Gold SWOT: The Gold-To-Silver Ratio Is Flashing A Bullish Signal For Silver

Strengths

- The best performing precious metal for the week was platinum, up 11.24%, with palladium coming in a strong second at 9.85%. Traders are increasingly bidding up silver, platinum and palladium as they look to bridge the widening gap between gold's record-setting outperformance and the lag in other precious metals. For platinum in particular, this rotation represents a key strength, as its extreme discount to gold, combined with industrial demand tailwinds, makes it a compelling catch-up trade in a broader precious metals bull cycle.

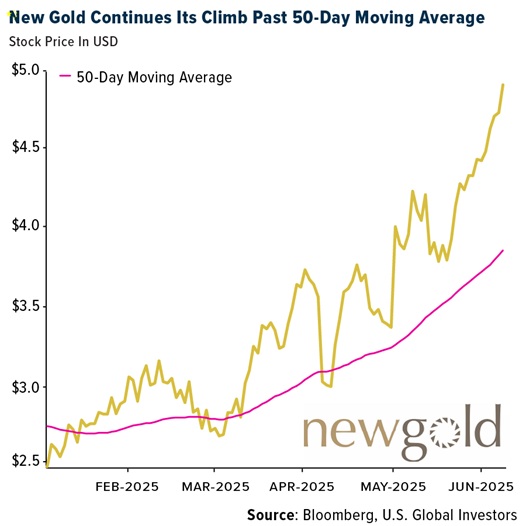

New Gold hit a nine-year high, underscoring growing investor confidence driven by operational performance, sustainability leadership and consistent production across its Canadian assets. The company’s improved safety metrics, strong local hiring and emissions reductions signal not just financial strength but also long-term ESG value creation.

- Central banks have emerged as a driving force behind the record-breaking bull market for gold, and while the true scale of their buying is shrouded in mystery, nobody expects them to stop. Globally, they are accumulating roughly 80 metric tons of gold a month, worth about $8.5 billion at current prices, analysts at Goldman Sachs estimate.

Weaknesses

- The worst performing precious metal for the week was gold, still up 0.62%. Raging Canadian wildfires have forced evacuations from several mining operations as heat and wind push flames across the resource-rich western provinces. Fires prompted Hudbay Minerals to evacuate its gold and copper mine near northern Manitoba’s city of Flin Flon, the company said in a Wednesday statement, threatening critical gold supply chains.

- Metals refiner Johnson Matthey sees muted demand for platinum jewelry among Chinese consumers, despite a recent surge in imports by manufacturers that is straining global supplies of the metal. The world’s second-largest refiner of platinum group metals said that strong physical demand from China has exacerbated market tightness and pushed prices to two-year highs, as the jewelry industry aggressively stockpiles the cheaper alternative to gold, according to Bloomberg.

- West African Resources has announced that it will adopt the Government of Burkina Faso's changes to the August 2024 Mining Code, which increase the government's equity interest from 10% to 15%. This will be applied to West African’s operating projects: Sanbrado (including Toega) and Kiaka, according to Canaccord.

Opportunities

- As of the end of 1Q25, total gold holdings of $8.8 trillion are still only around 4% of global equity, fixed income and alternatives. A potential shift of just 0.5% of foreign U.S. assets to gold could yield 18% annual returns, taking gold prices toward $6,000 by early 2029, according to JPMorgan

- Artemis hosted a site opening/mine tour, highlighting a well-functioning mine since declaring commercial production on May 2, after the first gold was achieved in January. Management commentary in the May 2 press release highlighted that the milling circuit had operated at 93% capacity over 30 days and 102% over 14 days. BMO’s discussion at the site reinforced that the processing plant overall continues to operate consistently above design capacity.

- The gold-to-silver ratio, which peaked above 105 in April, is now contracting—a historically bullish signal for silver, as past reversals from extreme levels have preceded sharp silver outperformance. With the long-term average closer to 60, silver's current breakout above $35 suggests it may be entering a catch-up rally toward gold, potentially targeting the $40–$50 range if the ratio continues to normalize, as it did during the 2008-2009 precious metals cycle. This serves as an opportunity for silver miners that move with operational leverage to silver.

Threats

- Platinum’s recent rally appears increasingly speculative, as macro headwinds from China, where EVs now outsell gas-powered cars and jewelry demand remains weak, undermine the sustainability of recent gains. With end-user appetite soft and inventories building despite tight supply, the metal faces heightened risk of sharp profit-taking as quickly as speculators piled in.

- The trajectory of gold ETF inflows will be important, with some slowdown recently with competition from other asset classes, particularly equities, while Morgan Stanley needs to see if the recent jewelry demand weakness will reverse as consumers adjust to higher prices.

- Scotia believes that the prospect of flat production, fewer multi-million-ounce discoveries and the need for diversification present a compelling case for increased M&A activity, especially in Tier-1 jurisdictions (Canada, the U.S. and Australia). For context, the senior producers (Newmont, Barrick, Agnico Eagle and Kinross) produce an average of 15- 16 Moz of gold per year, implying a need to replace these gold ounces every year.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of