Gold SWOT: UBS expects gold to reach new heights in 2024 and 2025

Strengths

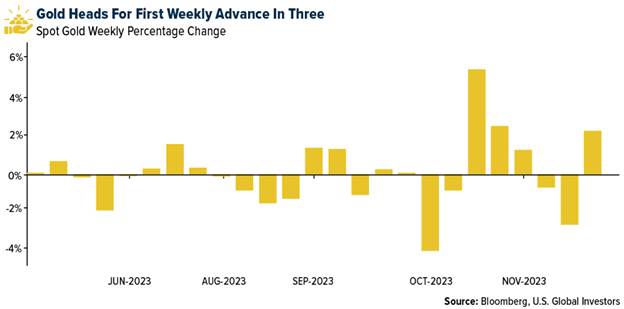

- The best performing precious metal for the week was palladium, up 8.50%, likely on the prospects of interest rate cuts that could spur industrial growth and stronger auto demand. Gold jewelers made brisk sales in India on the Diwali weekend with consumers' interest riding on a recent drop in prices. Jewelers feared hesitancy among buyers during the festival season after bullion prices jumped due to the Israel-Hamas War in early October. This week, gold headed for its first weekly gain in three, as reported by Bloomberg.

- According to Canaccord, B2Gold reported a better-than-expected quarter with 4% higher production than their forecast and 15% more ounces sold. Combined with cash costs that were 2% higher, EBITDA of $259 million was 19% ahead of their forecast of $217 million.

- Argonaut Gold reported adjusted basic earnings per share for the third quarter that beat the average analyst estimate. Adjusted basic earnings per share (EPS) was $0.01 versus a $0.47 loss per share (Bloomberg Consensus) Revenue of $104.8 million, +39% year-over-year, versus the estimate $107 million. Gold production was 53,911 equivalent ounces, a +17% increase from last year.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 2.35%. According to BMO, Lucara Diamond Q3/23 production was 98,000 carats, lower than the consensus of 107,000 carats, driven by lower processed head grades. Given the weaker diamond market environment and the uncertainty around the timing of sales of the >10 karat diamonds, revenue expectations have been lowered to $160-190 million ($200-230 million previously) on diamond sales of 365,000-385,000 carats.

- According to Stifel, Orla Mining released Q3 financial results after pre-reporting strong gold production of 32,400 ounces and increasing its FY23 production guidance. Adjusted EPS and cash flow per share (CFPS) came in at $0.02/$0.06, lower than their estimated $0.05/$0.07, driven by higher operating costs, tax expense and exploration spending.

- According to Morgan Stanley, the volume of India's rough diamond imports in October increased by 29% YoY (10% MoM) and their value appreciated 9% YoY (but down 1% MoM). This implies that rough prices may have declined by 15% YoY and 10% MoM. The value of polished stone exports from India—a proxy for demand—was down 33% YoY (25% MoM), while volumes decreased by 33% YoY (20% MoM), implying aggregate prices remained flat YoY, but down by 5% MoM.

Opportunities

- Calibre has agreed to purchase on a non-brokered private placement basis 66,666,667 common shares of Marathon at C$0.60 per share for gross proceeds of C$40million. Marathon shareholders will receive 0.6164 of a Calibre common share for each Marathon common share held, implying a value of C$0.84 per Marathon common share.

- UBS expects gold to reach new heights in 2024 and 2025 as the cycle matures and softer data ahead shifts the narrative to recession risks, falling real rates and Federal Reserve policy easing with the likely re-emergence of strategic positioning from investors, underpinned by a continuation of strong official sector purchases and steady fundamental demand. If they run their gold models at spot and assess what is priced in based on EV/EBITDA, free cash flow (FCF) yield and net present value (NPV), they calculate the SA gold equities are pricing in $1,800 per ounce, implying 20% plus upside risk if their 2025E average gold price forecast of $2,200 is achieved.

- Wheaton Precious Metals announced the acquisition of two existing streams from Orion Mine Finance for $450 million. These include gold and palladium/platinum streams on the Platreef project (South Africa, owned by Ivanhoe Mines) and a gold/silver stream on the Kudz Ze Kayah project (Yukon, owned by BMC Minerals). Concurrently, Wheaton announced an agreement to create a new stream on the Curraghinalt Project (Ireland, owned by Dalradian Gold) for $75 million ($20 million upfront).

Threats

- De Beers plans to stockpile unsold diamonds after the world's biggest producer responded to plunging prices by allowing its buyers to refuse to purchase all the stones they are contracted to buy. "We build up stocks of those because we are confident that over time the diamond price will increase and we will be able to sell that supply into the growing demand that we believe will come," Chief Executive Officer Al Cook said at a briefing in Gaborone.

- Precious metals are being stolen from catalytic converters. The new and the old metals would later be blended under intense heat, then shipped to a refinery. Recycling catalytic converters costs less than mining ore. But it carries a risk, as Stillwater discovered after paying more than $170 million for used ones, many of them stolen, according to an indictment handed up this spring on Long Island that implicated the mine.

- Russian gold is still finding its way into international markets despite being blocked from sales in the United Kingdom. Russia switched to Dubia and sold 96.4 tons of gold through the United Arab Emirates (UAE) in 2022, making it the country's largest supplier as reported by Bloomberg. Last week, the U.K. issued sanctions on counter parties in the UAE that delt with Russian gold trading, seeing those threats coming, in April 2023, Russian shipments of gold to Hong Kong have picked up dramatically wit 68 tons of imports this year. China could easily be the counterparty to these gold trading flows.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of