How High Can the Gold Price Rally in March?

Would Mr. Putin or a floating white balloon start World War III? The global economic system has changed to a multi-polar order as a result of the epidemic and the conflict in Ukraine, and America is now facing a number of difficulties. Together with the loss of economic clout, there is a growing worry about the collapse of American democracy, particularly after the mob uprising on January 6, 2021. Even though hundreds were detained, American politics has grown poisonous and deeply polarized, especially with the possibility of Mr. Trump or one of his acolytes taking office in 2024. A perfect storm of self-inflicted problems at home and more assertive foes abroad has exposed the American dream as a nightmare. Multi-polar orders that are becoming more powerful than America have filled the void created by an America that is becoming more and more insular. The domestic situation is more difficult. Washington is gridlocked, and the self-inflicted debt ceiling issue will soon spread there. As popular confidence in their government declines, particularly when the country sees debt as a collective right, American power has diminished along with it. This is also true of American financial power.

Start with money. America’s past shows there is a clear relationship between money supply and inflation, yet monetary discipline was relegated a relic of the past because there were always multiple reasons for governments to spend. When President Johnson pursued an agenda of deficit spending to finance the Vietnam War and at the same time pursued his “Great Society” social programs, which gave rise to the “Guns and Butter” inflation, the Fed and markets were caught off guard. Reminiscent of that era, investors again overlook that the injection of trillions of dollars from the pandemic to keep the economy afloat, trillions more to green the economy and billions to help Ukraine have left the economy with an inflation hangover. The United States is grappling with the massive debt monetization and today, the market is connecting the dots between deficit spending and historically high inflation. Nonetheless the Biden government continues to rack up huge deficits spending billions on the US Infrastructure bill, the CHIPS Act and the Inflation Reduction Act (IRA) which revamps US industrial policy while simultaneously stoking demand inflation.

Investors have developed an addiction to the easy money climate as a result of the near collapse of Wall Street a decade and a half ago, which led to government bailouts and tighter regulations. Over the course of two decades, a combination of free trade, easy money, and a symbiotic China relationship pushed valuations to historic highs, fueling the biggest stock market boom in history. The free money boom is over as leverage costs climb and inflation returns, bringing the chickens home to roost. Yet growth continues despite increasing borrowing costs, which is one of the key causes of the economy's and markets' resilience. Demand is impacted by higher interest rates, but supply cannot be increased by them.

Guns and Butter

We can recall when President Lyndon Johnson’s “Guns and Butter” era gave way to near-hyperinflation in the 1970s as prices exceeded 12%. After numerous attempts, Fed Chair Paul Volcker raised rates to get inflation down to 5% by 1977. However amidst the obituaries for inflation, the Fed prematurely eased monetary policy and inflation grew again to more than 14%. This time, Mr. Volcker was forced to raise rates to double digit levels, topping 19% to tame inflation, which sparked a recession that took 10 years to recover. Today while central banks, investors and governments are poised to declare inflation dead, inflation appears ready to snap back as America’s high flying economy surges on the strength of the consumer and Mr. Biden’s version of “Guns and Butter” spending. Retail sales spiked a whopping 3% at beginning of this year. Tight labour markets and business activity data are clear signs that the economy is still exuberant. Crypto is up from the lows. Unemployment too is at 53-year lows. Industrial production is unchanged from December 2022 with manufacturing resilient. America’s enormous appetite for imports have led to record deficits. In spite of recession worries, the economy is very much ALIVE and the continuing inflationary forces will ensure growth into 2024.

Furthermore, a major part of the “decline” in inflation was due to falling energy prices which is excluded from headline CPI. So-called core inflation has risen for the 32nd straight month and while inflation declined to 6.4% from the 9.1% peak last year, inflation is three times the Fed’s target. One consequence though is that the benchmark 10-year Treasury yield has climbed back to 4%, a level last seen in 2008. All that said, there are enough similarities between America today and America in the sixties to be worrying. Then Mr. Volcker ensured that the bill for LBJ’s “Guns and Butter” policy was eventually paid.

This time, nothing much has changed. This time, the government started a wave of extraordinary fiscal easing, replacing monetarism with interest rate manipulation and MMT, or modern monetary theory, also known as "free money," to fund endless rounds of fiscal profligacy. Because the Fed thought inflation was over, it provided low interest financing for that spending. They were mistaken. The central bank and investors didn't learn about the new, old religion of the past until the massive increase of money gave way to uncontrolled inflation. The fight against inflation is far from ended, just like the war. And what now?

That Other War, Climate Change

According to our analysis, President Biden's ambitious plan to green America is similar to Lyndon Johnson's "Great Society" but will cost the country trillions of dollars. His enormous Inflation Reduction Act, which provides approximately $400 billion in subsidies and handouts, largely to American businesses, achieves little to lower inflation. For Mr. Biden, spending is simpler in a gridlocked Congress that favors the pork barrel politics of multi-trillion-dollar subsidies and tax credits rather than modifying laws, regulations, or enacting a carbon tax. Deep rifts exist in American society. While consumers might be content to pay $4 per gallon, the Republicans who control Congress would abhor a carbon tax. However, it is apparent that America will alter significantly as a result of going green. The IRA launches a revolution in emerging industries like hydrogen, renewable energy, and particularly battery manufacturing but with little hope of a financial payoff.

The Republicans on the other hand hope to quash the initiatives and despite societal pressures for business and government to reduce our carbon footprint, internal divisions and commercial realities have divided the party’s response. Wall Street even jumped on the green bandwagon for fear of being on the wrong side in an election year, but a dozen US companies’ support for climate change including titans such as BlackRock, Blackstone and Vanguard has proven to be costly. Consequently, the financial consequences are huge and of concern is that neither party has calculated the financial cost. In fact, we believe the trillions of debts is a sinkhole and a costly downpayment, accounting already for a decline in America’s productivity as well as the deterioration in America’s balance sheet. Further, more public money will be needed since the private sector cannot justify the expenditures, without subsidies. The bottom line is that the war-time expenditures will saddle America with more debt at a time when US debt to GDP is a whopping 130%. America is living on borrowed time.

Greenflation Boondoggle

Mr. Biden's government-led greening of America involves spending on a variety of things, including nuclear power, chip manufacturing, and battery technologies, all of which create new issues. Since solar panels, batteries, and wind turbines are already more affordable abroad and are in oversupply, America must play catch-up. Ironically, if Biden were to win, America would be forced to depend more heavily on China, which controls the market by more than two thirds. As China already produces two-thirds of the world's batteries and seventy-five percent of its solar panels, the US will need to invest heavily in new infrastructure as well as strengthen its various electrical grids if it wants to put an electric car in every garage. Despite hefty subsidies, EV sales in North America are a pitiful 6% of all new vehicle sales, and they currently account for just 1% of all vehicles on the road. Even worse, a proposed California law would compensate automobile owners to convert their V8s to electric vehicles, which is difficult given that each state has its own rules. The free meal feature is typical of governments, and many programs represent a big financial waste for which taxpayers are responsible. The main cost of the current geopolitical unrest will be America's increasing reliance on foreigners to cover its expenses, especially in light of global warming.

To be sure Mr. Biden’s combative State of the Union speech to Congress was a stern determination to remake industrial policy, green the economy and a likely blueprint for his re-election next year. In the upcoming debt ceiling discussions, Mr. Biden wants to spend his way to re-election. The Republicans on the other hand want to reduce taxes. Both want guns and butter, and no one wants to raise taxes. And no one cares that $8 trillion has been added to the national debt in only two years, causing a showdown as the nation reached the $31.4 trillion debt cap. Social security and medicare are untouchables, but entitlements make up about 70% of federal expenditures. Consequently, spending cuts must be found from the remaining 30% of which defense spending is almost a trillion of US $6.2 trillion budget. Meanwhile the Republicans push for tax cuts in exchange for raising the nation’s borrowing cap, but without raising taxes (unlikely in an election year). Congress must scrape the barrel since interest on the nation’s debt alone will cost another trillion or 10% of spending. This game of chicken has only just begun. Oh yes, medicare and social security? Those programs run out of money by 2028, which will require new debt.

Wars, Wars and More Wars

Cold War echoes are audible everywhere as a result of Mr. Putin's incursion a year ago. The conflict over resources has joined the cultural war, Covid war, and cold war with China. The demand for billions of dollars' worth of armaments, such as battle tanks, infantry fighting vehicles, and heavy artillery, is driving up defense spending. After years of underinvestment and with the shift from peacetime, the industrial defense industry is poised for billions in orders as the West has to re-supply Ukraine, rebuild domestic supplies, and get ready for the next battle. According to the Kiel Institute, the West provided $38 billion worth of weapons to Ukraine as part of an estimated $150 billion in aid from the United States. Stockpiles of ammunition have been reduced; it will cost Germany alone $21 billion to restock its 30-day supply. To replenish depleted stockpiles, battle tanks are necessary, as well as more steel, iron ore, and coal. America already spends more on defense than any other nation, and the battle forces US expenditures and the defense business into a corner. Steel is frequently employed, especially in tanks, which are an essential aspect of the conflict in the Ukraine and the army's workhorse. 47,000 tonnes of steel are in the USS George Bush aircraft carrier alone. In modern tanks, composite materials like titanium, nanoceramics, and even depleted uranium are used to make the armor. America’s M-60 tank carries around 25 to 30 tonnes of steel, but the Russian workhorse T90 tank has 37 inches of steel.

All of this occurs at a difficult time when food prices are soaring due to unpredictable weather patterns and the conflict in the Ukraine. Sanctions do not apply to crops or fertilizer, but the fighting has disrupted transport routes, raising costs. To manage the "raw material" accounts on the balance sheets of the large commodities firms, about $500 billion in working capital is needed. The cost of trading commodities has increased due to rising interest rates and issues with supply chains, necessitating access to funds and credit lines. Compared to conventional vehicles, EVs require six times more minerals. The stakes and danger are enormous, as Trafigura, one of the largest commodity trading firms in the world, learned when they suffered a $577 million loss in an Indian scam involving bogus nickel.

Russia Is Not Alone

The West's condemnation of the conflict over the first 12 months was nearly uniform. The situation has changed a year later. An increasing number of nations have left the fray to protect their citizens from inflation and the war's unintended side effects. India still buys Russian energy, and when the UN General Assembly voted to condemn the war, China and India both chose to abstain. Russia has avoided the anticipated collapse as domestic support has grown, allowing the war to enter its second year despite receiving more sanctions than Iran. A total of 26 African nations as well as those from Latin America and Asia have chosen not to support the conflict. Despite a $25 billion budget deficit due to a 46% decline in oil and gas income, Russia's finances were stretched last year as government spending increased by 59%. Russia even traded gold, although an expanding number of nations have assisted Moscow in avoiding the harsh sanctions. Russia's MTS Bank has a licence from the United Arab Emirates that enables it to evade Western sanctions. In an effort to increase Russia's influence while becoming further cut off from Europe, foreign minister Sergey Lavrov travelled to South Africa, Mali, and Burkina Faso. Trade relations are still robust today despite the conflict. Less than 10% of the EU and G7 organizations have actually left Russia a year later, despite the fact that many Western corporations have already started to leave, according to the International Institute for Management and Development.

As a result of the war, multi-polar systems centered on business, technology, and security have emerged, splitting the world into rival blocs. There are also plans afoot for Brazil and Argentina in South America to combine their currencies, which would certainly result in the simultaneous decline of two currencies. The Pacific Alliance is another trade group of Chile, Columbia, Mexico, and Peru that supports tight connections with China and the use of the yuan. Eurasian Economic Union is another entity. Another unsettling effect of the conflict is the transformation of the global order into a complicated multi-polar one, undermining American hegemony as trade and energy are weaponized.

Is It a Bird, Is It a Plane……

Polarization continues to affect America’s foreign policy. Although China toned down its rhetoric, both countries are trying to out bash each other to score political points, aimed at their respective domestic audience. And as the election day comes closer, everything Chinese is being demonized with balloons and chips becoming the new pawns. First it was Tibet, now Taiwan. With Sino-American relations at its lowest point since Nixon went to China in 1972, such is the distrust between the two superpowers that Beijing’s 12-point peace diplomacy was greeted with skepticism, and even sparked Western suspicion that China would provide material support to Russia’s losing cause.

And just when it looked that China would welcome a visit by the US Secretary of State, a suspected spy balloon, the size of three buses violated American airspace deflating the pending visit. While much of Washington was looking up into the sky, the US military took down three other flying objects, not linked to China. China responded with fresh sanctions against two of the largest US defense contractors, Lockheed and Raytheon. With national security trumping economic interests, politics is blowing the geopolitical detente off-course. America spends almost one trillion a year on defense. If authorities are only discovering the balloons now, the billions spent on NORAD, jets and satellites were wasted since watching for balloons could have easily been accomplished using a $200 telescope. Better yet, NORAD could have turned on its Santa Claus tracker to spot drifting balloons.

After all the hot air, there is a timely need to repair relations, particularly at a time when both countries are emerging from Covid-lockdowns which hurt both economies. As the rift widens, so does the divide between the countries as Biden attempts to decouple the economy from China. But beneath the political rhetoric, there is a disconnect since the economic and financial reality is that both need each other in a co-dependent economic relationship. The law of common interests actually exists since despite the rhetoric, trade between the two countries was a record breaking $690 billion last year. Maybe China should have painted the balloon blue.

The Dollar Is Dead, Long Live the Dollar

Nonetheless we believe that the China-US rivalry has profound implications for a savings-short US economy. US debt to GDP has risen 100 percent since 2000 and US debt to GDP is 130%, as a result of the pandemic and Biden’s 25% boost in spending last year. In the past half century, annual US budget deficits averaged 3.6% of GDP but the deficit according to the Congressional Budgetary Office (CBO) will top 6.0% this year, a level that historically triggered (Greece, Italy and Turkey) financial trouble. A decades-long rise in debt resulted in the total stock of US debt exceeding GDP, another sign of trouble. A substantial part of that debt is financed by foreign money of which China is among the largest holders at almost a trillion dollars. Importantly China is not indebted to the West, it is the other way around. The difficulty for investors and politicians is that to fix this sorry state is to square the reality that relations are defined more by the scoring of political points on one hand and growing economic co-dependance on the other. What’s more, US allies (other than Canada) desire stable Chinese relations and with commercial ties growing, China has become Saudi Arabia’s largest trading partner, even exchanging oil for yuan. Left unsaid, with a huge manufacturing and financial base, China has the world hooked on its products, markets and finances. It may even one day tie the yuan to a basket of other currencies or even gold.

The decline of a dominant currency has happened only twice in the last century. Although the US economy surpassed Britain in 1870, it wasn't until the bills from waging World War I stretched its finances causing the collapse of the gold exchange system with its creditor, the United States replacing sterling with the dollar. Since then, the greenback has enjoyed a global role as the world’s reserve currency but ironically sank between 1960 and 1970 after Bretton Woods collapsed when America under the financial strain of the Vietnam War, was forced to devalue the dollar, severing the gold link in 1971. We believe that just as America displaced Britain, there are important similarities today that the extraordinary debts and fiscal pressures facing America will usher a period of dollar instability and investors will sell dollars to invest in gold as a store of value. The zenith of American hegemony only lasted 20 years from the fall of the Berlin Wall to the financial crisis of 2007-2008 but the guns and butter legacy of two long foreign wars and ambitious social programmes has made it the largest debtor in the world. Today China's rise as the second largest economy and global trade hub threatens the US position.

And with its share of the global economy falling to 20 percent and a trade imbalance of around $1 trillion dollars, the US is no longer the economic force it once was. With so much debt in dollars, it is unclear how the current floating currency system can continue to function. The Chinese have been avid gold buyers while simultaneously selling off their stockpile of American Treasury bonds. In fact, China will overtake America's debt-fueled economy in a few years, which is the fundamental reason why American foreign policy sees China as an adversary rather than a competitor. China has also changed the norms of the international financial system in an effort to de-dollarize the East. A petroyuan already exists. We think that future capital battles loom as a result of China's hegemony over the resources and energy markets and in a return to the days of realpolitik, China is making great efforts to internationalize the yuan due to its position as one of the top holders of US debt in the world. That aim would be aided by a yuan backed by gold. Currently, our system is dependent on the dollar. Without trust in the dollar, there is no reliable anchor or reserve currency in the globe. Gold is a good hedge if individuals think the dollar is overvalued or lack faith in it. Gold is an index of currency worries. It will be a good thing to have.

Recommendations

The demand for gold increased 18% to 4,741 tons, the highest level in more than a decade. According to the World Gold Council, central banks were buying gold as a hedge against the dollar and for some, a defense against sanctions. 417 tonnes were purchased in the final three months of the year led by the Chinese who purchased almost 70 tonnes in the past two months. Over the past decade central banks have been net purchasers of gold including Egypt, Qatar and Turkey who bought gold with Turkey buying almost 400 tonnes. Russia too has been buying gold and is the sixth largest central bank holder, producing a tenth of global production. For them, gold is an alternative to the dollar, possesses no counterparty risk and of course is sanction free. We believe that gold’s role as a store of value was the principal reason for its recent strength. Longer term however, gold is an inflation hedge which will take gold to new highs as investors realize that inflation is not only about food and energy. As such, we continue to believe gold will reach $2,200 per ounce this year.

Gold corrections followed a series of interest hikes which temporarily strengthened the dollar. Although the dollar has weakened since autumn, recent tough talk by Fed Chair Powell firmed the dollar. As shown, Fed’s pronouncements only impact gold temporarily, before gold reaches new highs. We believe that gold’s performance is telling us that all is not well with the dollar. As such, gold will continue outperforming markets.

Rising costs have hit the mining industry at a time when reserves and grades are declining. Also, with fewer discoveries, to combat declining reserves a modern-day gold rush is underway with mining companies resorting to M&A activity. Mid-sized players are bulking up on hopes to attract ETF support. Even junior producer Victoria Gold’s $25 million bid for ATAC, a junior explorer was trumped by Hecla’s $31 million offer. The dealmaking amounts to a bet that gold prices are heading higher. Today gold reserves in the ground are being valued at attractive levels such that it is cheaper to buy ounces on Bay Street rather than spend the time and money to explore and develop a mine, particularly when it can take 10 years to build a mine.

Panama is the latest country to pluck the golden goose’s feathers as the government forced a shutdown of First Quantum’s $6 billion mine. A new tax arrangement will likely be signed that will see the copper miner pay $375 million a year or so in extra taxes. That might look bad but consider Centerra losing its very profitable flagship, Kumtor to the Kyrgyz Republic in exchange for a swap of shareholdings which was more of a book transaction. Worse was the fire sale of Kinross’ profitable Russian assets at a fraction of the worth despite representing about 25% of its production. Today scores of countries from the Democratic Republic of Congo, Peru, Bolivia, Zambia, Tanzania and even Australia have extracted millions in revenues, reneging on earlier agreements to take advantage of rising prices. Deals in the mining business are or not forever.

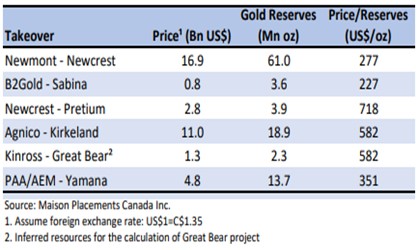

A review of the latest six deals shows that companies were willing to pay about $450 US or so for reserves in the ground. However, Newcrest’s bid for Pretium last was an outlier at a whopping $718/oz of reserves. Agnico Eagle’s recent acquisition of the balance of the Malartic as part of the takeout of Yamana is an example of how it is cheaper to buy ounces rather than explore. Pan-American bought the remaining Latin American assets of Yamana allowing the deal to go ahead. B2Gold’s bid for Sabina Gold and Silver for the Back River project in northern Nunavut at a cost of $1.1 billion or $227/oz per reserve excludes the billion-dollar cost to develop the mine.

But not all acquisitions work, and while the industry is hotly pursuing M&A deals, many senior companies who hit the growth wall are forced to pay up or make riskier bets. Australia’s Newcrest rejected Newmont’s $17 billion bid or $277/oz per reserve, but left the door open for a higher bid. Newmont's bid for example was a fill-in attempt because Newmont’s production profile is stagnant at 6 million ounces for the next few years, before the Yanacocha Sulfides project could come onstream. Ironically Newmont is still working on their last fill-in deal, Goldcorp with Coffee, Éléonore and Cerro Negro stuck in the development stage. Without a PEA, Kinross spent a whopping $1.8 billion to acquire the Great Bear project at $582/oz per reserve in northern Ontario. And after 500 kilometers of drilling, they only came up with a 3 million ounces resource which is shy of the 8 to 9 million rumoured ounces. And still there is no PEA. Furthermore Great Bear’s acquisition cost will increase because Kinross has yet to spend the billion dollars needed to bring this project on stream before the end of this decade. So much money, so little gold. Caveat emptor.

Agnico Eagle Mines Ltd.

Agnico Eagle had a tough year last year as inflation and costs increased at Meadowbank as well as mill restrictions at Fosterville and at Kittila which hurt output. Nonetheless Agnico’s production was in line with guidance and the company continues to grow organically following the successful merger with Kirkland Lake. Agnico has core assets in the Abitibi gold belt, Canada's North and the Canadian Malartic complex, following the purchase of the other half. LaRonde, Agnico’s flagship has been expanded five times which is a strategy that Agnico's management is pursuing with other core assets such as in Nunavut and the Abitibi gold belt. Management’s strategy is to use spare mill capacity to mine satellite deposits. Reserves increased 9% to almost 50 million ounces. The miner thus has a strong pipeline which is expected to grow 7% by 2025. Agnico Eagle has a balance sheet with $660 million in cash and a $1.2 billion undrawn credit facility. We like Agnico Eagle here.

Barrick Gold Corp.

Barrick Gold reported production of 1.12 million ounces in the fourth quarter at an all-in cost (AISC) of around $1,200/oz which was on target. Guidance was unchanged. When asked whether Barrick would be involved in the heated M&A activity, Mark Bristow said they would be an unlikely participant since they already have major development projects such as Reko Diq in Pakistan, Cortez in Nevada as well as the expansion of Pueblo Viejo processing plant in the Dominican Republic. Barrick at one time was built through acquisitions, but when conditions went the other way, Barrick was forced to take about $20 billion in write-downs and pay down a huge debt load. Today Barrick has grown through organic growth enabling them to retire most of that debt, strengthening their balance sheet. Reserves increased to 76 million ounces. Prefeasibility work at Lumwana’s huge copper deposit is expected on a new copper super-pit as well as a feasibility study at Reko Diq. Still, as a vestige of its past, the company took about a $1 billion write-down at the Loulo-Gounkoto project in Mali. Barrick’s major core asset is its Nevada base and a development pipeline including North Leeville, Horsham and Fourmile, ensuring that production will continue for decades. We continue to like the shares here.

B2Gold Corp.

B2Gold’s production was in line with guidance and Fekola had a strong quarter, despite water in the pit. B2Gold has started the Phase 1 Fekola regional development program developing infrastructure and the roads to handle satellite deposits. B2Gold has acquired Sabina Gold and Silver's Back River project for shares which gives B2Gold a North American footprint and significantly boosts its reserves. With mines in the Philippines, Namibia and Mali, Sabina will be a nice diversification move and a large construction ready project. A recent updated feasibility study showed that Back River will produce 200,000 ounces annually for the next 15 years at capex of $1 billion with production beginning in 2025. Sabina’s fully permitted project is a quality project with a reserve base about 9 million ounces and high-grade reserve of 3.6 million ounces at 6 g/t. B2Gold has a strong balance sheet with a $600 million undrawn line of credit, plus an accordion for total of $800 million available, and thus well-financed to build Back River. Buy.

Centerra Gold Inc.

Centerra Gold produced 53,000 ounces at Mt. Milligan in the fourth quarter but the BC mine is Centerra’s only operating mine. At Öksüt in Turkey, the company received approvals but are waiting for final approval to restart the ADR mercury abatement plant. Approval is important because Öksüt could produce about 35,000 ounces per month. Centerra has dusted off plans for the potential restart of the Thompson Creek mine which is a former moly producer and a prefeasibility is planned in the third quarter this year. Centerra reported a loss on ill-fated Kemess. Consequently Centerra burned cash. We think there are better situations elsewhere since the miner has not been able to replace production from the loss of its flagship Kumtor last year. Sell.

Eldorado Gold Corp.

Eldorado had a good quarter producing almost 454,000 ounces but below the bottom end of guidance. The good news however was the financing of Skouries which includes €680 million in funding, or 80 percent of the funding requirement. Skouries now fits in Eldorado's active plans. We believe the Greek assets were a hidden asset and the financing allows the construction with the goal of commercial production in 2025. Eldorado should produce 475,000 ounces this year, down slightly due to Lamaque in Québec where production for the quarter was 51,000 ounces. Eldorado's Turkish mines Kışladağ and Efemçukuru was a surprise, producing within guidance and Kışladağ, a mature mine should produce between 140,000 to 170,000 ounces after installation of the agglomeration drum. Eldorado will spend $250 million or so building Skouries this year, however Eldorado will need to issue equity to close the Skouries financing gap, but they have time. We like the shares here.

IAMGOLD Corp.

IAMGOLD announced that Côté Gold is now 73 percent complete. More important, the company has arranged financing to complete the project. IAMGOLD sold Rosebel to China's Zijin Mine for $360 million and part of Côté to joint venture partner Sumitomo in order to complete Côté’s financing requirements. Meantime, Essakane performed well producing 430,000 ounces throwing off important cash flow. Westwood produced 18,000 ounces in the last quarter, but costs are too high. Even after financing, IAMGOLD must spend half a billion this year on a project that could break the company. Sell.

Kinross Gold Corp.

Kinross produced almost 600,000 gold equivalent ounces in the fourth quarter at an all-in cost of $1,236/oz and for the full year produced nearly 2 million ounces in line with guidance. Paracatu and Tasiast had good quarters, but Kinross recorded a non-cash charge at Round Mountain which is a mature project. Bald Mountain only has a couple years of life. Kinross will produce 2.1 million ounces but at higher costs and has yet to make up the loss of its Russian assets which was dumped in a fire sale. Management released a resource at Great Bear project which is expected to cost over a billion dollars and Kinross has yet to complete a PEA study which is expected next year. With the project already costing $1.1 billion dollars to acquire and after another billion to build, first pour is not expected until 2029. Great Bear had 334 kilometers of drilling last year but Kinross could only come up with a M&I resource of 2.7 million ounces at 2.57 g/t. Moreover, the disappointment over the resource suggests that the IRR will be negative. Grade also seems shy of earlier expectations. Like Tasiast, Kinross will be hard pressed to make money here. Kinross is a sell.

McEwen Mining Inc.

McEwen’s Fox mining complex in northern Ontario and Gold Bar in Nevada should have a better year together with improved output from 49% owned San José in Argentina. McEwen Copper once wholly owned by McEwen Mining has arranged financing that will finance the huge Los Azules project in Argentina with mining giant Rio Tinto and Stellantis, one of the world’s leading carmakers. McEwen Mining will own 52% of McEwen Copper which is more than half of McEwen Mining’s market cap and valued today at almost half a billion, it is one of the world’s largest undeveloped copper projects. An IPO is expected after a PEA and we continue to like the developer here. The parts are worth more than the whole and an investor today gets the gold mines free. Buy.

Newmont Corp.

Newmont, the world’s biggest miner’s $17 billion bid for Newcrest was rejected. Newcrest, Australia’s biggest miner, is a 2.1 million ounces producer with mines in Australia, Papua New Guinea and Canada. Newcrest purchased Pretium in B.C. last year for a whopping $3.5 billion because Newcrest’s assets are very much mature. Ironically Newmont spun-off Newcrest almost 30 years ago and the buyback of mature assets appears a desperate move, even if the bid for shares was at a modest premium. Does size matter? This deal is a fill-in candidate and after the last Goldcorp acquisition which is still being worked on, such that a billion-dollar charge was taken last year, one wonders why management of Newmont is trying to do it again. Meantime, Newmont had a flat year producing 6 million ounces, generating $4.6 billion in EBITDA. Newmont has a reserve base of 96 million ounces and successfully replaced reserves. Switch into Barrick.

John R. Ing

Please refer to the Legal Section of our website (maisonplacements.com) for our Research Disclosures for an explanation of our rating structure at https://maisonplacements.com/research-reports

********