Gold SWOT: Newmont Flexes Its Gold Muscle

Strengths

- The best-performing precious metal of the past week was silver, yet down slightly 0.30%. Bloomberg sees further upside, driven by rising industrial demand, especially from photovoltaics, and the potential for a rerating against gold as fundamentals improve. With silver still trading at a steep discount to gold and technical indicators pointing to $35 as a new support level, analysts view a move toward and above $40 as increasingly likely.

- According to Raymond James, Osisko Development has entered into a credit agreement with funds advised by Appian for a senior secured project loan facility totaling $450 million. The loan will support the development and construction of Osisko’s fully permitted, 100%-owned Cariboo Gold Project in British Columbia, Canada.

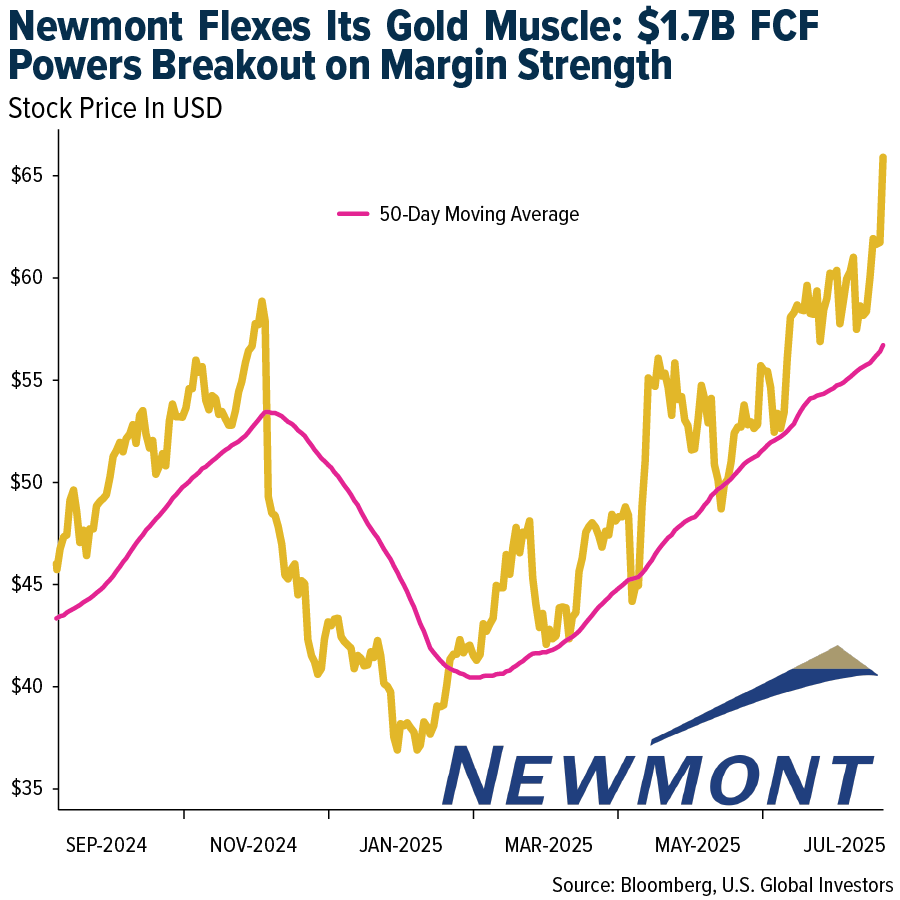

- Scotia reports that Newmont posted earnings per share (EPS) of $1.43, beating the estimate of $1.23. The beat was driven by higher revenue (due to better prices and sales), lower costs, and favorable below-the-line items such as exploration and G&A. Improved production (up 9%) and lower costs led to margin expansion. Newmont repurchased $1.01 billion in shares during the second quarter—or $1.36 billion year-to-date—with another $145 million repurchased in July. The company also announced a new $3.0 billion share repurchase program, bringing the total to $6 billion.

Weaknesses

- The worst performing precious metal for the past week was palladium, down 3.15%. Palladium prices remained under pressure in the second quarter as Norilsk Nickel, the world’s largest producer, reported an 11% quarter-over-quarter drop in output, compounding a 5% year-over-year decline—reflecting both operational softness and broader demand headwinds. Despite these weak fundamentals, sentiment is showing signs of stabilizing as hedge funds trimmed net bearish positions to a nine-month low, while long-only positions surged to a five-year high.

- Westgold’s fourth-quarter production and FY25 guidance slightly missed, according to RBC. However, quarterly growth and strong cash flow signal upside potential. The company produced 88,000 ounces in Q4, totaling 326,000 ounces for FY25.

- Orla Mining reported a pit wall failure at its Camino Rojo mine in Mexico, caused by heavy rain. The incident occurred on the north wall, an area planned for future layback and processing. Pit monitoring systems detected the issue early; no injuries, equipment damage, or environmental harm occurred, but mining has been temporarily suspended, according to Scotia.

Opportunities

- Intermediate gold equities are trading at 0.98x P/NAV—an 18.3% discount to senior golds. Mid-tier gold equities trade at 0.84x P/NAV, a 14.3% discount to intermediates and 30.0% to seniors. Stifel notes the market significantly discounts gold equities’ leverage to gold prices and underappreciated discovery and exploration optionality.

- Sibanye has agreed to acquire U.S. metals recycler Metallix Refining for $82 million in cash, with the deal expected to close in Q3 2025 pending regulatory approval.

- Equinox Gold announced CEO Greg Smith’s departure. Darren Hall, formerly President and COO, is the new CEO, and David Schummer is the new COO. Darren, with strong operational experience, plans to focus on disciplined execution as Greenstone and Valentine advance toward production, according to Scotia.

Threats

- Fresnillo’s attributable silver production (including Silverstream) was 12.5 million ounces in Q2/25, up 1% quarter-over-quarter but down 15% year-over-year, falling 6% short of Scotia’s 13.3 million ounce forecast. Management reiterated 2025 silver production guidance of 49–56 million ounces and maintained 2026 and 2027 guidance.

- Franco Nevada announced the acquisition of a 1% royalty on the Arthur Gold Project in Nevada (formerly the Expanded Silicon Project), operated by AngloGold, for up to $275 million. RBC views the deal as requiring high gold price assumptions and optimistic development to yield reasonable returns, but notes its overall materiality to the company is low.

- Aya reported second quarter silver production of 1.04 million ounces at its Zgounder Mine, slightly below Scotia’s 1.09 million ounce estimate, due to lower mill grades partially offset by better throughput and recoveries.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of