How To Know If We Are Heading For A Depression - Part 2

Just to remind you, a few weeks ago, I wrote an article which outlined the potential for a major bear market lasting between 13-21 years. In fact, this may even cause long-term depression. And, there were many comments to that article which mostly took objection to my view, which I categorized under the following 6 sections.

1 - "You need to take a more balanced approach incorporating fundamental analysis such as corporate earnings and economic data".

2- "Big banks are swimming in cash".

3- "The Fed will provide liquidity to keep us out of trouble".

4- "We do not have the same conditions as 1929".

5 - Outright disbelief in the potential for a long-term bear market.

6- How does one approach investing during a long-term bear market?

The first two sections we addressed last week in this article.

This week, we will address sections 3 and 4.

Since we are dealing with financial markets, which are non-linear and uncertain environments, I want to make it clear upfront that depression is obviously not a foregone conclusion. Therefore, I will end this series of articles outlining what I will need to see over the coming two years to tell me whether we are indeed heading into a 13-21 year bear market. And, if the market takes the path I lay out over the coming two years, then it will make a long-term bear market a high probability. Until such time, I am going to be taking my cues from the market action week by week and month by month, and will not likely take on an extreme bearish posture until I see strong confirmation in the next year or two. But, I will likely be raising a lot of cash in the coming months.

3- "The Fed will provide liquidity to keep us out of trouble"

One of the most ubiquitous beliefs maintained by investors worldwide is that the Fed controls the market. That is why we have all seen the phrase "you can't fight the Fed" quite often through the financial media. However, history proves that this is simply a fallacy.

What is truly funny is that I recently read an article noting that "[w]ithout the government's intervention, there would have never been a housing crisis," whereas a commenter noted that "without gov intervention, the S&P would be well south of 2000." Funny how many investors believe the Fed is the cause of both the larger upside moves in the market, and the downside moves in the market.

Most interestingly, the Plunge Protection Team, of which the Fed is a key player, is charged with "enhancing the integrity, efficiency, orderliness, and competitiveness of our Nation's financial markets and maintaining investor confidence." Yet, it is a fact that we have had more inefficiencies, lack of orderliness, and outright market crashes since the advent of the Plunge Protection Team compared to the period of time before it was created. It seems either it is not doing its job, or it is simply unable to do its job, as it is really not in control. I will let you make that decision after you read the facts I will now present.

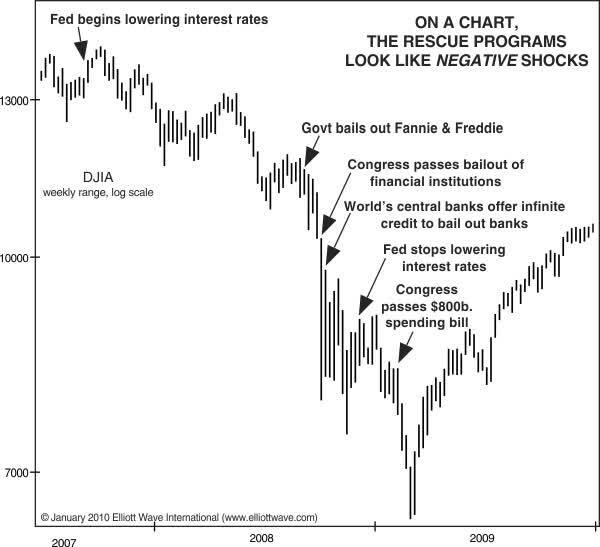

So, let's start with the most common belief that it was due to the Fed that the market bottomed in March of 2009, and began a new bull market. So, I am going to post this chart, which was published by Elliott Wave International and shows all the government responses to the financial crisis at the time.

Elliott Wave International

As you can see, the government tried over and over to stem the tide of the decline. Yet, it proved quite ineffective until the market eventually bottomed on its own and began to rally.

Now, I am quite certain that many of you view this as the market "eventually" responding to the Fed's actions and maintain that the market would have dropped a lot more if not for the Fed (despite no empirical evidence to support your claim). So, allow me to tell you a little story about my children.

When my children were 3-4 years old, and we were stopped at a traffic light, they would look at the traffic light and say "now," as they tried to time the light changing back to green. And, if it did not change, they again yelled out "now." And, this went on for maybe another 5 to 10 times, depending on how long the light took to change. Yet, when the light finally changed at one of their "nows," they proudly assumed that they caught that timing ever so perfectly.

Most of you who believe the Fed "caused" the market to bottom in March 2009 are really no different than my children. After the many "nows" that the government attempted, the market eventually bottomed just like the traffic light eventually turned green.

You see, just like my 3-year-old does not necessarily comprehend that there is something internal to the traffic light that caused the light to change at a specific interval, most market participants do not comprehend that there is something internal to the stock market that eventually caused it to bottom at a specific interval as well. This is clearly evidenced by the fact that none of the exogenous actions initiated by the Fed and the government were able to cause the turn to the stock market every time they figuratively said "now" with their actions. My 3-year-old and most market participants are not terribly different in their lack of understanding that there is an internal mechanism which drives the market rather than an exogenous one.

In fact, the Maestro himself - Alan Greenspan - understood this quite well. He has been quoted as proclaiming the same:

"It's only when the markets are perceived to have exhausted themselves on the downside that they turn."

Notice, he did not say that when the Fed lowers rates or adds liquidity will the market bottom. In fact, I can show you another example where the Fed began slashing rates and adding liquidity to the market, yet it did not prevent the market from collapsing. And, that time frame was 2020.

Elliottwavetrader.net

Again, as you can see, the Fed proclaimed "now" many times before the market finally bottomed when it 'exhausted itself to the downside.' In fact, for those of you who were following my analysis at the time, I outlined my expectation for a bottom in the 2200SPX region well before we even struck that region, and no matter how many times the Fed acted with their proverbial "nows." That is where I expected the market to "exhaust itself to the downside." Moreover, I even publicly outlined that I expected the market to bottom in the 2200SPX region and then rally from there to north of 4000SPX. And, many ridiculed me for that expectation:

"Coming from someone who still thinks the bull market of January is alive enough to carry us to 4,000, that's highly unmeaningful. . .. Here is the 2200 exactly that you said the S&P would bottom at before taking the trip back up to 4,000. . . What do you want to bet the ECONOMY is going to pull it down a lot further and that 4,000 is a lot further away than your charts ever said. . . . THIS bull market did not ever come close to taking us to 4,000, and it is not taking us anywhere ever again because it is DEAD. OFFICIALLY and in EVERY way. Every index is DEEPLY into a bear market now. The bull is dead, and so it can NEVER take us to 4000. What you predicted can NEVER come true now . . . . my own resolution is that this market has a lot further to fall because it is now following the economy, which it long divorced itself from; whereas Avi doesn't believe the economy ever means anything to stocks and has told me so several times last year. . . So, you have that common sense view, or you can believe Avi's chart magic will get you through all of that and is right about a big bounce off of 2200 all the way back up to 4,000."

As we now know, the market eventually 'exhausted itself to the downside' exactly where we expected that it would, and then began to rally as expected as well.

Even more recently, those that continued to proclaim that "you can't fight the Fed" missed out on the rally from 3500-4800SPX because of the exact same type of thinking which led to the exact opposite result.

In the past, most believed that the Fed's lowering rates would cause the market to rally. But, more recently, the Fed had been raising rates, which led those following this fallacious mechanical paradigm to believe the market would fall while the Fed raised rates. Yet, this time, while the Fed continued to raise rates (and continued announcing their intention of rate increases), the market rallied against the common expectation. So, despite the common view that "you can't fight the Fed" while they were raising rates, anyone who fought that common fallacy did quite well through 2023.

I can outline many more instances through recent history in many other markets, such as the bond market, the US Dollar, precious metals, etc. to prove this point over and over. There are many historical instances wherein it was extraordinarily clear that the Fed was not in control despite the common mantra "you can't fight the Fed." And, anyone who relied upon that common fallacy found themselves on the wrong side of the market.

It is not easy being a contrarian. And, it is not easy to see through all the fallacies which are hurled upon us by the financial media. But, with the appropriate glasses and an open mind, it is much easier to ferret out the truth.

Rather than continue to provide many more such historical examples, I am going to conclude this issue with just one more point. Undoubtedly, there are many of you reading this article that believe the market is going to explode higher when the Fed starts lowering rates. Unfortunately, it is clear that you do not know your history, as history has shown us that this is not a foregone conclusion. Consider what happened when the Fed began lowering rates in September of 2007, which you can even see noted at the top of the first chart above - yes, exactly . . . right before the heart of the 2008 decline began in earnest.

At the end of the day, I believe the Fed is playing a game of chicken they cannot win. Over the last 15 years, they have convinced almost everyone, in a Pavlovian manner, that they are able to control the markets based on their actions. But, just as with many other times in history, this will prove to be a fallacy. The Fed does not control the market. Just consider how well the Bank of Japan has been able to take them out of their 34-year bear market despite its similar actions to the contrary. When the tide turns in the United States, the Federal Reserve will be viewed as similarly ineffectual.

Lastly, if you are still not convinced, allow me to post some quotes from our clients who have worked in that area of the financial markets:

"I work for the Fed and I still agree with Avi that the Fed doesn't matter in the long run."

"I worked as a trader in EF HUTTON's Government Bond Dept. in years encompassing the last great inflation. We sometimes got 'privileged' information. [Usually through past Federal Reserve staff that decided to 'go work for the street'.] I can attest that having such information beforehand and positioning with it was just at least as often a disaster as a boon. You MUST learn to ignore it. I left the firm in 1985. EF Hutton was part of Lehman Bros. when they went down the drain. AVI is 100% right IMHO."

4- "We do not have the same conditions as 1929"

Mark Twain purportedly said that "[w]hile history does not necessarily repeat, it certainly does rhyme."

The truth is that we do not have the same conditions as 1929, for the most part. But, I never expected that we would.

You see, Ralph Nelson Elliott outlined for us many years ago that the action we see in a wave 4 correction is going to be different than a wave 2 correction. In 1929, the market dropped quite precipitously during the crash and did not bottom until 1932. So, the drop during that time was basically in a straight line. And, that was the wave 2 correction of the same longer-term wave degree for which I am expecting an impending 4th wave correction.

Based upon Elliott's theory of alternation, the wave 4 bear market that we are expecting will not likely take shape in the same manner. In other words, it will not likely be a single crash which completes wave 4 in one fell swoop. Rather, it will likely be a drawn-out event taking many years, with multiple smaller crashes along the way.

So, again, while the environment in 1929 may have been different than the current environment, I would not expect them to be the same, since the nature of the correction we expect will be quite different than the one seen during 1929-1932.

Moreover, since this 4th wave bear market that I am expecting is one wave degree larger than the one that occurred from 2000-2009, I am clearly expecting it to take longer. For this, and many other reasons, I am expecting the impending bear market to last at least 13 years, and potentially as long as 21 years. So, again, I think it will be much longer and drawn out in duration than the correction we experienced at the start of 1929.

Lastly, anyone who has followed me through the years knows that I am not a perma-bear, who constantly proclaims the sky is falling week after week like many other writers. Anyone reading my analysis over the last 13 years knows quite well that I am bullish when I view the market as having bullish potential and bearish when there is bearish potential. I am neither a perma-bull nor a perma-bear. As my clients have noted, I am simply "perma-profit." So, please understand that I am not providing this bearish perspective simply because I am a perma-bear. Rather, this is what the long-term analysis is showing me for the coming years.

Even if you have thought me to be eccentric or a complete crackpot (which I, my 8,000 subscribers, and almost 1,000 money manager clients can assure you I am not), please consider the items I am discussing in these missives with an open mind. Those who have done so have seen their ability to navigate our financial markets much improve. But, you must keep an open mind to consider these matters seriously. Ultimately, my goal is to help those willing to open their minds protect themselves from what I believe can be a very difficult financial environment over the coming decade or two.

Next week, we will discuss the 5th and 6th issues highlighted at the start of this article.

*********

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of