JPMorgan Is Bullish On Gold

Strengths

- The best performing metal this week was palladium, up 2.81 percent with continued price strength. Gold traders were split between bullish, bearish and neutral on the yellow metal this week as prices struggled to recover and posted a monthly loss for February. Lawmakers in Romania are drafting legislation aiming to repatriate the country’s gold stored in the United Kingdom. The bill is to amend a Romanian central bank law that allows only 5 percent of its gold reserves abroad. This is a positive signal of countries wanting to hold their gold domestically. Palladium saw a seventh monthly gain in February and is up an amazing 83 percent since mid-August. The precious metal has been rallying due to a supply shortage as car manufacturers increasingly need palladium to meet emission standards.

- Another precious metal getting attention as of late? Platinum. In the month of February, platinum saw the biggest inflows into ETFs in almost six years. The palladium rally has helped renew investor interest in its sister metal. Impala Platinum Holdings, the world’s second largest platinum miner, made a significant reduction in its debt and share prices rose more than 9 percent on Thursday to the highest since October 2016.

- Kitco News reports that the drama between the world’s two largest mining companies intensified this week. Newmont Mining rejected an all-stock merger proposed by Barrick Gold. Newmont released a statement saying that it prefers to move forward with its acquisition of Goldcorp, with that new company surpassing Barrick to become the world’s largest miner.

Weaknesses

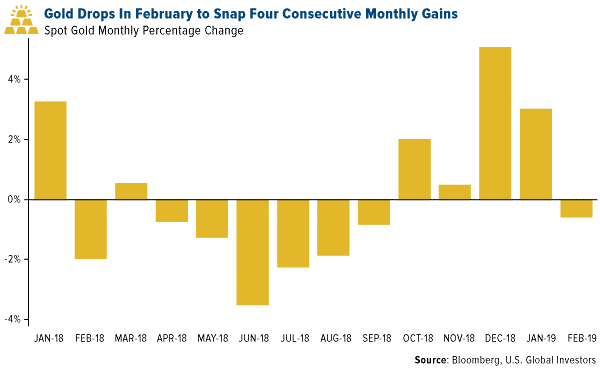

· The worst performing metal this week was silver, down 4.74 percent on hedge funds cutting their net long position by about 10 percent this past week. American Eagle gold coin sales fell 81 percent in February to just 12,500 ounces after posting a two-year high in January, according to U.S. Mint data. This comes as spot gold prices hit their highest level since April on February 20, and then slid to post the first monthly loss in five, writes Bloomberg. The London Bullion Market Association reported that gold trading in January declined to an average 19.6 million ounces per day, a 17 percent drop from the previous month. Gold suffered a narrow loss in February after four straight months of gains. Michael McCarthy, chief market strategist at CMC Markets, said that the “U.S. dollar strength is a key danger for gold, and the technical picture for gold has deteriorated with the failure around $1,340.”

· Turkey continues to sell its gold reserves. Central bank data from Ankara shows that reserves fell 4.5 tons month-over-month in January to 440.8 tons. At least eight tons of gold were removed from Venezuela’s central bank last week, according to unidentified government sources who did not say where the gold was going to. In 2018, 23 tons of Venezuelan gold was transported to Istanbul, and some speculate that is the same place this going is going to as well.

· Centamin Plc, an Egyptian gold miner, saw its shares fall as much as 22 percent on Monday after forecasting production estimates below analyst expectations. The company forecast production from 490,000 to 520,000 ounces in 2019, which is less than the amount mined in 2017.

Opportunities

· According to Australia & New Zealand Banking Group Ltd, palladium consumption by the auto sector will grow 1.1 percent in 2019 due to stricter environmental laws requiring more usage of the metal. This comes despite the recent contraction in car sales in both Europe and China. Strategists Daniel Hynes and Soni Kumari wrote in a report that “with emission regulations getting tighter across major countries, we see higher loadings requirements offsetting a slowdown in the auto sector’s palladium demand.” Bloomberg reports that Impala Platinum Holdings plans to start building a new palladium mine that could begin producing as early as 2024. The miner plans to start work on the Waterberg project in South Africa in 2021, says CEO Nico Muller. Anglo American Platinum Ltd, the world’s top platinum miner, is looking at plans to boost its palladium output through the expansion of one of its current mines.

· JPMorgan is bullish on gold as a hedge against rising inflation. Strategists led by John Normand wrote in a note last week that “TIPS and gold seem like the most durable inflation hedges for a unique macro environment when the Fed’s reaction function isn’t the only regime change impacting real assets.” Bloomberg’s Joanna Ossinger writes that “the Fed appears to be considering trying to let inflation run hotter than its 2 percent target to make up for years below that level.”

· Heraeus wrote this week the geopolitical risks should keep central banks buying gold. IMF data shows that at the end of 2018 central bank gold reserves reached their highest level since 1997 at 33,800 tons. The company writes that current geopolitical risks and growing concern about the U.S. dollar should drive more purchases of gold as a hedge against instability and a way to diversify.

Threats

· In regards to Barrick’s attempt to takeover Newmont, Doug Groh, a portfolio manager at Tocqueville Asset Management had some harsh words. “It seems arrogant on Barrick’s behalf to assume shareholders will believe in the value creation of the merged Barrick-Newmont entity as the offset to a premium that’s not paid in the marketplace directly in the bid. It’s cheeky on their part to assume shareholders are so naïve as to assume premium value will come through their execution.” According to Bloomberg Intelligence analyst Andrew Cosgrove, the top 20 holders in Barrick, who own 55 percent of total shares outstanding, also own 91 percent of Newmont’s shares. This fact makes it clear that Barrick’s management may have a hard time fighting against shareholders if they support Newmont and demand a higher premium. Another potential issue regarding this potential merger? Review by the Federal Trade Commission and Department of Justice about it possibly substantially lessening competition in the gold mining space in the United States. Would America want its largest domestically based gold company to be taken over by foreign hands? Barrick would dominate Nevada, potentially stifling competition in the nation’s biggest gold mining state.

· Goldcorp could be left at the altar, so to speak, if Newmont merges with Barrick. Under that proposed merger, Newmont would need to abandon its already planned acquisition of Goldcorp. Additionally, Barrick would need to sell several small Australian miners as a part of the deal. But would anyone be there to buy them? Or will the other miners allow Barrick to struggle to rationalize its assets instead of helping it turn noncore assets into cash?

· The Environmental Project Agency (EPA) is facing negligence claims after workers triggered the release of millions of gallons of mining wastewater and toxic sediment into the Animas River in New Mexico. The 2015 Gold King Mine spill occurred when the EPA accidentally opened a passage leading into the mine when trying to identify actions needed to address contamination flowing from the site, writes Bloomberg. The government isn’t required to clean up their spill.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of