Gold: Technical Setup Turns Bullish With Jobs Miss and CPI Ahead

Tuesday is often quite a soft day for gold. There are numerous theories about why it happens, but the more important news is if there is softness today, it could mark the final low before a powerful surge to $3800 begins.

For some key insight into this golden matter:

This action on this daily chart is technically superb.

A (14,7,7 series) Stochastics buy signal is coming into play and enough time has passed during the formation of the rectangular drift between $3200 and $3440 to reasonably assume that a major upside breakout is imminent.

As good as the daily chart looks, the weekly is even better.

For a stunning view of it:

A positive triangle/pennant is in play and the (14,5,5 series) Stochastics oscillator is sporting an ultra-bullish inverse H&S pattern.

What about silver?

The launchpad for silver is a Friday close over the highs near $39.

Last week’s dip stopped almost precisely in the centre of my $37-$35.50 buy zone for gamblers. There’s not enough of a price sale for investors to buy, but eager gamblers and momentum players should have bought… and still can today!

Palladium is another very interesting precious metal. It’s in the buy zone for both gamblers and investors, and it would become a bigger buy for investors at about $1100.

I’m not expecting palladium to make new highs on this run (which should last well into 2026), but it should double in price and happy investors can then put the proceeds into supreme money gold.

What about palladium’s sister metal, platinum?

A pullback to the deep value zone near $1100 is much less likely for platinum than palladium and a move over the $1500 area highs could ignite another big surge towards $1800-$2200.

I would expect that breakout over $1500 to bring in significant Chinese gambler buying on the SHFE futures market. In a nutshell:

All the metals look good, but there can only be one currency queen, and that of course is gold!

With the jobs report disaster now in the history books, the next big reports of fear trade significance are next week’s CPI and PPI inflation reports.

Some stock market pundits are calling for a 50bps rate cut in September. That could occur if the new jobs report chief isn’t simply a government propagandist and issues real numbers that highlight the dismal jobs growth but...

That cut won’t occur if the CPI, PPI, and PCE inflation reports begin spiking higher too. In fact, if they spike too high there could be hikes rather than cuts!

It’s likely going to take a few more months to get a handle on how much growth stagnation and price inflation the government’s tariff taxes are going to create.

When that smoke finally clears, there’s likely to be some concerning stagflation… and gold stocks could quickly become a significant focus for major institutional investors.

This is the stunning CDNX weekly chart. My projected pullback is in play, and it likely ends in the 700-600 range. A move over the 800 area highs would create fresh institutional interest.

This is the GDXJ junior miners ETF chart. Note the fantastic position of the (14,7,7 series) Stochastics oscillator at the bottom of the chart. The bullish action of the GDXJ ETF and the CDNX index is adding to the bullishness of the entire metals sector.

Junior mine stock investing isn’t for everyone, especially with size, but as the gargantuan gold bull era rollout continues, these miners look set to outperform everything! At $199/year, my junior resource stocks newsletter is an investor favourite, and I’m doing a special pricing this week of $169 for 14mths! Send me an email or click this link if you want the special offer and I’ll get you onboard. Thanks!

What about the senior miners?

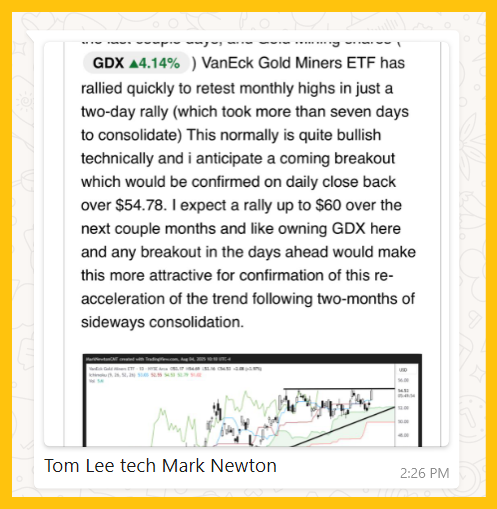

This is a fabulous GDX chart. There’s an exciting triple-headed inverse H&S pattern in play… with a close over the neckline of the pattern.

A few days of pullback action now would be technically normal and gamblers can buy. Investors should already be “locked and loaded” for a surge to $60. That’s the target of the H&S pattern.

Tom Lee is a very influential analyst and fund manager. He and his team have recently begun to focus on gold stocks. Interestingly, his top technician has the same short-term $60 target that I’ve issued and a move to that price zone would bring in even more institutional investment. To sum it all up:

Last week ended on a very positive note for gold, silver, and the miners. I’ll dare to suggest this week should be even better!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: