Gold SWOT: For The First Time Since October, Copper Slumped Below $9,000 Per Ton

Strengths

- The best performing precious metal for the week was platinum, but still down 2.92% on little metal-specific news. The Perth Mint sold 80,941 troy ounces of gold in the month of April, and 2.1 million ounces of silver in minted product, according to a website statement. The Mint’s depository saw marginal increases in both gold and silver holdings.

- The University of Michigan’s index on U.S. consumer sentiment dropped to 59.1, the lowest reading since 2011, marking a fresh decade low. Inflation was cited as the headline issue which is pushing buying plans for durables to fall to record low on high prices. The recent drop in gold comes as the U.S. dollar rises to 20-year highs, making the metal more expensive for international buyers. The opposite is happing to consumers in the U.S. now. Gold is getting cheaper and goods and services more expensive. With the dollar at a 20-year high, U.S. exports are likely to drop, perhaps marking a reversal.

- In the fourth quarter of 2021, Ghana’s GDP growth came in at 7% year-over-year, reports Renaissance Capital. The most notable thing about the growth, however, is that the extractive industry (gold mining) grew for the first time in eight quarters, albeit slightly, providing a glimmer of recovery for the sector throughout the region.

Weaknesses

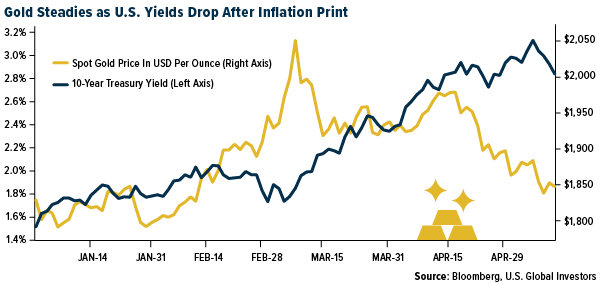

- The worst performing precious metal for the week was silver, down 5.84%. Gold slipped to the lowest in three months as the dollar strengthened and interest rates rose after another U.S. inflation report reinforced expectations that the Federal Reserve will maintain its path of aggressive monetary tightening. Prices paid to U.S. producers increased 11% from April of last year gold has dropped 11% from a March peak as faster cost pressures fueled expectations that the Federal Reserve will aggressively tighten policy. A rally in the dollar to the highest in two years is also weighing on the precious metal. “Risk aversion keeps on driving the strong dollar trade, which has been weighing on gold prices,” said Ed Moya, senior market analyst at Oanda.

- First Majestic announced this week that it will decrease its regular quarterly cash dividend to $0.60 per share from the previous dividend of $0.79 cents per share.

- Investors in the world’s top gold exchange-traded funds (ETFs) are rapidly pulling out their cash, reports Bloomberg, as markets are roiled by the Federal Reserve’s hawkish return. Over the last three weeks, in fact, the SPDR Gold Trust has seen outflows equivalent to more than 38 tons of bullion – making it the biggest drop in over a year.

Opportunities

- Anglo American Plc has searched for nearly four years for partners to support its idea of replacing open-pit mining’s monster diesel trucks with climate-friendly, green hydrogen-fueled vehicles instead, writes Bloomberg. Finally, after investing $70 million on its own to back the concept, the company announced last week a new 220-ton vehicle capable of carrying about 290 tons of ore without producing global warming emissions in the process. Replacing the mine haul trucks with hydrogen-fueled ones would slash emissions at Anglo’s open-pit mines by 80%.

- Barrick Gold Corp. is searching for new copper projects in both Zambia and the Democratic Republic of Congo. The company already owns a copper mine in Zambia and in April laid out plans for a $7 billion copper-gold project in Pakistan, writes Bloomberg. Copper is an essential part of the world’s efforts to decarbonize, and new supply is strained globally, so Barrick continues to look for opportunities in this space. Gold Fields Ltd.’s chief executive officer said the South African producer is looking to expand in South America, despite investor concerns over populist policies and risks of higher mining taxes there.

- Stablecoins sound reassuring in concept and should behave according to expectation, with perhaps one caveat, and that is when interest rates are at or near zero. It's likely none of the crypto enthusiasts of today were trading fixed income back in 1994 when Orange County went belly-up. Investors were laminating 3.00% yields as uncompetitive, so they reached for other fixed income derivative products with slightly higher yields. The Fed raised short rates 300 basis points in the first six months of 1994, essentially flatting the yield curve. Every investor who owned derivative products and relied on that interest rate spread lost their income stream. When today’s yield investors recognize they can earn a higher risk-adjusted yield through short-dated U.S. Treasury bills and notes, parking money in so-called “stablecoins” may not be as safe as government debt or owning nobody’s debt, like gold.

Threats

- A House Natural Resources panel held a meeting on Thursday on bicameral legislation that would create a 12.5% royalty on companies for new mining operations and an 8% royalty on existing operations, writes Bloomberg, exempting miners that earn less that $50,000 in mining income. House Natural Resources Chair Raul Grijalva said he knows the mining industry will push hard against the bill (known as the Clean Energy Minerals Reform Act), and against any efforts to impose fees on extraction. He is unsure if the legislation could attract Republican support. Offering the U.S. mining industry the likely highest royalty fee structure in the world to incentive mining is unrealistic and likely a non-starter.

- Argonaut Gold plummeted early in the week after disclosing that expected capital cost of C$800 million are anticipated to be required to bring its Magino project in Ontario, Canada into production. This was a 15% increase from the previous estimate. This leave the company in an uncomfortable position as the assets have been considered to have been at least shopped to other companies. Toronto-based Iamgold is also running low on cash as S&P Global Ratings estimate it will incur nearly $1.3 billion in free cash flow deficits this year and next to bring its Cote Gold project to commercial production. S&P Global noted in its report that Iamgold will likely exhaust its resources and require sizable external funding. Pure Gold is another company that is trying to reset with new management but has a debt burden to deal with.

- What are equity investors in the gold space going to do with all these struggling assets? Feed them to the banks that loaned them the money. Talk to us after that.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of