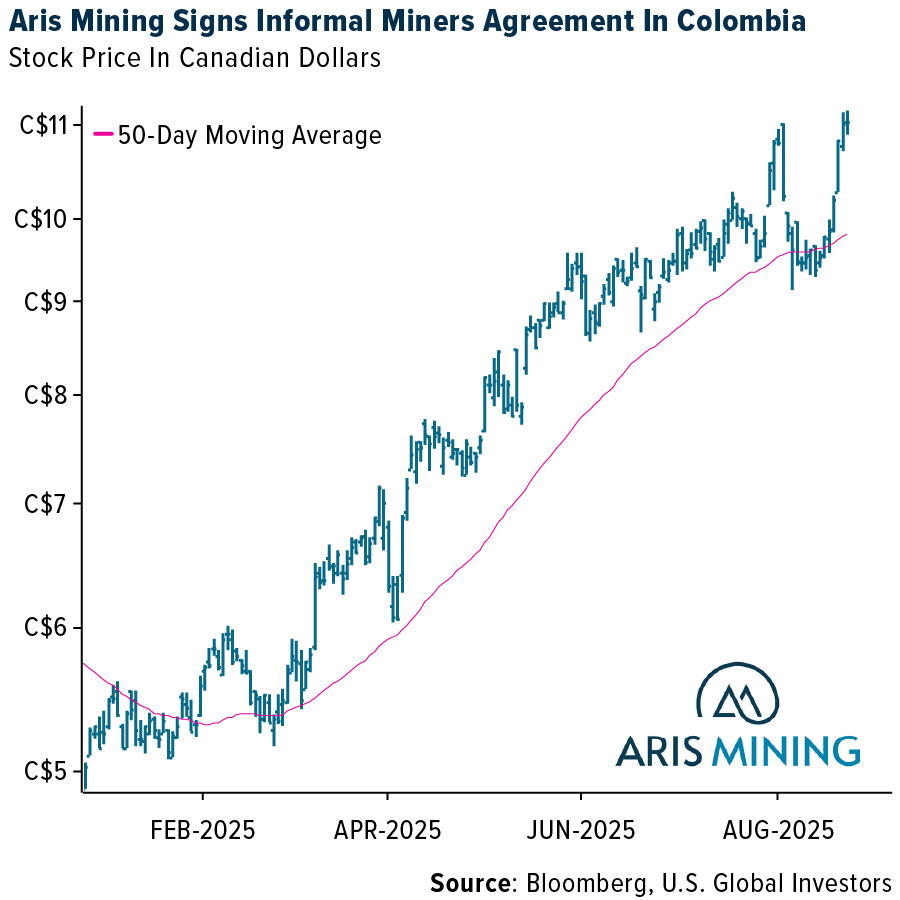

Gold SWOT: Aris Mining Signs Informal Miners Agreement In Colombia

Strengths

- The best-performing precious metal for the past week was silver, up 3.12%, and ending the month higher by 9.98%, making it the strongest performer among precious metals for the month. For the first time since 1996, foreign central banks now hold a larger share of their international reserves in gold than in U.S. Treasuries, a significant shift in the global financial landscape, as noted by Otavio (Tavi) Costa, a macro strategist at Crescat Capital, on X.

- According to JP Morgan, Ramelius’ FY25 EBITDA of $819 million beat consensus by 5%, driven by lower expenses. Profit after tax came in at $476 million, 4% above expectations.

- Equinox announced the start of ore processing at the Valentine mine and remains on track for first gold pour by late September, with nameplate capacity expected in Q2 2026, according to BMO.

Weaknesses

- Palladium was the worst-performing precious metal of the past week, down 0.89%, and also the worst for the month, falling 8.00%, a possible sign of weakening industrial demand. West African Resources Ltd. was halted after the Burkina Faso government moved to acquire a 35% stake in its newly built Kiaka gold mine. The government already holds a 15% free-carried interest, and the 2024 mining code allows such equity participation, according to Raymond James.

- Orezone Gold Corp., where the Burkina Faso government holds a 10% free-carried interest, saw its share price fall nearly 15% on speculation it could be next after West African’s announcement.

- Harmony Gold Mining Co. Ltd. dropped 14% in U.S. trading after full-year net income missed expectations. BMO’s Raj Jay noted lower production guidance, along with higher costs and capital spending. In a strong gold market, missing guidance is costly to shareholders.

Opportunities

Vietnam will end its state monopoly on gold imports and exports, aiming to close the gap between local and global prices. The move could also boost demand as the premium disappears.

- Newmont Corp., the world’s largest gold miner, is considering major cost-cutting measures—including job cuts—after its $15 billion acquisition of Newcrest. Costs have surged, with all-in sustaining costs hitting a record in 2025, according to Bloomberg.

- Aris Mining has partnered with 2,500 small-scale miners, who now produce 45% of output from its Segovia mine in Colombia. Instead of evicting them, Aris provides support and buys their gold—offering a more cooperative model than other miners in the region.

Threats

- Botswana President Duma Boko has declared a public health emergency and launched a $348 million response plan after a prolonged slump in diamond sales dried up funding for medical supplies. The military is now leading an emergency distribution effort following the collapse of the national medical supply chain, Boko said in a televised address Monday.

- Harmony Gold is guiding FY25 EPS to between R21.90 and R25 per share (+18% to +35% year-over-year), missing Bloomberg and Visible Alpha consensus estimates of R28.96 and R32.10, respectively, according to Morgan Stanley.

- Hochschild Mining shares fell as much as 20% after cutting 2025 production guidance at Mara Rosa by 60% to 35–45K ounces, down from the original 94–104K target, following plant issues and a six-week suspension.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of