Goldman Forecasts $2000 Gold

Strengths

· The best performing precious metal for the week was silver, up 0.83 percent as hedge funds boost their net long position to a 14-week high. Swiss exports of gold to the U.S. hit another high in May to 126.6 tons. ETFs added 27,739 troy ounces of gold to their holdings on Thursday, marking the sixth straight day of inflows. Bloomberg notes that total gold held by ETFs rose 22 percent this year to 100.9 million ounces.

· Goldman Sachs raised its 12-month price forecast for gold to $2,000 an ounce. Analysts including Mikhail Sprogis said in a note that “gold investment demand tends to grow into the early stage of economic recovery, driven by continued debasement concerns and lower real rates.” The bank added that it estimates fear-driven demand for bullion has boosted prices by 18 percent this year.

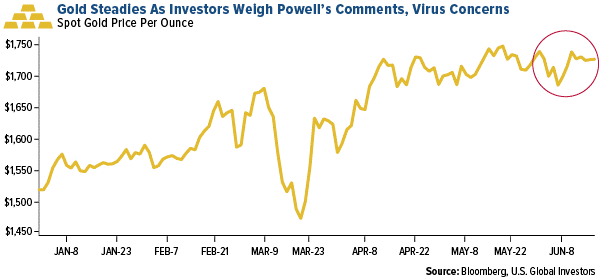

· Gold has traded in a narrow range for the past month. The two biggest factors for the metal are comments from the Fed and COVID-19. The yellow metal has held its gains for the year on the wave of unprecedented stimulus to support the economy and concerns of the number of virus infections rising. Gold then had a surprise rally on Friday and finished the week back in the $1,755 range.

Weaknesses

· The worst performing precious metal for the week was palladium, down 1.08 percent, despite the positive news that it should remain in deficit this year. Traders were rotating positions to silver with expectations that industrial uses for palladium will still be soft in the near term.

· Although gold and silver are in favor with ETF investors, money managers’ net long positions in Comex futures and options for the metals are down by more than 50 percent this year, according to Bloomberg. Commerzbank AG says gold positions have fallen for five of the past six weeks, which explains why prices are stuck in a range despite strong demand from ETFs.

· Gold retreated early in the week after the U.S. dollar strengthened on concern that a second wave of COVID-19 infections could hurt the economic recovery. Equities fell on Monday on news that Beijing reported new virus cases. “The sell-off happening in other assets is rubbing off on gold as well,” Gnanasekar Thiagarajan, director of Commtrendz Risk Management Services, told Bloomberg.

Opportunities

· Anglo American Platinum CEO Natascha Viljoen said the palladium market should remain in deficit in 2021 and sees a small deficit for this year. The metal producer also said it is targeting 70 percent of output capacity by the end of June with potential for that to rise to 90 percent in the second half of this year.

· Cardinal Resources announced that it has entered into an agreement with Shandong Gold where Shandong will acquire 100 percent of the issued and outstanding shares in Cardinal in cash. K92 Mining provided an update on operations amid the COVID-19 state of emergency in Papua New Guinea. The miner said its gold production is one track to exceed production in the first quarter, despite lower running time due to shutdowns.

· Advisors to the world’s wealthiest are urging them to hold more gold in their portfolio. Reuters reports that some private banks are now channeling up to 10 percent of client portfolios into gold as central bank stimulus reduces bond yields. Nine private banks spoken to by Reuters said they had advised clients to increase their allocation to the yellow metal.

Threats

· A growing worry in the economy is that job losses could become permanent from the coronavirus effects. Bloomberg Economics research highlights that about 50 percent of job losses came from the lockdown and weak demand, 30 percent from the reallocation shock and 20 percent from high unemployment benefits encouraging workers to stay home. Federal Reserve Bank of Minneapolis Neel Kashkari commented that his base case is that a second wave of virus comes this fall and the unemployment rate could go higher.

· Evercore ISI research showed that total macro risk has climbed to a new all-time high in its 14-year model. The research says, “volatility associated with changes in S&P correlation now accounts for more than half of total macro risk, followed by the risk influence of credit spreads and the U.S. dollar.”

· Veteran investor Jeremy Grantham said in an interview on CNBC this week that the U.S. stock market is in a bubble and that investing in the market now is “simply playing with fire.” Bloomberg notes that the S&P 500 index has risen almost 40 percent from its March 23 low. Grantham added that “it is a rally without precedent – the fastest in this time ever and the only one in the history books that takes place against a background of undeniable economic problems.”

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of