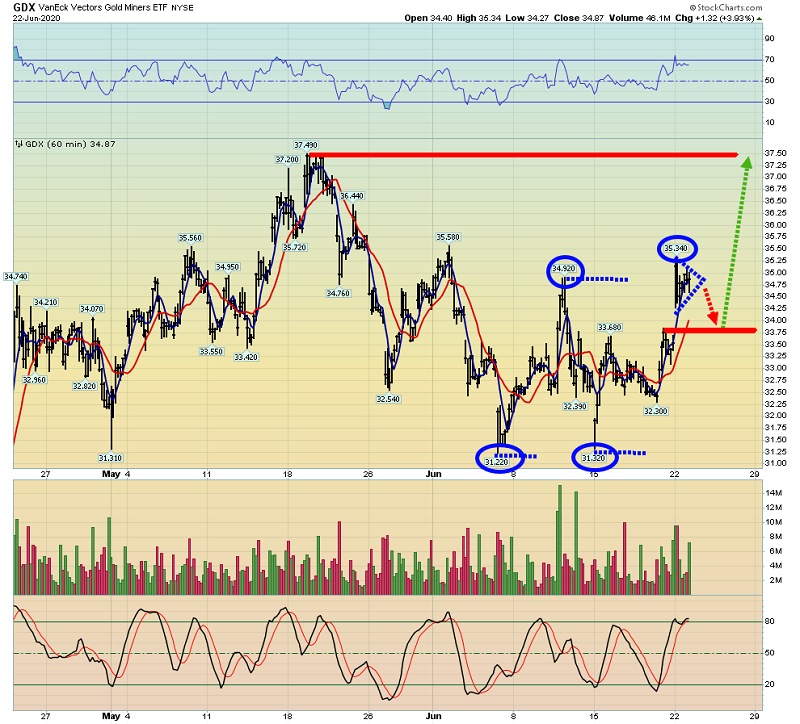

A closer look at the GDX chart. Yesterday, a small bull pennant formed and GDX rallied above the $34.92 high.A close above $35 today would be particularly impressive.

Once Newmont trades above $60 and Barrick above $26 (basis NYSE trading), I believe the gold stock consolidation/correction will have run its course.

From there, a rise to and above the 2020 highs would be the next exciting event… for most of the world’s gold and silver miners!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my “Golden Leaders Of The Pack” report. I highlight key intermediate and senior gold/silver stocks that are beginning fresh uptrends, with include razor-sharp buy and sell tactics for each stock!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: