The Impact Of Monetary Policy On Gold

In March, the World Gold Council released the newest edition of its Investment Update. What can we learn from the publication? Let’s examine the most recent history of Fed tightening and loosening with respect to its effect on gold prices.

Is Fed’s Dovish Turn Positive for Gold?

The WGC has recently published the new Investment Update about the effects of monetary policy on gold. The main finding is that, historically speaking, when the US monetary policy turns from being tight into a neutral stance, the price of the yellow metal increases, although this effect is not always immediate. Indeed, the gold’s reaction to the March Fed’s U-turn was initially rather muted, as the chart below shows.

Chart 1: Gold price from March 20 to March 22, 2019.

Why the short-term effects are not clear cut? There might be a few possible explanations, according to the WGC:

- uncertainty over whether hiking might resume;

- weakening of inflationary pressure;

- shift in investor allocation to safe fixed income from riskier assets, in lieu of allocations to gold;

- an uncertain dollar trajectory (lower interest rates versus safe-haven demand)

We generally agree, but more dovish Fed may often support the risky assets, actually.

The stock market was one of the greatest beneficiaries of the easy monetary and financial conditions in general and quantitative easing in particular.

And what about the longer horizons? Well, the WGC’s analysis indicates that gold does perform better in a post-tightening cycle, but the period over which this occurs varies:

For example, gold rose 3.6% in 2001; 12 months after the Fed stopped raising rates. But it rose 7% only one month after the transition in 2007, a trend that continued as it was 19% higher 12 months after the Fed’s last hike.

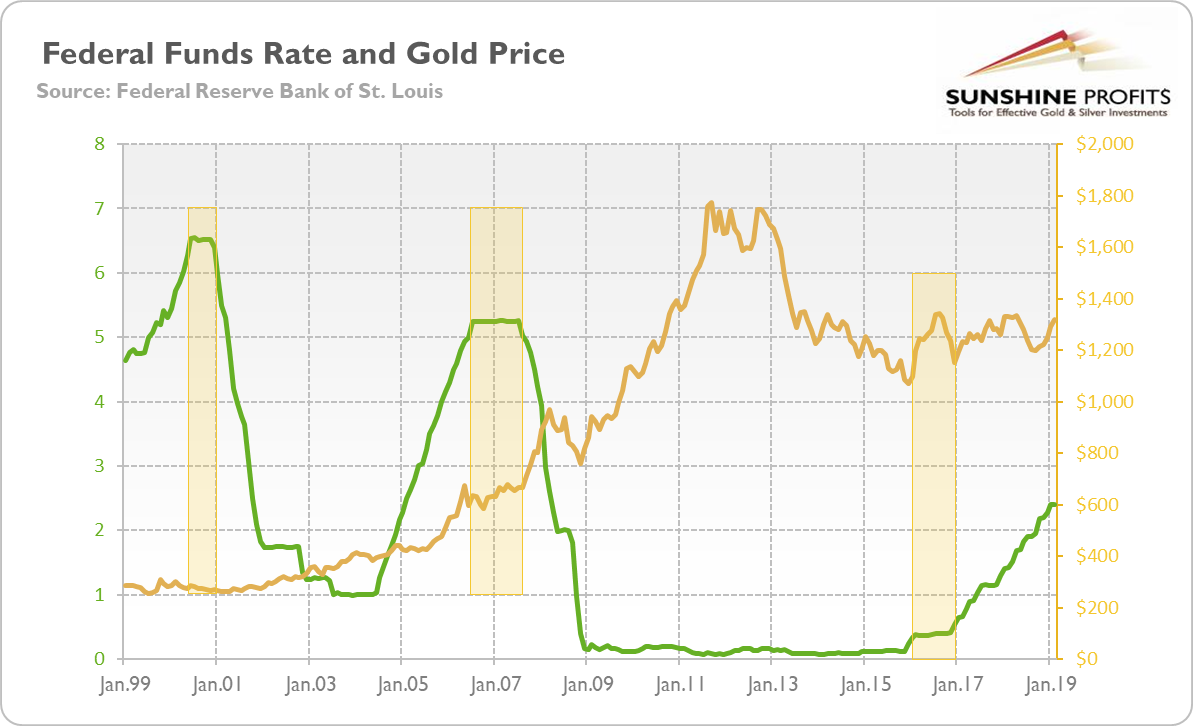

The only problem with the WGC’s analysis is that the last Fed’s hike in the previous tightening cycle was in July 2006, not in 2007, as the chart below clearly shows. So, it should be around 5 percent, not 19 percent, as the organization states.

Chart 2: Federal funds rate (green line, left axis, in %) and the price of gold (yellow line, right axis, London P.M. Fix, in $) from January 1999 to February 2019

The chart also reveals that the gold prices started to rally only when the Fed began lowering the federal funds rate: with a certain lag in 2001 and more quickly in 2007. Then, after the 2008 bankruptcy of the Lehman Brothers, it declined due to the forced sales to gain liquidity, and started to rally again after the Great Recession was fully in force. The latest case of the Fed’s pause is also very telling. It occurred in 2016 when Yellen was the Fed Chair. The dovish volte-face just after the first hike in December 2015 was positive for the gold prices, but the effect was temporary. When it was clear that it was not a reversal, but only a pause and the further tightening was on the way, the gold prices declined.

Implications for Gold

The latest WGC’s investment update is interesting, but it does not present accurately the periods of the Fed’s switches from tightening into neutral. Hence, our analysis, with adequate data, is less bullish.

The key takeaway is that keeping rates steady by the Fed removes significant headwinds for the gold market. However, gold starts go up only when the Fed begins to cut interest rates. The Fed’s pause in 2016 was positive for the yellow metal, but the effect was temporary when the US central bank returned to normalize its monetary policy again.

Hence, the gold’s future depends on whether the current dovish U-turn is only a pause or whether it is a prelude to cutting rates. The markets expect one cut this year, so if traders are right, gold may shine. But if the global growth accelerates again later this year or in 2020, as we expect it to, the Fed may deliver one or two more hikes. Gold will not escape the sideways trend, then.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.