Gridline Tactics: A KISS For Gold

The big story is yields. The ten-year US treasury nominal yield chart.

For gold, what matters right now is real yields (nominal yields minus the rate of inflation). Unfortunately, the US rate of inflation is measured with what I call…

The Orwell Index.

The US CPI (consumer price index) seems to include almost everything that is of no consequence to the average citizen, and nothing that is.

While George Orwell didn’t create the US CPI, it could be an entity in one of his fictional novels about unchecked government socialism and propaganda.

Substantial inflation destroys stock markets. Institutional money managers already have inflation as their number one concern after a tiny “pop” in the CPI. The brick and mortar Dow looks good but the Nasdaq is soft.

If the $300 support zone on this chart fails, high-tech darlings (like Tesla) could implode. The Biden administration is borrowing money and giving it to consumers (vaccinated or not) who want some fresh air.

For now, the consumers are sitting on the money and much of it is just arriving in their bank accounts. It’s potentially incredibly inflationary. I call it “growflation”; the economy grows, but it’s mostly oriented around outrageous amounts of new government debt.

Money managers are stampeding out of technology and into the Dow, but if the Orwell inflation index stages enough of a rise to cause real yields to drop as nominal yields break above the inverse H&S neckline pattern on the ten-year nominal rates chart… all stock markets could begin to crash.

What I consider to be the world’s most important chart, which is of course the weekly gold chart highlighting the key support and resistance zones.

It’s important for amateur investors to remain calm in a price reaction. Buy at support and sell at resistance. It’s really that simple.

In the intermediate term, gold is either going to trade at $1966 resistance where investors can sell some, or it will trade at $1566 support where they can buy modestly in a calm emotional state. Nothing else really matters.

In the short term, gold will trade down towards $1671 support again, or rally towards $1767 resistance again. For short term traders, nothing else should matter.

If real rates in America were calculated with a proper inflation index instead of the silly Orwell index, institutional money managers would be gold buyers instead of price chasing bitcoin they failed to buy at $100.

These managers really believe they are suddenly “bitcoin experts”. They are spouting as many upside price and time targets for bitcoin now as they did for gold when it was at $2000 major resistance in the summer.

The money managers tell silly stories about bitcoin being better than gold but not better than government fiat. While they try to make peanut profits with bitcoin and other ageing coins that could soon belong in a relic museum, I’ve brought in insider and hardcore fundamentalist “King Crypto” to add heavyweight muscle to my blockchain newsletter.

We are focused on new generation crypto coins (like Kusama), ETFs, and businesses that have the best fundamentals in the sector. We are not hunting for elephants… we are riding them, and it feels great!

What about the metal miners? Well, even at $1500 gold, many are cash cows in the case of producers (and prospective cows in the case of the explorers). The leaders are sporting AISC numbers of $1000/ounce and lower, yet their price action makes it look like they are bleeding red ink with AISC over $2000!

Some gold bugs wonder if naked shorting is one cause of the lack of price appreciation for these stocks.

That is certainly possible, but whatever the reasons for the lack of performance (or outperformance at times), most investors will be best served by doing their buying and selling around the support and resistance zones I highlight on the weekly gold bullion chart.

My mantra is KISS; keep it simple, superstar!

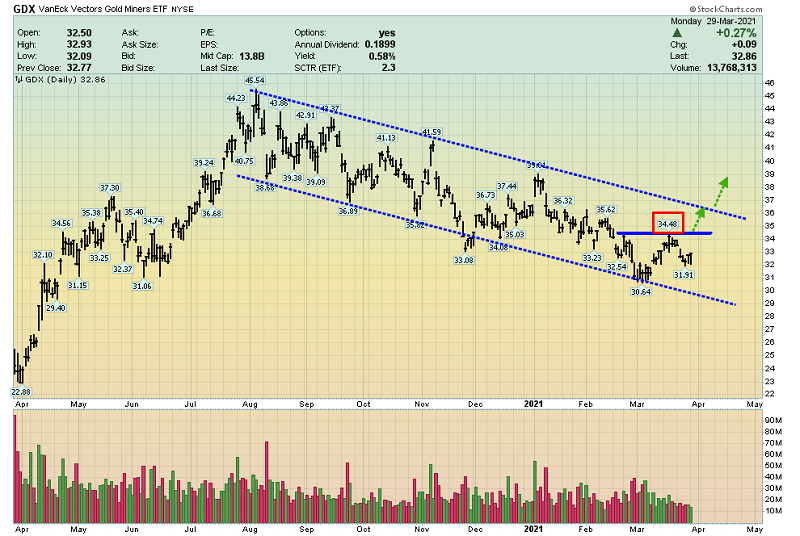

The GDX daily chart. The first real green shoot on this chart would be a surge above the $34.48 high. The next one would be an upside breakout from the down channel.

While I wouldn’t do any further long-term buying unless gold trades at $1566, GDX did have a light up day yesterday, with gold down about $20/ounce.

For the first time since the 1970s, the miners are beginning to feel firmer than gold, and that’s almost certainly because of… inflation.

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Triangle Of Champions” report. I highlight key stocks with operations in British Columbia’s Golden Triangle.

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

***

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: