Janet Yellen’s Interest Rate Intentions Are Good For Gold

Strengths

- The best performing precious metal for the week was silver, up 2.05 percent. Reuters reports that Mario Cantu, the General Coordinator of Mining for Mexico (which the U.S. Geological Survey estimates was the world’s biggest silver producer in 2015), expects to see lower gold and silver production in 2016.

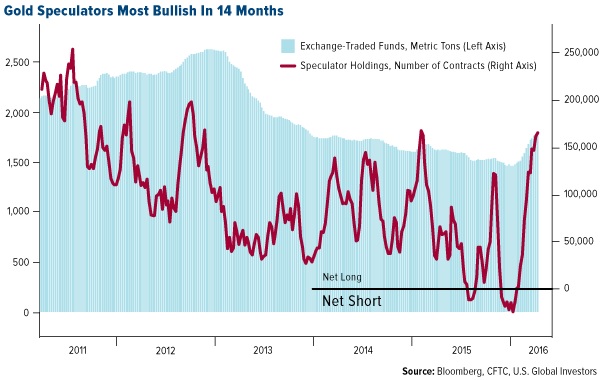

- Gold popped to a one-week high following Federal Reserve minutes that indicated policy makers would remain cautious on raising interest rates, reports Bloomberg. Gold speculators think the precious metal has more room to run too; while gold futures have dipped from a 13-month high, hedge funds are the most bullish in fourteen months as seen in the chart below.

- Central banks are buying gold, according to Wealth Daily, which reports that banks added 483 tons of gold in net purchases. That is the second-largest accumulation of gold by central banks in a year since the end of the gold standard era, continues the article. Speaking of gold buying, Eric Sprott announced this week his purchase of 10 million Newmarket Gold shares from Luxor Capital for C$22.5 million, making him the second-largest holder according to Bloomberg data.

Weaknesses

- The worst performing precious metal for the week was palladium, down -4.58 percent. In a research note from UBS this week, the bank noted platinum and palladium as having limited attention from investors right now. Saying that “interest is lackluster and liquidity conditions are poor,” the group explains that both metals have “barely” reacted to news reports of auto sales, which are important since PGMs are used for catalytic converters.

- China added the smallest amount to its central bank gold reserves in March, reports Bloomberg, with the People’s Bank of China expanding holdings by 0.5 percent. In India, gold imports slumped 88 percent last month, as a strike by jewelers continues in several parts of the country. Inbound shipments declined to around 15 metric tons in March versus 133 tons a year earlier, reports Bloomberg.

- Strong manufacturing and jobs data out of the U.S. pushed gold down for earlier in the week, reports Bloomberg. Speculation that the American economy is gaining momentum could dampen demand for gold as an alternative asset.

Opportunities

- Integra Gold Corp. announced this week its $6 million strategic investment in Eastmain Resources by way of a non-brokered private placement. The private placement is conditional on the successful election of the revised slate of Eastmain Board nominees at the annual general meeting of shareholders on April 29. The proposed Board of Directors is a group of well-respected and experienced leaders in the mining space. Eldorado Gold, which owns a significant share of Integra, was also upgraded by Credit Suisse the same day as the Integra announcement to Outperform from Neutral, with an additional push coming from Scotia as well.

- Fed Chair Janet Yellen says she is prepared to allow inflation to overshoot and unemployment to fall below sustainable levels to prolong the U.S. economic recovery, reports the Financial Review. Yellen’s intentions to keep interest rates low for longer is a positive sign for gold. Credit Suisse also pinpointed opportunities for the precious metal this week. The group believes the equities rally isn’t over yet, and that gold could reach $1,300 an ounce on the back of ETF buying and a declining mine supply, reports Bloomberg.

- Last week the World Gold Council released its latest market update report, where the effects of negative interest rate policies on gold were covered. Not only does the report state that “negative interest rates double gold returns,” but also suggests investors “consider doubling their gold allocations amid negative rates.”

Threats

- Stan Druckenmiller, who compounded money at an annualized rate of return of 30 percent during his 25 years as a hedge fund manager, is warning investors, reports ZeroHedge. Druckenmiller believes the U.S. is heading for disaster. “When I look at the current picture of expected tax revenues combined with benefits promised to future generations, this is the most unsustainable situation I have seen ever in my career,” he states. JP Morgan has also expressed its doubt on the U.S. equity market in particular, adding that central banks can no longer save the day.

- The Federal Reserve announced Friday that it will hold a closed meeting on Monday April 11, with speculators stating the Fed will likely discuss the possibility of negative interest rates. The closed meeting will be held “under expedited procedures” during which the Board of Governors will review and determine advance and discount rates charged by the Fed banks, reports ZeroHedge. The last time the Fed held such a meeting they raised rates a month later in December 2015.

The White House is pushing investors toward government accounts and out of private investment accounts, writes the Wall Street Journal, and President Obama’s regulators aren’t slowing down. The article explains that the Department of Labor says its so-called fiduciary rule will make financial advisers act in the best interest of clients. Continuing that what the rule fails to mention is that it carries an “enormous potential legal liability and demands such a high standard of care that many advisers will shun non-affluent accounts.” Perhaps the government would like to collect those management fees from retirement accounts versus the private sector. They have a wealth of experience managing Social Security assets.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of