Gold - Where Has All The Volume Gone?

As penned in last week's piece: "...Now we hesitate to say -- in near-term context only -- that 'tis 'Game Over' in just a wee sense for Gold..."

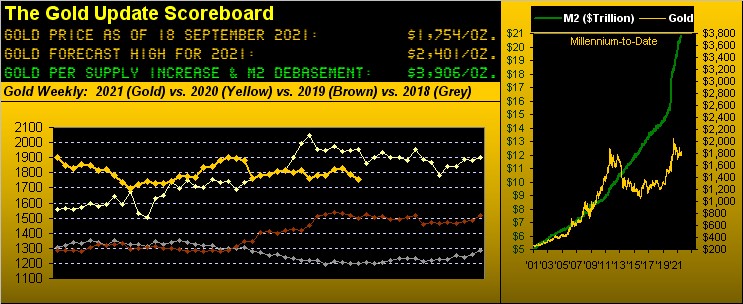

Now a week on, 'twas more than a wee waning for Gold, price having weathered quite a comparative wallop. Of the year's 37 trading weeks-to-date, 'twas Gold's eighth-weakest from high-to-low (by both points [-39] and percentage [-1.9%]) in settling yesterday (Friday) at 1754 -- a price first achieved better than 10 years ago on 09 August 2011 when the U.S. Money Supply ("M2" measure) was $9 trillion: today 'tis $21 trillion. (We'll pause here for a brief moment to allow for your exhausting of expletives.....)

To be sure, today's 1754 is far removed from the above Gold Scoreboard valuation of 3906, deemed itself by many a rather conservative appraisal given that -- by the 3Ds of Debasement, Debt and Derivatives -- it does not account for the latter two.

Albeit to be fair, Debt is a direct creation of Debasement (see "Federal Reserve Requirement"), whereas Derivatives in turn are just funny money. Or for you WestPalmBeachers down there, to put it all in the simplest of terms, if everybody sold their paper assets at the same time, we'd all end up with almost nothing -- except, obviously, if you've got Gold. (See, too, in our 04 September missive the comment on selling stock holdings into a bid-less market).

Still for Gold, this past week seemed at times rather bid-less as we turn to price's weekly bars from one-year ago-to-date. The unceasing parabolic Short trend is now an annoying 12 weeks in duration, having been triggered at a price just 10 points above 1754 at 1764 a million years ago this past 18 Jun:

By any iota of common sense, these lowly Gold levels are fairly nonsensical, one has to say. (But yes the market is never wrong). As cited a week ago, more and more 'tis "The M Word" that comes to the fore, the "Manipulators" being blamed for suppressing Gold's price: plausible, perhaps.

But at the end of the day, liquid market participation is a critical driver of price. And in a world where Gold remains stunningly under-owned, there's clearly a decline in its trading participation. Per the COMEX, the contract volume for Gold is significantly on the skids: the average monthly volume in 2018 was 6.0 million contracts; in 2019 'twas 6.4 million contracts; last year ran at 5.7 million contracts: but through August for 2021 the average monthly contract volume is just 4.4 million contracts. That is a 31% reduction from two years ago.  "Where has all the volume gone?"

"Where has all the volume gone?"

To borrow a description from a most valued charter reader: 'tis gone into "shiny objects" such as earningless stocks and cryptocrap.  "When will they ever learn?"

"When will they ever learn?" --[Pete Seeger, '55] Answer: when they see their selling proceeds are far less than the balance stated in their prior brokerage statement.

--[Pete Seeger, '55] Answer: when they see their selling proceeds are far less than the balance stated in their prior brokerage statement.

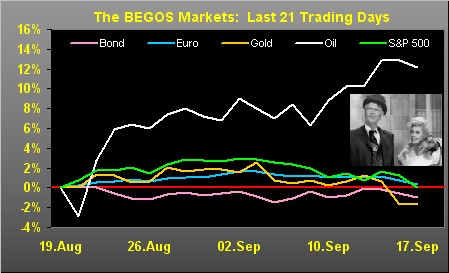

As well, let's not discount Black Gold, the price of Oil month-over-month running away in the primary BEGOS Markets' percentage race. So-called "Texas-Tea" is +12.1% since this date in August whilst the other four components are listless laggards, Gold being the weakest -1.7%:

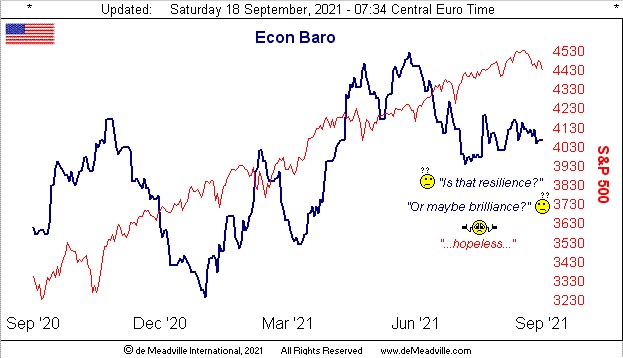

Meanwhile, the FinMedia is in complete economics disarray. Two days ago per Dow Jones Newswires: "U.S. Economy Shows Resilience During Delta Surge." Then yesterday per Bloomy: "U.S. stocks fell ... as investors evaluated the resilience of the global recovery amid concerns about the delta virus..." So which is it?

Here's the StateSide truth:

Regionally, both the New York State Empire and Philly Fed Indexes posted bold September improvements over those for August, whilst that latter month's Retail Sales whirled 'round to growth from July's shrinkage. Also, August inflation readings slowed via the CPI and Ex/Im Pricing. That again is more welcome news for the Federal Reserve, its Open Market Committee to release their next Policy Statement come Wednesday (22 September). And the latest buzz emanating from the Eccles Building is that tapering of Bond asset purchases is to commence in November.

"But mmb, 'Has the S&P crashed yet' like you always ask?"

Nary a wit, Squire. Yet, 'tis notably amusing how a spate of S&P down days (eight in the last ten) raises the sheeple's "uh-oh" factor a tad. To us, 'tis merely noise: from the S&P 500's all-time of 4546 (02 September) through yesterday's settle (4433) is a diminutive drip of -2.5%. To be honest, until we get that first -7% trading halt in the S&P Futures, there's really not too much downside about which to get excited, even as we've comprehensively pointed to a -60% move being warranted simply to revert (which, yes, always eventuates) to the median price/earnings ratio (20.4x), our "live" reading at present 50.6x.

'Course, there is also the old-fashioned bear market "Gentlemen's Crash" wherein the Index declines for months on end without indication of capitulation. But in these algorithmically-driven "Fast Times at Wall $treet High", we 'spect -- whenever it comes -- 'twill come with merciless vengeance. (See above reference to "bid-less"). Moreover: given that September/October by the calendar traditionally is "Crash-Season", should such occur this year, the FOMC doubtless shall continue to leave any notion of a November tapering at bay.

As to this seasonal pullback for the S&P, for the past 41 years the average decline in the Index from the Friday before Labor Day through the end of October is -6.5%. Therefore in that vacuum as measured from this year's Friday, 03 September when the S&P settled at 4535, a -6.5% decline by October's end would see 4240 trade; (which certainly is peanuts considering the eventual -60% correction necessary just to get the price/earnings ratio back to its median, barring some sensational increase in earnings).

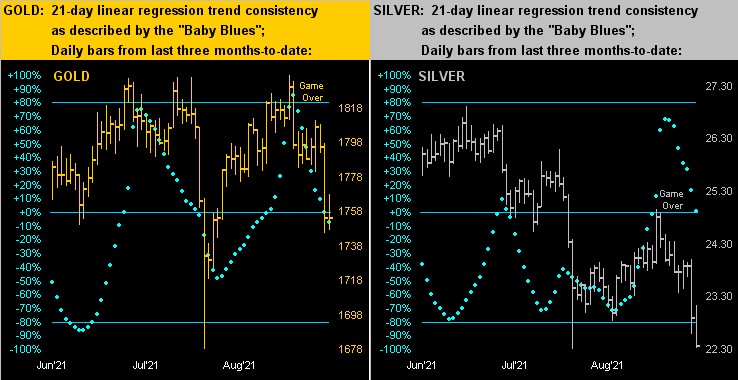

Now as we drill down ("down" being the operative word of late) into our proprietary precious metals technicals, here we've the two-panel display of the daily bars from three months ago-to-date for Gold on the left and for Silver on the right. And clearly therein you can see the wee call from a week ago of "Game Over" as the "Baby Blues" of linear regression trend consistency began to topple:

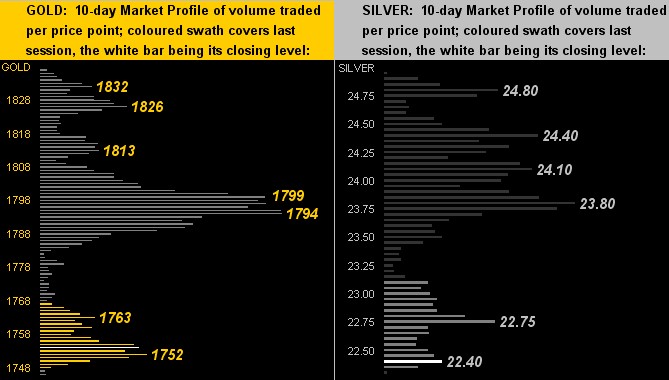

Thus further toppling in turn, down through the 10-day Market Profiles for Gold (at left) and Silver (at right) went price. And as usual Silver took the brunt of the bash, her weekly change being -5.9% versus Gold's -1.9%, the result being a leap in the Gold/Silver ratio from 75.3x a week ago to 78.4x today:

So how low might the PMs go? Simply by structure (with a wink therein from Pisa's own Leonardo "Fibonacci" Bonacci), we'd look for Gold to hold in the 1744-1717 zone; for Silver -- already down to 22.36 -- below 21.81 can be materially problematic: for were it to bust, the low 18s/high 17s appear as the braking zone. Do us a favour, Sister Silver: let's not go there. Rather let's go to the Gold Stack:

The Gold Stack

Gold's Value per Dollar Debasement, (from our opening "Scoreboard"): 3906

Gold’s All-Time Intra-Day High: 2089 (07 August 2020)

Gold’s All-Time Closing High: 2075 (06 August 2020)

2021's High: 1963 (06 January)

The Gateway to 2000: 1900+

The Weekly Parabolic Price to flip Long: 1854

The 300-Day Moving Average: 1843, but now falling

The Final Frontier: 1800-1900

The Northern Front: 1800-1750

10-Session “volume-weighted” average price magnet: 1793

Trading Resistance: 1763 / 1794 / 1799 / 1813 / 1826 / 1832

Gold Currently: 1754, (expected daily trading range ["EDTR"]: 24 points)

Trading Support: 1752

On Maneuvers: 1750-1579

10-Session directional range: down to 1746 (from 1837) = -91 points or -5.0%

2021's Low: 1673 (08 March)

The Floor: 1579-1466

Le Sous-sol: Sub-1466

The Support Shelf: 1454-1434

Base Camp: 1377

The 1360s Double-Top: 1369 in Apr '18 preceded by 1362 in Sep '17

Neverland: The Whiny 1290s

The Box: 1280-1240

We'll close it out for this week with these brief observances compiled from "The Buffoonery Dept."

■ U.S. Commerce Secretary Gina "Right On!" Raimondo cites high taxes as being requisite for the nation to compete globally; (no comment);

■ U.S. Senator Chuck "Good Luck!" Schumer is querying businesses as to ramifications were the nation to default on its debt; (one has to ask?)

■ Dallas FedPrez Kaplan and Boston FedPrez Rosengren have apparently sold some of their individual stock holdings. Whilst this has caused an ethics stir, we infer that perhaps they merely read The Gold Update and as such are aware of the S&P's excessive (understatement) overvaluation; (just sayin'...);

■ U.S. fiscal policy is being credited (per DJN) in COVID's wake for "...pushing poverty in the opposite direction..." (at this point we're laughing too much to continue typing).

So instead: let's turn up the volume! Got Gold?

www.deMeadville.com

www.TheGoldUpdate.com

********