How The Fed Creates Bull and Bear Markets

Bull and bear markets don’t just happen – they’re created by the Federal Reserve. While few investors dispute the power that Fed interest rate policy has on the market, the extent to which it influences the direction of stock prices in both directions is often downplayed. Moreover, the health of the economy is often decided by the Fed’s interest rate policy.

While it’s no secret that loose monetary policy on the Fed’s part benefits stocks and can lead to credit bubbles, researchers tend to underestimate the effect tight money policy has in creating market crashes and economic recessions. Restrictive money policy on the Fed’s part has frequently led to falling stock prices. The extent and duration of the monetary tightness is what determines the severity of the bear market. The longer the Fed restricts money, the more severe the downturn will be.

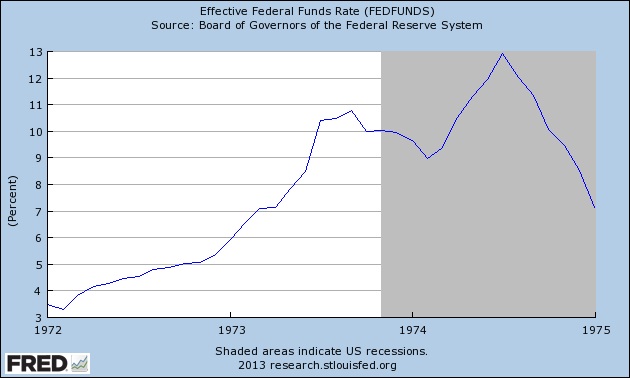

Consider the bear market of 1973-74. The Dow Jones Industrial Average experienced a decline of 40 percent, which at the time was the worst bear market since the Great Depression. The Dow peaked in early 1973 at an all-time high of 1150 before commencing a Chinese water torture type decline for the next two years. The decline was precipitated by tight money on the part of the Fed, which began raising interest rates in early 1972.

It wasn’t until mid 1974 that the Fed began lowering rates and loosening money. Although it took about six months to have the desired effect, by 1975 the Dow launched a recovery rally which by early 1976 had completely retraced the decline of 1973-74.

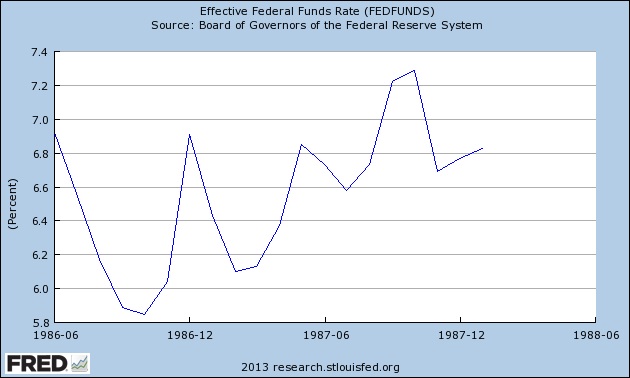

The next major crash was of course the October 1987 stock market crash which witnessed a 1-day drop of 22% in the Dow. Not surprisingly, the October ’87 crash was preceded by a rising fed funds interest rate in the year prior to the crash. The effective rate rose from approximately 5.8 percent a year before the crash to around 7.3 percent at the time of the crash.

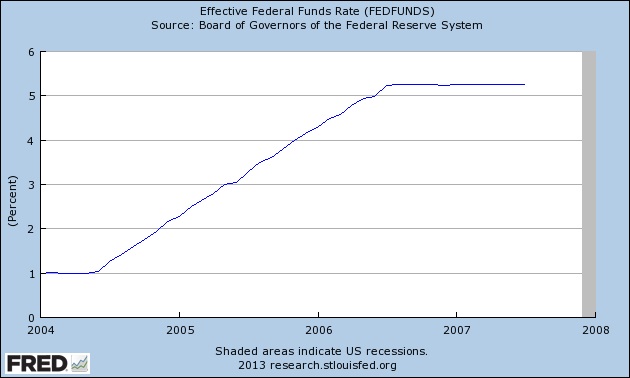

By far the most egregious example of the Fed abusing its power to engineer a financial debacle occurred in the period between 2004 and 2007. This was the 3-year period that transitioned into the credit crisis of 2007-2009. The Federal Reserve under the chairmanship of Alan Greenspan raised the interest rate from 1 percent in 2004 to just over 5 percent in 2006. Rates were then left at this level for another year before being reduced. By that time, however, the damage had been done and it was too little, too late.

The interest rate hike of 2004-2006 could not have occurred at a worse time, for the financial market and the economy of those years were predicated on a real estate boom that was dependent on low interest rates. By raising the fed funds rate as many times as he did, Greenspan essentially sealed the doom of the U.S. economy and stock market.

There are some economists who overestimate the effect of loose money and credit in creating market crashes. While they correctly identify loose monetary policy as a prime contributor to a financial market bubble, they ignore the devastating impact of a subsequent tight money policy. Loose money doesn’t cause a market crash by itself; it’s the combination of loose money followed by tight money and credit conditions which serves as the catalyst for a crash.

There is an “X-factor” to all of this, however. While there is no sign of monetary policy tightness on the Fed’s part, there is what might be called “policy tightness” by the world’s leading governments, including the U.S. Congress. Fiscal austerity current reigns supreme among U.S. and European governments and it could eventually prove detrimental to the Fed’s efforts at continuously flooding the system with liquidity. As Dr. Scott Brown of Raymond James has said, fiscal tightness amounts to a “self-inflicted restraint on growth” and that amounts to “very bad economic policy.” It also explains why, despite record levels of liquidity, the economy has been able only to tread water in recent years while financial markets have soared to new heights.

Could it be that austerity will ultimately prove to be the catalyst that kills the recovery? The question remains unanswered but with the downward pressure exerted by next year’s 120-year Kress cycle bottom, a failure of Congress and other governments to admit that austerity has been a failure could prove fatal.

********

Momentum Strategies Report

The stock market recovery is nearly four years old, and investors wonder if it will continue. While many experts have made forecasts for the coming year, few have been as impressive as the Kress cycles in projecting the market’s year-ahead performance since the recovery began.

Each year I publish a forecast for the coming year based on a series of historical rhythms known within Kress cycle theory. Last year’s forecast was remarkably accurate in predicting the pivotal market turns, including the June 1 bottom in the S&P.

Here’s a sampling from last year’s forecast:

“The first five months of 2012 will likely be characterized by greater than average volatility....This will create a level of choppiness to coincide, if not exacerbate, the market’s underlying predisposition to volatility owing to the euro zone debt crisis…the May-June 2006 stock market slide could be repeated in May-June 2012. Our short-term trading discipline should allow us to navigate this volatility and there should be at least two worthwhile trading opportunities between [January] and the scheduled major weekly cycle around the start of June 2012. From there, the stock market should experience what amounts to the final bull market leg of the current 120-year cycle, which is scheduled to bottom in October 2014.

“Keeping in mind that like snowflakes, no two markets are exactly alike, the Kress cycle echo analysis for 2012 tells us to expect a final upswing for stocks in the second half of the year with the first half of 2012 likely to be more favorably to the bears, especially if events in Europe are allowed to get out of hand.”

This is your opportunity to find out what the Kress cycles are telling us to expect for 2013. Subscribe to the Momentum Strategies Report now and receive as my compliments to you the 2013 Forecast issue.

In addition to that you’ll also receive the MSR newsletter emailed to you each Monday, Wednesday and Friday. MSR provides reliable forecasts and analysis of U.S. and global markets based on internal momentum, cyclical and technical factors. Low-risk stock and ETF recommendations are also made based on my proprietary system of selection. Specific entry and exit instructions are also given for each recommendation.

[For the complete 2013 Kress cycle forecast for the U.S. stock market and the latest newsletters, subscribe to the Momentum Strategies Report at the link below.]

http://www.clifdroke.com/subscribe_msr.mgi

Clif Droke is the editor of the three times weekly Momentum Strategies Report newsletter, published since 1997, which covers U.S. equity markets and various stock sectors, natural resources, money supply and bank credit trends, the dollar and the U.S. economy. The forecasts are made using a unique proprietary blend of analytical methods involving cycles, internal momentum and moving average systems, as well as investor sentiment. He is also the author of numerous books, including most recently “2014: America’s Date With Destiny.” For more information visit www.clifdroke.com