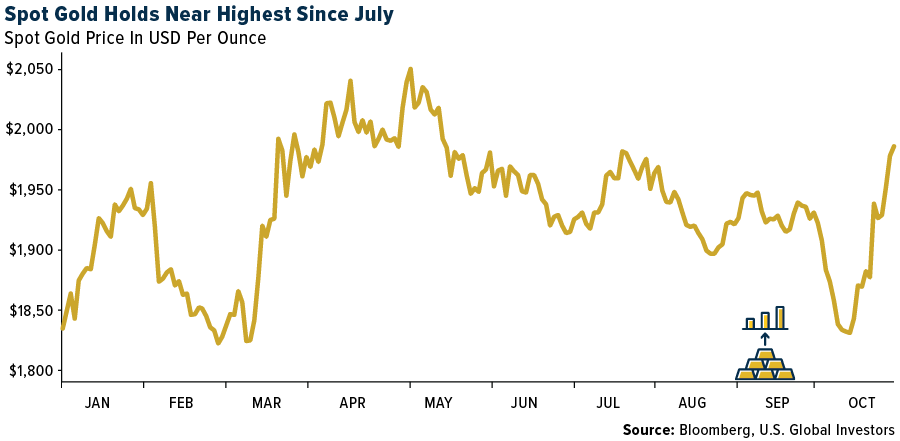

GOLD SWOT: Gold Hit a 13- Week High Last Week on the Back of Safe-Haven Demand

Strength

- The best performing precious metal for the week was silver, rising 2.75%. Gold hit a 13-week high due to increasing geopolitical tensions and war between Israel and Palestine. Gold has historically functioned as a safe-haven asset and conflict has produced tremendous demand for the yellow metal. Unfortunately, if these sad events continue, the price of gold will likely continue to rise. However, gold equities are trailing the price change in bullion over the past month, perhaps seeing this as a short-term jump in gold, but also subject to a potential drop.

- The Indonesian mining company, PT Amman Mineral Internasional, which owns the country's second-largest gold and copper mine, has experienced a remarkable 269% rise in its stock price since its record-breaking IPO in July. This surge in value has created six new billionaires, including the company's chairman, Agus Projosasmito, whose stake is worth $2.7 billion. Notably, these newly minted billionaires share connections with Anthoni Salim, the head of the prominent Salim Group conglomerate, who also benefited from the company's success, increasing his fortune by over $4 billion to $9.7 billion.

- Newmont has announced the resolution of the strike at the Peñasquito Mine in Mexico, as it reached a definitive agreement with the National Union of Mine, Metal, and Allied Workers of the Mexican Republic, which was subsequently approved by the Mexican Labor Court on October 13. Newmont's focus is now on safely reinstating the workforce and achieving stable production levels at the Zacatecas-based Tier 1 operation, with a status update planned during the third quarter earnings call on October 26.

Weakness

- The worst performing precious metal for the week was palladium, dropping 3.55%, as hedge funds raised their net-short position to a record high. Newcrest Mining Ltd. reported a decrease in gold production for the first quarter, with 454,312 ounces produced, down 18% from the previous quarter. Additionally, copper production saw a 12% decrease with 30,624 tons produced, while all-in sustaining costs per ounce increased by 18%, and the AISC margin per ounce dropped by 34% in the same period. Newcrest also reaffirmed its 2024-year forecast, maintaining expectations for gold production between 2.00 million to 2.30 million ounces and copper production between 120,000 to 140,000 tons.

- Centamin PLC reported that profit and revenue decreased in its latest quarter as gold production fell by over 20%. However, the company reiterated full-year guidance, but is more likely to come in on the low end.

- Both Gold Fields Ltd. and Harmony Gold Mining Co. Ltd. were cut to underweight at Morgan Stanley earlier in the week after posting 25% and 26% price gains, respectively, in the prior week with the surge in gold.

Opportunity

- Delegates at the London Bullion Market’s Association annual conference were surveyed for their precious metals forecast of prices one-year out. For gold, the participants see prices at $1,990.30 an ounce next year, which is about 3% higher than current prices. The silver price is seen at $26.80, almost 14% higher. Palladium was forecast to be 10% higher but platinum was the standout precious metal with an expected 28% lift in price.

- Gold has reached a 13-week high, driven by robust demand from central banks and consumers in India and China, as well as a notable shift away from its traditional inverse correlation with real yields. While yields have begun to rise in various markets, gold continues to attract investors as a safe-haven asset, despite strong economic data in the United States and potential changes in the relationship between real yields and the precious metal. This deviation from historical correlations may sustain gold's ongoing uptrend.

- Orla Mining boosted its forecast gold production by about 10%, from 110,000 ounces to 120,000 ounces for the year. Third quarter production was robust at 32,425 ounces. On Tuesday, Richard Gray raised his recommendation on the mining company to buy from market perform. Orla has seen a significant pullback in its share price post the September gold mining shows in Colorado on speculation that a potential acquisition is being contemplated.

Threats

- The iShares Gold Trust's Relative Strength Index (RSI) has risen above 70, indicating potential overbought conditions, further supported by the stock closing above its upper Bollinger band. Over the past year, when the ETF crossed this threshold, it typically experienced an average 1.7% decline in the following 20 days, despite currently maintaining positions above its 200-day and 50-day moving averages.

- The dominant rise of silver jewelry, once considered out of fashion since the late 2000s, is now emerging as a formidable challenge to gold. Its resurgence since early 2023 threatens gold's position as the precious metal of choice, with sales of silver increasing significantly, both in the mid-range and luxury sectors, as well as the second-hand market. As silver gains momentum and recognition, its sleek and modern allure could potentially lead to decreased demand for gold, posing a looming threat to gold prices.

- Petra Diamonds Ltd. reported full results of Tender 2 of fiscal year 2024 with disappointing results. Like-for-like diamond prices were down in the 16% -18% range, reflecting market weakness, as reported by Bloomberg. The sale was brought forward due to the rough diamond import moratorium in effect between October 15 to December 15, 2023, to better manage the balance between an oversupplied rough diamond market and consumer demand.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of