Inflation And War: Are Investors Prepared?

The “I” word is… inflation. If a serious inflation cycle is beginning, a lot is going to change for the fiat-oriented citizens of the United States, and not in a good way.

Legendary investor, economist, and money manager Mohamed El-Erian is horrified by the US central bank’s relentless “We know it’s transitory!” inflation narrative.

He believes that the Fed needs to act sooner rather than later to stop inflationary winds from becoming a hurricane.

My view is quite different. In my professional opinion, the Fed doesn’t need to do anything… because the Fed needs to be shut down. Private enterprise doesn’t need the “Financial Markets Welfare Office” that the Fed has become.

Horrifically, American stock market investors no longer resemble capitalists. They look like socialist deadbeats, waiting for their next handout from a central bank mommy and government daddy.

Real estate inflation is a Fed creation that has made “debt for life” the hallmark of being a homeowner.

If rates stay low, house prices continue to rise, and the banks make big profits from the sheer size of the mortgages. If rates rise, the banks and government entities (Fannie/Freddie) that control the mortgage debt foreclose on an enormous number of houses. Here’s the bottom line:

Win-win for the banks and government. Lose-lose for the average end of empire American citizen.

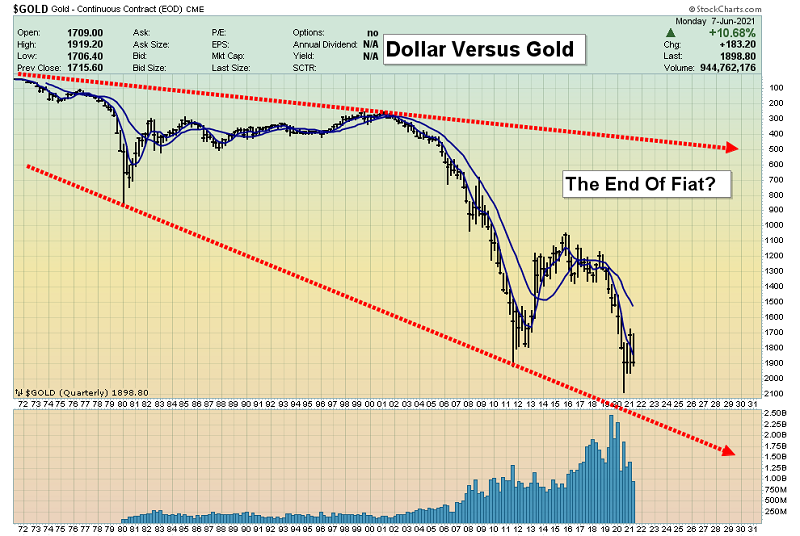

This long-term chart of the dollar versus gold is ominous.

It looks like the dollar’s endless decline is entering an acceleration phase. The chart action could be indicating that the Fed won’t raise rates to match inflation. Instead, as inflation worsens, it will essentially do nothing but make more “It’s transitory!” statements.

There will likely be a few tiny rate hikes as the Fed pays lip service to the coming stagflation, but in a serious hiking cycle, the housing market, the stock market, and the government bond market would all collapse. That means the Fed will just watch inflation surge and leave it to the government to solve the problem.

The government’s solution? Well, in 2019 I warned the gold community that 2020-2021 would see a deadly virus cycle, and of course that’s exactly what transpired. I’ve outlined 2021-2025 as the potential time frame for an even more ominous war cycle.

Governments turn very mean when their fiat currencies collapse. Disturbingly, most of America’s military spending was used for offensive action to ruin landlocked nations thousands of miles away. The citizens have no bomb shelters, and even after the Corona crisis, preparation for actual germ warfare is non-existent.

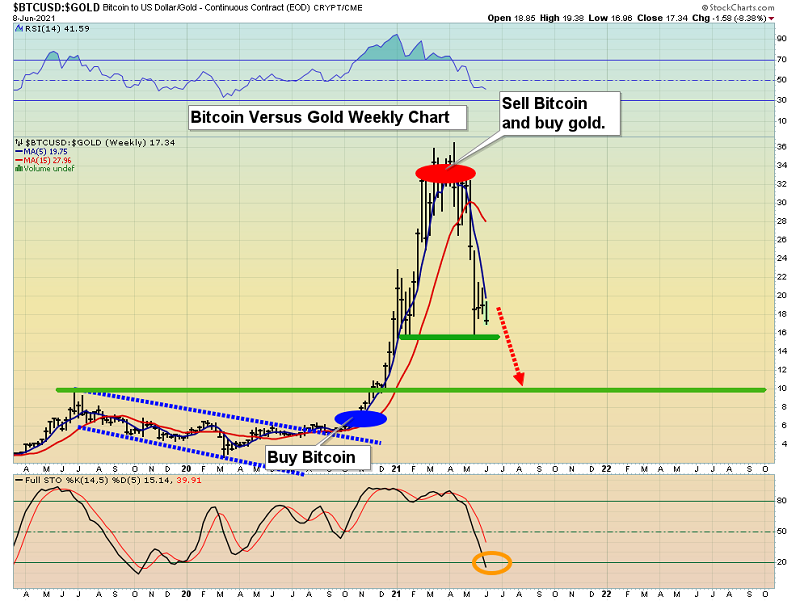

It’s obvious that citizens need to sell dollars and buy gold, but what about crypto? This stunning bitcoin versus gold chart.

Most investors want to see a 1:1 ratio for the stock market versus gold and bitcoin versus gold. In contrast, I’ve found that ratio chart numbers tend to work a lot like stock market P/E (price to earnings) ratios.

A ratio of 10 or lower for Dow versus gold tends to indicate that the stock market offers value. The same could be true for bitcoin. At a ratio of 16, bitcoin can be bought for a trade, but it’s not in a value zone. A drop to 10 would be a drop into the value zone.

The big picture for currency is that fiat is failed money, bitcoin is trying to become money, and gold is the ultimate money. For gold, that’s just the way it has been, the way it is, and the way it’s likely always to be.

As noted, the US government could be closer to war than most citizens realise. In a war-spiced inflation cycle, it’s important for citizens to own precious metals, and spice that ownership with some awesome miners.

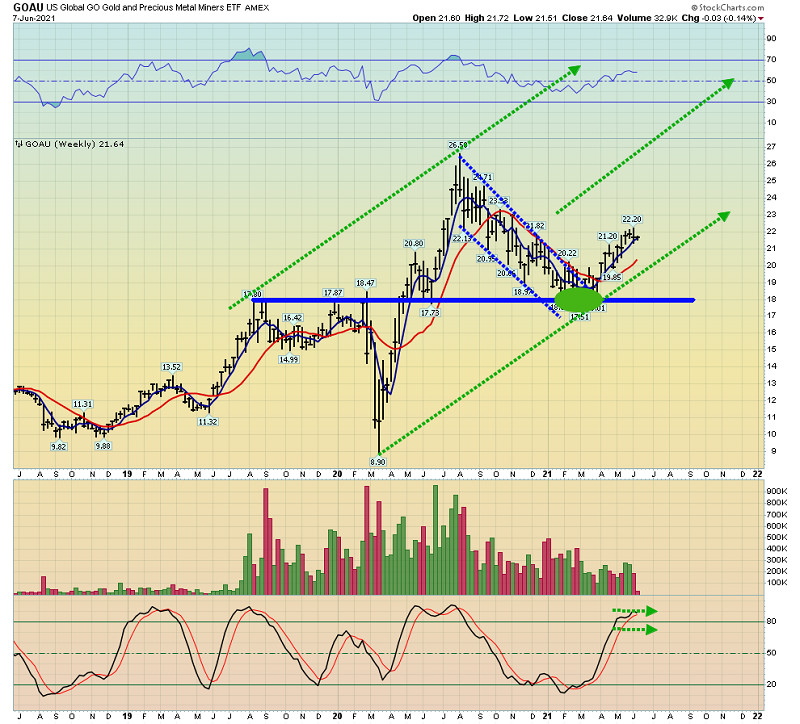

What I call the “Maserati of ETF’s” GOAU chart.

The famed Maserati three-pronged fork logo fits perfectly with the GOAU chart action. My $18 area buy signal came as gold arrived at the powerful $1671 gold price “launchpad”.

Some key short-term tactics. The price action from the $18 buy point has been stellar. Dips can be bought with confidence.

I’ve highlighted three minor trend lows that can be used for buying. Stoploss enthusiasts can place their stops just under those lows.

Silver miners are also starting to look “perky”. The SIL ETF chart. A substantial inverse H&S bull continuation pattern appears to be in play. The head of the pattern is enormous, and this is often the case with continuation patterns.

Stoploss enthusiasts can take buy-side action in the right shoulder zone. Long-term investors who bought in March near my “power buy for the miners” zone of gold $1671 are looking great. With Fed man Jay essentially sucking his thumb as an inflation swell turns into a giant wave, the metals and miners are clearly… the best and obvious place for investors to be!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Ten Golden Dollars!” report. I highlight key miners trading under $10 that both stoploss enthusiasts and long-term investors can buy now to make good potential profits while managing risk!

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line: Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: