Gold Stocks, What to Do Now?

Introduction

I'm sure by now most participants of the financial markets are familiar with a popular theory that we have now entered into the era of "things", from the era of "paper assets". The things we are referring to are commodity items such as those represented within the CRB index, like energy, precious metals, raw materials, meat and foodstuff. The purpose of this article is not to debate "why", simply because I am neither qualified, nor academic enough to get into such depths; but what interests me and concerns me is "when".

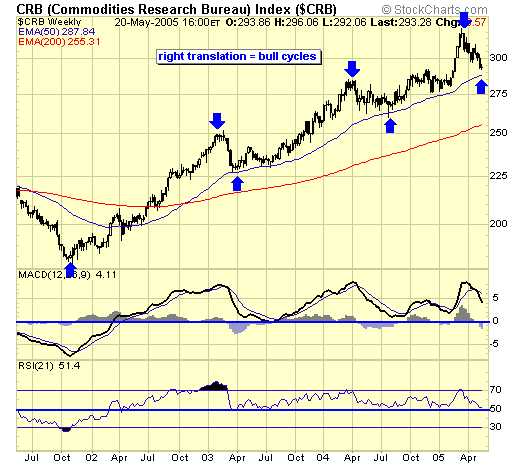

CRB index - this chart is a beaute. It shows clearly that it bottomed right after 9/11, and since has been trending up with three sharp pullbacks, one in 2003, one in 2004, and the current one. This type of sharp pullbacks are signatures of a bull market, technicians call them "right translations", because if you look carefully, each up arrow is a cycle bottom, and each down arrow is a cycle top, and a cycle begins at a bottom and ends at a top. So, those who are certain that the March high was the top of the bull market are only guessing, because there is no way to know until after the fact. And the most important thing in technical analysis is that : something isn't until it is. TA is not about predicting the outcome of the markets, although many indulge themselves thinking as such. TA is about finding opportunities in the markets so that we can enter and exit the markets with risk and reward in our favor. The two sectors I'm most interested in are energy and precious metals, and together, they comprise 35% of the CRB index, therefore, their charts should be very similar.

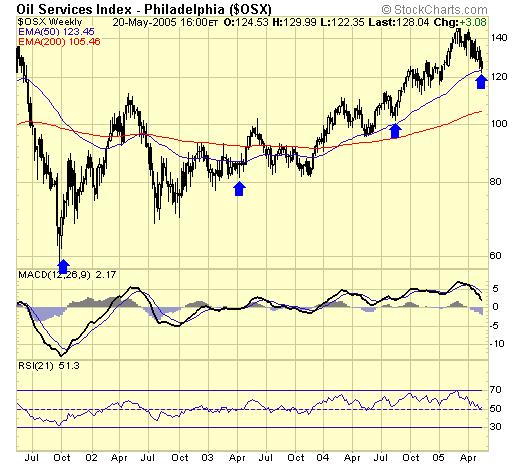

My interests are energy stocks and not oil and gas, therefore the OSX is what we are looking at. I left out the tops because I wanted to show the cycle bottoms from the CRB should also be excellent buy points for the energy sector.

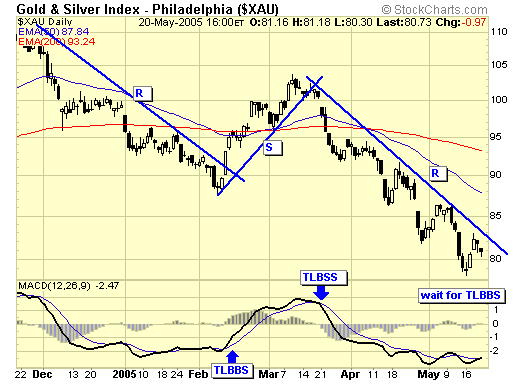

And for the metal stocks also.

Obviously, it is much too early to declare a cycle bottom today. What is required to position oneself in order to take advantage of this possible cycle bottom is…..

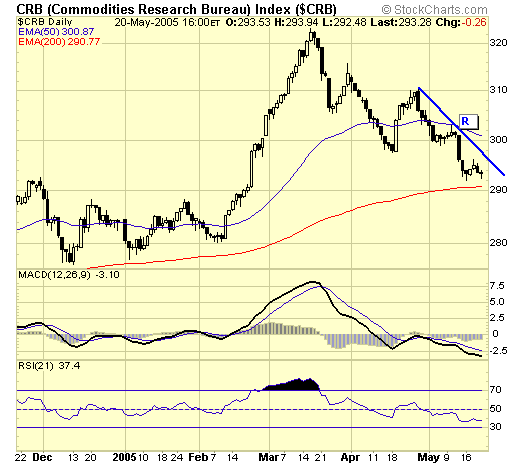

When we have a TLBBS (trendline break buy signal) on the CRB's daily chart, and we are close. When and if this happens…

A TLBBS should also be forthcoming on the OSX…..

and the metals index.

What about paper assets? If we are really in the era of "things", paper assets should be down, down, down…

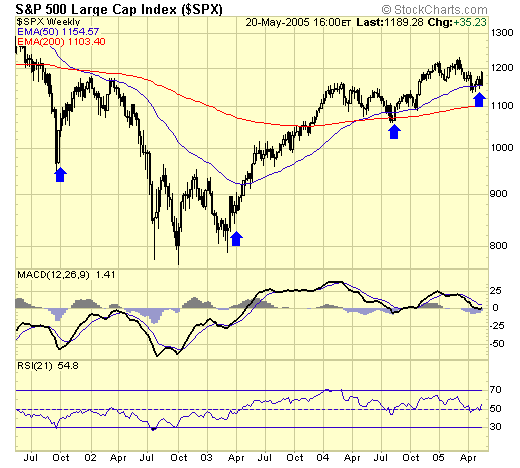

The SP500 index does not appear to be down at all, in fact those CRB cycle bottoms would be ideal buy spots for the $SPX and the broad market also, with the exception that the SPX actually bottomed a year after the CRB, but nevertheless, these were bottoms.

Tech sector has already given a buy signal, we are now 50% invested, with 50% going to energy and metals should they decide to join the party.

Summary

I cannot help but noticed how closely the three sectors of metals, energy and technology which I focus on relate to each other so well these past three years. In fact, I pointed out to my subscribers recently how all three sectors were racing each other to a bottom. What surprised me was the fact that technology won the race, with a very timely buy signal a few days ago while metals and energy are still trying to find a bottom. Those who insist that resource stocks are the only game in town are missing out, from what I can see, diversification is the way to go for the foreseeable future and timing, like they say, is everything.

Jack Chan at www.traderscorporation.com

21 May 2005