Gold SWOT: Equinox Gold Corp. Announced The First Gold Pour At Its Valentine Gold Project

Strengths

- The best-performing precious metal for the week was silver, up 0.70%, with Friday’s gains nearly three times those of gold. Investors are starting to notice silver’s historic 3-to-1 beta relative to gold. Gold inched higher as traders weighed the Fed’s rate-cut outlook, with bullion hovering just below recent record highs at week’s end. While lower rates support the metal, a stronger dollar following Powell’s cautious remarks limited further gains.

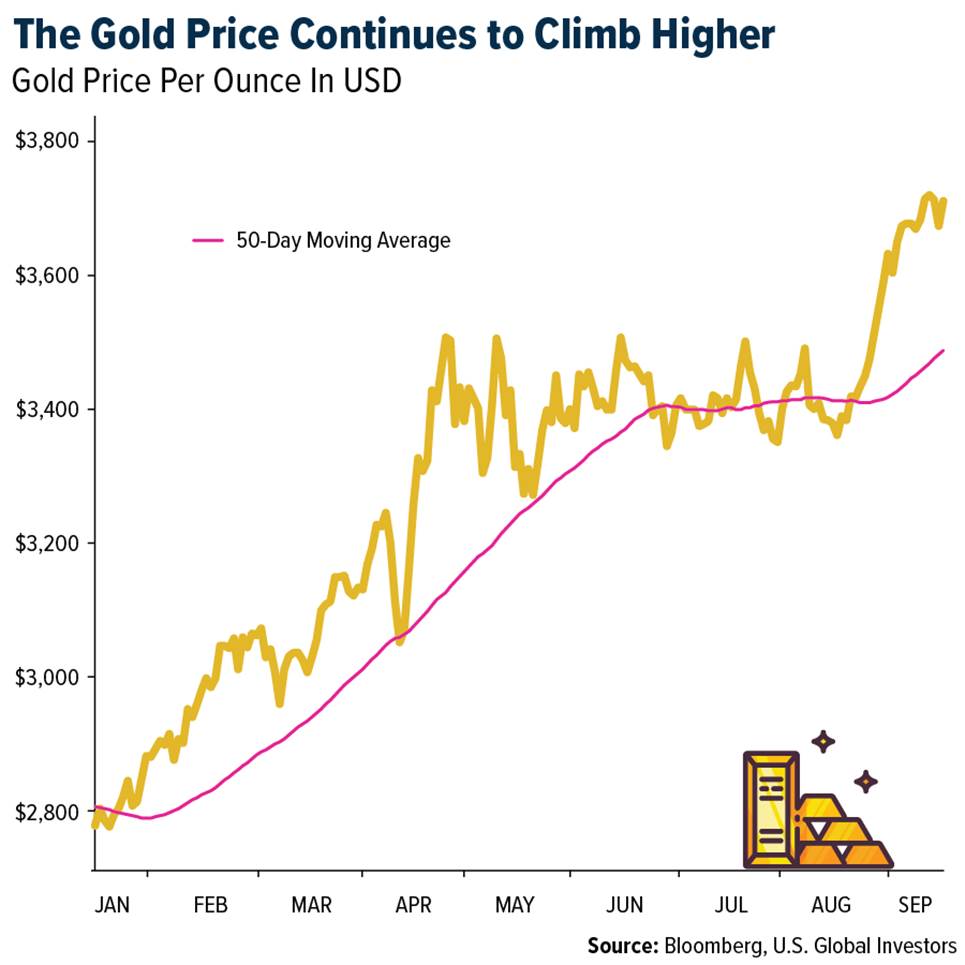

- According to a Bank of America analyst, gold broke out from a triangle consolidation and reached a new all-time high of $3,674 on September 8. Further declines in yields and/or the dollar could push prices toward upside targets of $3,735, $3,790, $3,935, and $4,000. In recent years, price leadership has gradually shifted from the futures market to physically backed ETFs, which have seen steady inflows lately.

- Zijin Gold Int. Co. Ltd. is raising HK$25 billion ($3.2 billion USD) in a Hong Kong IPO, the largest globally since May, with trading set to begin Sept. 29. Strong demand saw the share sales quickly covered, backed by cornerstone investors including GIC, BlackRock, and Fidelity.

Weaknesses

The worst-performing precious metal for the week was palladium, down 6.13%. The USITC has launched the final phase of its investigation into Russian palladium imports, ruling that U.S. producers were materially harmed by subsidized and unfairly priced shipments. The case, initiated by Stillwater Mining and the United Steelworkers Union, could lead to antidumping and countervailing duties if confirmed by the Commerce Department.

- According to Stifel, B2Gold’s 2025 production guidance has been lowered to 80,000–110,000 ounces (from 120,000–150,000 ounces) due to a crushing capacity shortfall at the processing plant, along with challenges commissioning a new mine. This represents a 30% reduction from the mine’s original guidance.

- Bank of America, speaking at the Mining Forum Americas, indicates producers are showing modest cost discipline slippage as cut-off grades are lowered to increase metal production. They also note that intense competition for royalty and streaming deals is driving down returns, making more transactions dependent on higher gold prices.

Opportunities

- Equinox Gold Corp. announced the first gold pour at its Valentine Gold Project, located in Newfoundland and Labrador, Canada. Management also noted that commissioning is progressing well, with throughput averaging 47% of nameplate capacity for the first 15 days of operation, positioning the project to ramp up to its nameplate capacity of 2.5 million tons per year, according to Canaccord.

- According to Raymond James, Barrick Mining Corp. has announced an updated Preliminary Economic Assessment (PEA) on Fourmile. The PEA indicated Fourmile could have average annual gold production of 600,000 to 750,000 ounces per year at mining rates of 1.5 to 1.8 million tons of ore per year, with over 25 years of mine life. The PEA estimates project capital at $1.5 to $1.7 billion, cost of sales at $850 to $900 per ounce, and all-in sustaining costs (AISC) of $650 to $750 per ounce.

- RBC is encouraged by Artemis Gold Inc.’s announcement of a planned 33% increase in Phase 1 processing capacity at Blackwater to 8 million tons per year by Q4 2026, along with long-lead orders placed ahead of the Phase 2 expansion. In their view, this outlines a near-term accretive catalyst through a low-capital optimization, providing an incremental benefit to project economics ahead of the now further de-risked Phase 2 expansion decision.

Threats

- Canaccord believes consensus already expected Gold Road Resources Ltd. to miss guidance for calendar year 2025. They still see some risk to production in the second half of 2025, given the implied grades required to hit the bottom end of guidance.

- With the recent rally in gold, gold equities have experienced significant buying pressure, pushing up valuations. As a group, the intermediate gold producers in Scotia’s precious metals coverage universe are now trading at a spot price-to-net asset value (P/NAV) of 0.82x, above the long-term average of 0.81x for the first time since February 2021.

- Global gold ETF inflows slowed from recent weeks but remained strong at $2.01 billion. Notably, China returned to net inflows for the first time in six weeks. Silver ETFs saw net outflows of 7.6 million ounces last week, led by Europe, according to BMO.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of