Gold SWOT: Gold Surged To The Highest Since March 2022 Following Weaker Job Opening Data

Strengths

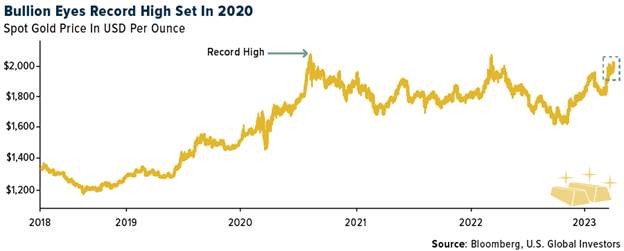

- The best performing precious metal for the holiday-shortened week was silver, up 3.64% and marking four consecutive weekly gains. Gold surged to the highest since March 2022 after weaker job opening data fueled expectations that the Federal Reserve may be nearing the end of its monetary tightening. Vacancies at U.S. employers dropped in February to the lowest since May 2021, suggesting a cooling in labor demand, but still indicative of a job market that’s too tight for the Fed.

- Canaccord expects inflation to be less of a headwind for producers in 2023, with expectations for mining all-in sustaining costs (AISC) to be relatively flat in 2023. Year-to-date, the royalties are up 11% as a group, ahead of the senior gold producers and gold bullion, but trailing the intermediate producers and junior producers. Royalty performance has been led by Osisko and Wheaton Precious Metals.

- Calibre Mining reported first-quarter gold production of 65,750 ounces (5% above consensus), comprising Nicaragua gold production of 54,997 ounces and Nevada gold production of 10,753 ounces. The first quarter includes the first ore production from the Pavon Central open pit as well, which the company began mining in January 2023.

Weaknesses

- The worst performing precious metal for the holiday-shortened week was palladium, down just 0.82%. Gold Fields corporate reserves largely reflect depletion and no meaningful additions, while resources declined more meaningfully. Overall, these changes have a limited impact to valuation, but reinforce long-term risks of depletion. Reserves as of year-end 2022, total 46.1 million ounces, a decrease of 2.3 million ounces year-over-year.

- Metalla Streaming reported a headline earnings per share (EPS) loss of $0.11 that included $2.0 million in impairment charges on the Joaquin and COSE royalties. Additionally, during the fourth quarter of 2022, the company determined depletion had not been appropriate at its Silverback investment and recorded a catch-up charge. This was well below consensus for a loss of $0.01.

- According to Bank of America, the commodities team is bullish gold, calling it to $2,200 per ounce by the fourth quarter of 2023. However, the gold price has reached substantial technical resistance ($2,000 - $2,078 as key resistance), and the bank sees potential seasonal weakness before the second half of the year.

Opportunities

- Bloomberg reports that Newcrest Mining and partner Harmony Gold have signed a Framework Memorandum of Understanding with Papua New Guinea (PNG) for the Wafi-Golpu project. This is a significant step forward in the process to ultimately the signing of a Mining Development Contract for Wafi-Golpu. Just at the end of March, Barrick Gold and its partners agreed to resume operations at the Porgera gold mine. K92 Mining has been operating in PNG for the past seven years and has enjoyed good relations with the government, and evidently the government desires to have the gold miners return to their mineral-rich country.

- The World Gold Council (WGC) reiterated its view that central banks will continue to build their official gold holdings. This is based on the WGC's survey of central banks, but also the view that emerging and developing country central banks are inclined to purchase gold because of the metal's appeal versus other asset classes - low or negative yielding sovereign debt, rising sanctions risks and a threat of currency wars. Gold is an important reserve asset that isn't exposed to downside from geopolitical risks, cannot be de-based and lacks default risk.

- According to Scotia, in 2023, companies reported guidance for production 2% higher than 2022 production, with cost guidance 2-6% higher than 2022 reported figures. Although costs are expected to remain high, producers are seeing some easing of inflation (particularly fuel prices). Scotia believes the higher gold price environment, coupled with some relief in cost pressures, will lead to margin improvement.

Threats

- According to Canaccord, until Gatos is able to refile its backed financials and hold its annual shareholder meeting, it may be in violation of the extension granted by the TSX. Notably, the TSX has appeared to be more lenient than the NYSE throughout this process and has often followed the lead of the U.S. regulators. Therefore, Canaccord expects that it is possible the TSX will extend its March 31, 2023, deadline to align with the NYSE before halting the stock or commencing de-listing proceedings.

- While the proposed reform addresses some important points currently missing in Mexico’s mining law (e.g. the need of a social impact study and the approval of a mine restoration and mine closure plan), there are still two key concerns: 1) a considerably lower concession period (15 years vs. 50 years today), which may drastically change the economic viability in a capital intensive industry, and 2) lack of clarity on how the new rules proposed in the bill may be implemented, effectively reducing legal certainty for miners. Without new investments, mining activities could be negatively impacted in the long term. Silvercrest, Orla Mining, First Majestic and Torex Gold Resources have large Mexico exposure, and they will likely look to other countries to grow their operations in other countries.

- According to Bank of America, Kinross Gold has appreciated 23% year-to-date on the gold price rally, outperforming the S&P/TSX Gold Index by 16% and has reached the bank’s price objective. The group also thinks first quarter 2023 results could be operationally weak owing to the tie-in at Tasiast (a key mine) and sharply higher cost at the U.S. mines.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of