Gold: Winter Is Coming

Winter is coming. Drilling deeper into the record market levels, the US is unlikely to fully escape the global headwinds. Namely, in the past six months, the world’s major currencies have fallen more than ten percent against the dollar in a stealth currency war driven by expectations of higher rates in a race to the basement. Increasing anxiety is that the decline is reminiscent of the Depression era currency war when each country sought a competitive advantage in a period of slow growth. The recent tumble in financial markets also reignited fears about Europe and the chronic structural problems left over from the eurozone debt collapse. Twenty-five banks failed the so-called European Stress Test last year.

Geopolitical shocks in Ukraine and the Middle East have exacerbated the decline in currencies in a catastrophic chain of events. German industrial output suffered its biggest drop in five years, adding to a string of bad news. Italy’s position has worsened over the years with the ratio of Italian public sector debt to GDP increasing 150 percent according to Eurostat, a level where problems previously arose.

Russia has become the pariah of the world. The ruble has dropped to the lowest ever and $75 billion has left the country since yearend. Inflation has climbed aggravated by the self-imposed ban in western food imports. Interest rates are double digit and falling oil prices revived fears of a full blown currency crisis on the scale of 1998 or 2008. More significantly Western capital markets are closed to Russian firms which will need to repay $52 billion over the next six months, a tall order since over half of the country’s revenues is dependent on energy. Russia’s isolation is not temporary and the Western banks’ exposure, in particular Europeans have not yet dealt with this change. Markets are vulnerable to a big surprise. Winter is coming.

Quantitative Easing is Over… Long Live Quantitative Easing!

Central bankers are supposed to be stewards of our currency which is why pronouncements are watched for hints over the course of the economy or when interest rates will change. What is clear, however is that central banks are all about creating money using financial engineering. After five years the world is awash with some $70 trillion, led by the Federal Reserve’s balance sheet that has ballooned to a record $5 trillion which represents a liability for the state. Money is a commodity whose creator is the state. Central bankers also control the money supply, which has grown in importance as the size of government deficits increase. This money has to go somewhere. A major beneficiary of course has been the Wall Street banks who benefited from near zero interest rates allowing them to take advantage of the “free money”, for arbing, leveraging and placing big bets on the casino-like markets, fueling bond and stock market bubbles. But now with the termination of quantitative easing, markets are worried as to what is next. Volatility is back and bubbles always burst.

Central bankers are caught in a “liquidity trap” of their own making. After printing more of the world’s reserve currency to pay for three rounds of bond buying over 37 consecutive months, this printed money no longer has any effect, sort of like “pushing on string”. Part of the reason is that the central bankers’ surrogates, Wall Street and “City” bankers are sitting on trillions of reserves due to new capital rules (“living will cash reserves”). The ECB, Bank of Japan and Peoples’ Bank of China are key participants in a currency re-alignment, the consequence of helicopter money and serial quantitative easing programs.

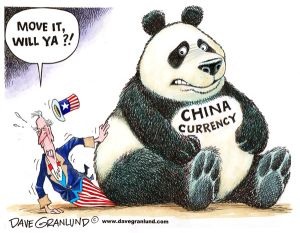

Stealth Currency Wars

And still despite a decade of zero growth, Japan has unveiled another round of money printing causing the yen to fall to an seven year low. The euro has fallen 10 percent against the dollar. China’s renminbi has slipped after nine years of appreciation against the dollar. Simply after exhausting their money printing ways, currency wars have become the central banks’ “policy du jour” in order to give their economies a boost allowing them to postpone needed structural reforms. As a percentage of GDP, G7 debt has exploded to 120 percent of GDP from 81 percent in 2007. Over the same period, US debt soared 90 percent to over 100 percent of GDP excluding unfunded liabilities. Despite the trillions created, global debt levels have increased almost four times GDP while GDP has not grown suggesting there are structural reasons for the deceleration in growth. The world has simply become more leveraged, while debt has grown to unsustainable levels. Currency-market volatility will spill over into other markets. Gold will be a good thing to have.

Currency manipulation is reminiscent of the mercantilist age of “beggar thy neighbour” currency protectionism. Then, the supply of currency was controlled by a cartel of central banks and exchange rates were manipulated for trade advantage. And today, the US Treasury has criticized its trading partners and allies like Germany and Japan over their exchange rate policies. A stealth currency war has heated up and America has become the target since global currencies float around the dollar whose value was set free by Nixon in 1973. Yet America’s creditors like China have built up $4 trillion of reserves and those creditors are looking for alternatives to the outdated dollar reserve currency regime. During the Asian crisis, China was burnt and this time instead of recycling their dollar hoard they are buying dollar denominated assets, such as real estate, companies, and gold. The dollar’s strength is not only temporary but illusory.

Debt Trap

With the debt overhang, there is growing concerning that growth is not enough. President Obama has out-Cartered Jimmy Carter, the last ineffectual leader whose approval sank to stubborn lows while still in office. And the Democrats’ loss of the Senate promises two years of dysfunctional government . This “hope” leader has a record of promising more than he can deliver and is now viewed as a liability with his cerebral approach to world problems failing. And after repeated red lines being drawn, he has reluctantly gone to war after a premature exit contributed substantially to the conditions that have forced him to return again. The larger question, will this war define his presidency as did Bush, particularly when the piggy bank is empty. Understandably, the Middle East’s rich powers and Asia should support the cause but Mr. Obama has antagonized those allies. In a term and half, America and Mr. Obama have been left isolated operating a wholly reckless financial system. This is unsustainable. As debt rises, investors will take flight, central bankers will weaken and – sooner rather than later – the dollar will collapse, joining the currency war.

To be sure, Europe’s outlook is also weak and getting weaker amidst rising tensions among its key members over Eurozone rules. Unlike Japan who owes much of its debt to itself, America owes more than half of its debt to foreigners. America’s borrowing binge has left some of its big creditors exposed and is not only too big to fail, but too big to bailout.

The World Order Has Changed

Europe and America seem to be unsuccessfully protecting the old world economic system or order. The European Union is threatened from internal divisions and the fact they are not tied together financially. The Middle East is divided along secular lines. The United States seems to leading from behind destined to two more years of legislative dysfunction. And within this power vacuum, the East has emerged from a regional power to a powerhouse with China’s emergence changing economic fortunes and shifting economic realities. The various orders are plotting divergent courses.

“Every battle is won before it is ever fought”. Sun Tzu’s Art of War written in the sixth century is an excellent primer on eastern strategy with application to wars, business and economics. Sun Tzu says, “know that to fight and conquer in all your battles is not supreme excellence”. It is better to conquer without fighting or destroying your enemy. To win, it is best to take over your enemy (or institution) than to destroy them.

China is flexing its economic muscle by becoming a net exporter of capital allowing them to become more assertive as an economic superpower, laying the foundations for a Sino-centric financial system. We’ve seen it before. America replaced British dominance in the late 18th century and America’s power and dollar has reigned for much of this century.

Sino-Centric Financial System?

Alibaba, Lenova and Industrial and Commercial Bank of China (ICBC) are now part of the West’s daily life. The Shanghai Gold Exchange (SGE) rivals Comex with trades settled in renminbi. We believe these moves are part of the internationalization of the renminbi, the natural competitor to the dollar. Another significant step is the currency swap agreements with the Bank of England and the European Central Bank.We believe China’s grand strategy is long term. A new global currency would allow China to circumvent Western dominated institutions. China is sitting on a massive hoard of dollars and needs not takeover the West. China only has to establish the financial entities and internationalize the renminbi (RMB), to grow and challenge the Western dollar-centric financial system.

A major plank is the establishment of the renminbi as a major international currency. The opening of the Shanghai-Hong Kong Stock Connect will give all foreign investors access to the Chinese market while also permitting mainland investors to buy Hong Kong listed stocks. Currently some dual listed Chinese shares trade at a whopping discount of 30 percent to the shares in Hong Kong and under the program, the link will arb this discount. Longer term, the China Securities Regulatory Commissions and Hong Kong are converging, opening the door to China’s equity market and liberalizing its capital markets.

Another plank is the establishment of multi-lateral institutions like the Asian Infrastructure Bank, which offer financing for badly needed infrastructure. The creation of an Asian Infrastructure Investment Bank rivals the World Bank. The post-economic world order has changed. The US government’s Export Import Bank has extended loans and guarantees of $590 billion over its 80 year history. By comparison, Chinese institutions in only two years have provided some $670 billion according to Fred Hochberg, Chairman of EXIM Bank. China wants a seat at the table. The country has also set up renminbi hubs to clear and settle transactions in London, Frankfurt, Seoul, Hong Kong, Singapore and now Canada.

Gold’s Role in The Sino-Financial System

Meantime, America’s debt load is its Achilles heel. China is poised to take advantage of this. The foundations for a Sino-centric financial system have been laid with gold a major part of it. We believe resource dependant China has taken a page from Sun Tzu’s book, using its diplomatic and economic muscle to regain superpower status. China once reigned the world during the early fifteenth century when the Ming Dynasty sailed ships around the world, a whole century before Europeans found America. China consumes most of the world’s resources and sits on the largest cash reserves. Yet, the dollar and lack of global institutions limits its influence. That is changing.

China is the largest consumer of gold and producer of gold, buying most of the world’s gold. We believe building up its gold reserves would be a major step since the move would hedge China’s massive $4 trillion dollar stockpile and importantly solidify the renminbi’s role as one of the world’s reserve currencies. In one week alone, withdrawals from the Shanghai Gold Exchange spiked a whopping 68.4 tonnes. The Shanghai Gold Exchange is one of China’s source for physical bullion. China owns $1.3 trillion of US public debt. To date, China has been patient allowing America to spend more than it produces but how much longer will allow it to debase its currency and debts.

For China, gold is a hedge against a depreciating dollar and negative real interest rates. China knows that paper currencies can be debased and centuries ago, gold retained its value over paper currencies. Asia is awash with dollars. China has more dollars than they want. In addition, with central banks loaded with American sovereign debt, the notion that America can grow its way out of debt has lost credibility particular when the very same arguments in Europe ended in failure. Greece just paid nine percent for debt. Paul Krugman aside, history shows that the reliance on debt to boost consumption doesn’t work. America is just another example of the age old phenomenon in which debt increases due to a credit binge and its spending and quantitative easing has left debt piled on more debt. This is unsustainable. Still markets post daily highs and we are told that all is well. The inflection point, we believe has arrived when creditors worried about the greenback will rush for the exits. It is not so different this time.

The World Gold Council with the China Gold Association recently co-sponsored the first ever China Gold Congress in Beijing. At the conference it was reported that Chinese demand has been growing at almost 2,200 tonnes of gold in 2013, more than previously disclosed. China National Gold, the largest gold producer in China was co-sponsor of the Gold Conference and its president, Mr. Song Xin, endorsed full convertibility of the renminbi with gold as a major step to establishing the renminbi as a reserve currency. Mr. Song also said that accumulation of gold was in the national interest. Backing its currency with gold would accelerate that move.

China’s gold reserves were last reported in 2008 at 1,054 tonnes. This accounts for less than 2 percent of China’s massive $4 trillion of foreign exchange reserves. But where to store its gold? China has been building vault space to replace Western vaults in Switzerland, London and Fort Knox. Rather than depend on the West, China has opened up vaults in Shanghai, with storage capacity of 2,000 metric tons of gold. Recently, China announced plans to open a vault across from Hong Kong in Shenzhen with a storage capacity of 1,900 metric tons. Unlike Germany who must wait seven years to repatriate its gold from the vaults in Britain and the United States, China has been building its own vault space.

Recommendations

We believe the end of QE III (at last), the stealth currency war and China’s insatiable appetite for gold will revive interest in gold. The end of Obama’s QE programs and transition is unknown which is why the market players have headed for the exits. To be sure, higher rates and more uncertainty will follow. In this situation, we continue to believe gold will rally over $2,000 an ounce as investors seek its store of value. Currently, gold is very oversold having broken down from a year trading range. Meantime, the US dollar is technically overbought and vulnerable in the midst of a currency war. Russia continues to be a buyer of gold, holding 1,150 tonnes, up 72 percent making it the world’s sixth largest gold holder. Nineteen central banks bought gold last year. We believe that higher gold prices are in the offing based on the fundamentals including Chinese buying, a fiat US dollar and resultant spiraling currency war. Ironically, while the Western central bankers shed gold as an archaic metal that pays no interest and holds no use in today’s modern day economic order, China is steadily accumulating gold. China and gold have a long history, much longer than fiat currencies like the US dollar.

We believe the end of QE III (at last), the stealth currency war and China’s insatiable appetite for gold will revive interest in gold. The end of Obama’s QE programs and transition is unknown which is why the market players have headed for the exits. To be sure, higher rates and more uncertainty will follow. In this situation, we continue to believe gold will rally over $2,000 an ounce as investors seek its store of value. Currently, gold is very oversold having broken down from a year trading range. Meantime, the US dollar is technically overbought and vulnerable in the midst of a currency war. Russia continues to be a buyer of gold, holding 1,150 tonnes, up 72 percent making it the world’s sixth largest gold holder. Nineteen central banks bought gold last year. We believe that higher gold prices are in the offing based on the fundamentals including Chinese buying, a fiat US dollar and resultant spiraling currency war. Ironically, while the Western central bankers shed gold as an archaic metal that pays no interest and holds no use in today’s modern day economic order, China is steadily accumulating gold. China and gold have a long history, much longer than fiat currencies like the US dollar.

Gold prices fell 42 percent to a 4 ½ year low, crushing demand for gold stocks. The entire market cap of the TSX gold index is less than $100 billion or one third of Alibaba. Over a third of the industry is losing money today as they face pressure from declining prices. A split has occurred among the world’s largest gold miners with two tiers developing. One tier has those miners with low cost gold operations and the other tier comprises producers plagued with the legacy of overvalued acquisitions and high cost operations. In a race for growth, many expanded output at high cost and now find themselves losing money on every ounce of gold produced.

The latest round of quarterly earnings reflected this split with Barrick showing a major improvement but well-loved Goldcorp recording disappointing losses due to production problems at Penasquito and flagship Red Lake. Industry mining costs are still “out of control” and grades have deteriorated. Yamana shocked the street with a billion dollar write-down which was long overdue for its Latin American assets. Nonetheless, with many of the world’s largest producers trading at decade lows, we believe that stocks have been so beaten up that they are attractively priced with “ten bag” potential. Companies with low costs and a rising production profile are favoured such as Barrick Gold, Agnico Eagle Mines and Eldorado Gold. We would take profits on Goldcorp and Newmont, avoiding Kinross, Yamana and IAMGold, because those companies still have unresolved problems and further write-downs are expected.

Agnico-Eagle Mines

Agnico posted a solid quarter but earnings showed the difficulty of low commodity prices. Production guidance was increased to 1.4 million ounces due to the acquisition of Canadian Malartic. Next year, Agnico is expected to produce 1.6 million ounces. The loss in the quarter was attributable to lower commodity prices and increased exploration spending. Agnico also closed the Cayden acquisition which is a prospect in Mexico and shareholder approval is expected by year end. Agnico has a stable of potential producers with the Amaruq maiden resource near Meadowbank expected next year. We like the shares here.

Allied Nevada Gold

Nevada-based Allied reported a big loss, due to a charge on the heap leach pile. Allied’s open-pit Hycroft mine produced only 50,000 ounces and half million ounces of silver in the latest quarter. Working capital has declined. The Company unveiled a revised feasibility study to expand Hycroft costing $1.7 billion to process the huge sulphide resource. Allied has a huge debt load and will need a joint venture partner or a higher gold price to put the Hycroft expansion into production.

Barrick Gold Corp.

Barrick posted the best results of its peers, beating Street estimates. The results were due to a turnaround at African Barrick as well as the lowering of all in costs to $880 an ounce. Guidance was maintained between 6.1 million and 6.4 million ounces as operations were stabilized. Pascua Lama remains under “care and maintenance” with rumours that the Chinese have been invited on a joint-venture basis. Barrick is focusing on their core areas in Nevada with Cortez, Gold Rush and Turoquoise Ridge. John Thornton also upgraded its management ranks and the company is leaner and moving in the right direction. Barrick has the largest in situ reserves in the world. We like the shares here.

Detour Gold Corporation

Detour Gold reported a loss but produced 115,000 ounces in the quarter from its flagship Detour Lake Mine in northeastern Ontario. Mill throughput was lower than design capacity of 55,000 tonnes per day, which was 14 percent lower than targeted levels due to unplanned downtime. The shortfall resulted in a loss, but the Company reaffirmed guidance for this year. Detour has a 15.5 million ounce resource. Average mine output will be down and production will meet the lower part of its guidance. We expect Detour to produce 460,000 ounces this year and 540,000 ounces next year. Cash is at almost $140 million. We like the shares down here, but Detour will need another few quarters to get up to design capacity.

Eldorado Gold Corp

Eldorado reported decent results in the quarter producing 196,000 ounces, a 20 percent increase over a year ago with all-in costs at $786 per ounce. Eldorado is a low cost operator with mining, development and explorations operations in Turkey, Greece, China, Romania and Brazil. The Company has a first rate balance sheet with almost a billion dollars’ worth of liquidity. Gold production was almost 200,000 ounces with higher production from Efemcukuro in Turkey due to improving mill throughput and grade. Cash operating costs were also lower in the quarter. Eldorado’s Chinese Jinfeng and White Mountain performed well but the Company is still waiting for approval for Eastern Dragon from the government. Eastern Dragon is currently under care and maintenance and permitting is still on-going. Eldorado hopes for approval but this project has been delayed for some time raising speculation that Eldorado may sell Eastern Dragon or its Chinese operation. Eldorado has a growing development pipeline and the Company is known for its execution capabilities.. We like Eldorado here.

Goldcorp Inc.

Despite flat output, Goldcorp reported a loss of $44 million due to chronic problems at Penasquito mine which was hit with a $36 million writedown on its low grade stockpiles. Gold production was 651,700 ounces. Penasquito produced 129,000 ounces at an all in cost of $1,142 per ounce. Water remains a problem and won’t be solved until later but the poor results overshadowed pouring the first gold bar from Eleonore in Quebec. Cerro Negro in Argentina will be in commercial production in the quarter at a cost of $1.7 billion. Nonetheless a review of Goldcorp’s results shows that not only has Penasquito underperformed but flagship Red Lake had a disappointing quarter. Goldcorp threw in the towel and withdrew the EIA for El Morro in Chile. Goldcorp, one time was a high flier and priced to perfection however with the recent disappointing results, we believe that there is downside here.

Kinross Gold Corp.

Kinross reported a loss despite a good operating quarter. Kinross salvaged something from high grade Fruta Del Norte project in Ecuador through the sale of the project to Lundin Gold for $240 million. The project was stalled over negotiations with the government. Meantime, Kinross has not yet shelved problem-prone Tasiast gold project looking to finance this $1.6 billion project. We believe the project does not make sense here. In addition, Kinross’ heavy exposure to Russia remains an overhang despite that Kupol is performing well. Kupol produced a record 195,000 ounces but Kinross’ exposure to Russia makes investment risky at this time. We would avoid the shares here.

New Gold Inc.

Intermediate producer, New Gold reported a good quarter, producing almost 94,000 ounces at an all in cost of less than $850 an ounce. New Gold has four producing mines and three development plays. Guidance was maintained and the fourth quarter should be New Gold’s strongest with contributions from New Afton and Peak Mines. Peak Mines’ grade improved which helped the quarter. New Gold has cash and cash equivalents of almost $400 million and the Company also has a $300 million revolving credit facility. New Gold is expanding New Afton and continues work at Rainy River which is a mammoth project awaiting improved capital markets. Both Blackwater and Rainy projects are huge and thus suitable for the next bull market.

Newmont Mining Corporation

Denver based Newmont reported lower earnings and production declined due to lower output at Carlin and Twin Creeks. Australian volumes were also down with copper output hit by the shutdown of Batu Hijau in Indonesia. Despite reserves of 88.4 million ounces, Newmont has very little on the horizon, except the new Merian mine in Suriname, which is a big low grade project. Newmont is also spending money at the Turf Vent Shaft in Nevada, Phoenix Copper Leach, Vista Vein and Yannacocha but near term the outlook is mediocre with the company in “harvest mode”. Production will be flat with all in cost about $1,050 per ounce. Newmont has $1.8 billion of cash on its balance sheet however. A merger with Barrick still makes sense.

Yamana Gold Inc.

Yamana produce 1.2 million gold equivalent ounces last year. Yamana had a rough quarter, taking a $1 billion write-down on C1, Santa Luz and Ernesto/Pau-a-pique. The poor results were largely due to an accounting charge as these assets are for sale. Dividends were also reduced. Lower commodity prices also hurt results. Yamana is focusing on its “cornerstone assets” which include newly acquired Canadian Malartic and El Penon in Chile. Yamana financed Canadian Malartic with debt and it is this debt overhang that is causing Yamana’s shares to lag the market. Sell.

John R. Ing

416-947-6040